Federal Excise Tax Exemption Certificate PDF Form

What is the Federal Excise Tax Exemption Certificate PDF

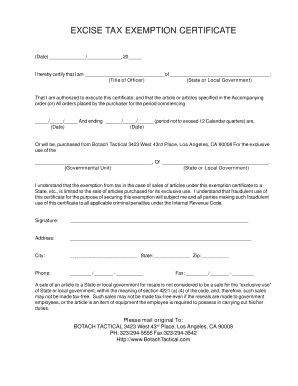

The Federal Excise Tax Exemption Certificate PDF is a document that allows certain entities to claim exemptions from federal excise taxes. This certificate is primarily used by businesses that purchase goods or services subject to excise tax, such as fuel or heavy trucks, which may be eligible for tax relief under specific conditions. The form serves as proof that the purchaser qualifies for the exemption and is crucial for ensuring compliance with IRS regulations.

How to Use the Federal Excise Tax Exemption Certificate PDF

Using the Federal Excise Tax Exemption Certificate PDF involves filling out the form accurately and submitting it to the supplier or service provider from whom the goods or services are being purchased. The certificate should detail the purchaser's information, the specific items being exempted, and the reason for the exemption. Once completed, it is essential to retain a copy for your records, as it may be required for future reference or audits.

Steps to Complete the Federal Excise Tax Exemption Certificate PDF

Completing the Federal Excise Tax Exemption Certificate PDF requires careful attention to detail. Follow these steps:

- Download the certificate from a reliable source.

- Fill in the required fields, including your name, address, and tax identification number.

- Specify the type of goods or services being purchased and the applicable exemption reason.

- Sign and date the certificate to validate it.

- Provide the completed certificate to your supplier or service provider.

Key Elements of the Federal Excise Tax Exemption Certificate PDF

The Federal Excise Tax Exemption Certificate PDF includes several key elements that must be accurately provided for it to be valid. These elements include:

- Purchaser Information: Name, address, and tax identification number of the entity claiming the exemption.

- Exemption Reason: A clear statement of why the exemption is being claimed.

- Item Description: Specific details of the goods or services being purchased.

- Signature: The signature of an authorized representative of the purchasing entity.

Legal Use of the Federal Excise Tax Exemption Certificate PDF

The legal use of the Federal Excise Tax Exemption Certificate PDF is governed by IRS regulations. To ensure compliance, the certificate must be filled out correctly and submitted to the supplier at the time of purchase. Misuse of the certificate, such as claiming exemptions for ineligible purchases, can lead to penalties, including fines and back taxes. It is essential to understand the specific eligibility criteria and maintain accurate records of all transactions involving the certificate.

Eligibility Criteria for the Federal Excise Tax Exemption Certificate PDF

Eligibility for using the Federal Excise Tax Exemption Certificate PDF typically includes businesses and organizations that meet specific criteria set by the IRS. Common eligible entities include:

- Government agencies.

- Non-profit organizations.

- Businesses engaged in manufacturing or certain types of transportation.

- Entities that purchase fuel for exempt purposes, such as farming or commercial fishing.

Quick guide on how to complete federal excise tax exemption certificate pdf

Prepare Federal Excise Tax Exemption Certificate Pdf effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily access the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents quickly and without delays. Manage Federal Excise Tax Exemption Certificate Pdf on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Federal Excise Tax Exemption Certificate Pdf with ease

- Locate Federal Excise Tax Exemption Certificate Pdf and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select key sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a standard wet ink signature.

- Verify the information and then click the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about misplaced or lost documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Adjust and eSign Federal Excise Tax Exemption Certificate Pdf and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the federal excise tax exemption certificate pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a federal excise tax exemption certificate PDF?

A federal excise tax exemption certificate PDF is a document that businesses can use to claim exemptions from federal excise taxes when purchasing certain goods or services. This certificate helps in providing necessary information to suppliers and ensures compliance with federal regulations.

-

How can I create a federal excise tax exemption certificate PDF using airSlate SignNow?

Creating a federal excise tax exemption certificate PDF with airSlate SignNow is simple. You can easily fill out a template, customize it to fit your needs, and then save it as a PDF for distribution. Our platform offers a user-friendly interface that simplifies the entire process.

-

Is there a cost associated with generating a federal excise tax exemption certificate PDF?

While airSlate SignNow offers various plans that include access to document templates and eSigning capabilities, generating a federal excise tax exemption certificate PDF is included in these features. You can choose a plan that fits your business size and needs, ensuring cost-effectiveness.

-

What are the benefits of using airSlate SignNow for my federal excise tax exemption certificate PDF?

Using airSlate SignNow for your federal excise tax exemption certificate PDF streamlines the process of document creation and management. Our platform allows for quick eSigning, secure sharing, and easy storage, enhancing your workflow and ensuring compliance without hassle.

-

Can I integrate airSlate SignNow with other platforms for federal excise tax exemption certificate PDF generation?

Yes, airSlate SignNow offers integration with various platforms, allowing you to create a federal excise tax exemption certificate PDF within your existing workflow. Whether you use accounting software or document management systems, our integrations enhance functionality and convenience.

-

How secure is my federal excise tax exemption certificate PDF with airSlate SignNow?

Security is a top priority at airSlate SignNow. When you create and store your federal excise tax exemption certificate PDF, you benefit from advanced encryption and all industry-standard security protocols, ensuring that your documents remain safe and confidential.

-

How does airSlate SignNow streamline the process of signing a federal excise tax exemption certificate PDF?

airSlate SignNow simplifies the eSigning process for your federal excise tax exemption certificate PDF by providing intuitive tools that allow users to sign documents electronically in just a few clicks. This reduces turnaround time and improves efficiency in managing your tax exemption needs.

Get more for Federal Excise Tax Exemption Certificate Pdf

- Company profile form 303708168

- Daily mail map offer order form

- Locator and information services tracking system lists data

- Pnb postal link form

- Cash farm lease form crawford county crawford uwex

- Colorado expungement forms criminal record clearing and recordclearing

- Massachusetts transportation and warehousing geographic area series economic census census form

- Social media confidentiality agreement template form

Find out other Federal Excise Tax Exemption Certificate Pdf

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online