Cra in Delware Form

What is the Cra In Delware Form

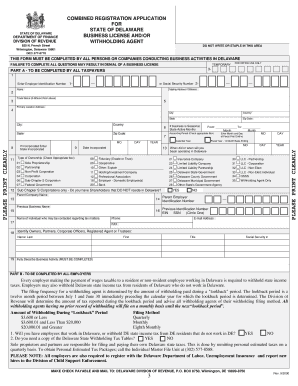

The Cra In Delware Form is a specific document used primarily for tax purposes in the state of Delaware. It serves as a crucial tool for individuals and businesses to report their income, deductions, and other relevant financial information to the state authorities. This form is essential for ensuring compliance with state tax laws and regulations. Understanding its purpose and requirements is vital for accurate filing and avoiding potential penalties.

How to use the Cra In Delware Form

Using the Cra In Delware Form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including income statements, deduction records, and any previous tax filings. Next, carefully fill out the form, ensuring that all fields are completed with accurate data. It is important to review the form for any errors before submission. Once completed, the form can be submitted electronically or by mail, depending on the preferences of the filer.

Steps to complete the Cra In Delware Form

Completing the Cra In Delware Form requires a systematic approach. Follow these steps for successful completion:

- Collect all necessary financial documents, including W-2s, 1099s, and receipts for deductions.

- Download the latest version of the Cra In Delware Form from the official state website.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income, including wages, dividends, and any other sources of income.

- Detail any deductions you are eligible for, such as business expenses or education credits.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or print and mail it to the appropriate state department.

Legal use of the Cra In Delware Form

The legal use of the Cra In Delware Form is governed by state tax laws. This form must be filled out accurately and submitted by the designated deadlines to ensure compliance. Failure to do so may result in penalties, including fines or interest on unpaid taxes. It is advisable to keep a copy of the submitted form and any supporting documents for your records, as they may be required for future reference or audits.

Key elements of the Cra In Delware Form

Key elements of the Cra In Delware Form include personal identification details, income reporting sections, and deduction claims. Each section must be completed with precise information to ensure accurate tax calculations. The form also includes a signature line, which is necessary for verifying the authenticity of the submission. Understanding these elements is crucial for effective completion and compliance with state regulations.

Required Documents

To complete the Cra In Delware Form, several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Previous year’s tax return for reference

- Any additional documentation required for specific deductions or credits

Form Submission Methods (Online / Mail / In-Person)

The Cra In Delware Form can be submitted through various methods, offering flexibility for filers. Options include:

- Online: Many taxpayers prefer to submit their forms electronically through state-approved platforms for faster processing.

- Mail: Completed forms can be printed and sent via postal service to the appropriate state department.

- In-Person: Some individuals may choose to deliver their forms directly to local tax offices, ensuring immediate confirmation of receipt.

Quick guide on how to complete cra in delware form

Complete Cra In Delware Form seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents promptly without interruptions. Manage Cra In Delware Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The easiest way to alter and eSign Cra In Delware Form effortlessly

- Find Cra In Delware Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form searching, or mistakes that require creating new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Modify and eSign Cra In Delware Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cra in delware form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Cra In Delaware Form?

The Cra In Delaware Form is a document used primarily for tax purposes, facilitating the declaration of income for businesses operating in Delaware. By utilizing airSlate SignNow, you can easily create, send, and eSign this essential form, ensuring compliance with state regulations.

-

How does airSlate SignNow help with the Cra In Delaware Form?

airSlate SignNow streamlines the process of managing the Cra In Delaware Form by allowing users to fill out, sign, and send the document electronically. This ensures quick turnaround times and enhances overall efficiency, especially for busy professionals and organizations.

-

Are there any costs associated with using airSlate SignNow for the Cra In Delaware Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are affordable, ensuring that you have a cost-effective solution for managing documents, including the Cra In Delaware Form, without sacrificing quality or features.

-

What features does airSlate SignNow offer for the Cra In Delaware Form?

airSlate SignNow provides features such as customizable templates, real-time collaboration, and secure eSigning specifically designed for forms like the Cra In Delaware Form. These functionalities help ensure accuracy and ease of use, making document management straightforward.

-

Can I integrate airSlate SignNow with other software for the Cra In Delaware Form?

Yes, airSlate SignNow seamlessly integrates with various applications, such as CRM systems and cloud storage services. This means you can automate workflows involving the Cra In Delaware Form, enhancing productivity and ensuring that all your documents are easily accessible.

-

Is airSlate SignNow secure for handling the Cra In Delaware Form?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with data protection regulations. This makes it a reliable choice for managing sensitive information found in the Cra In Delaware Form, giving you peace of mind.

-

How can airSlate SignNow benefit my business when dealing with the Cra In Delaware Form?

By using airSlate SignNow, businesses can save time and reduce errors when completing the Cra In Delaware Form. The platform enhances your operational efficiency, allowing you to focus more on your core activities while ensuring compliance with tax obligations.

Get more for Cra In Delware Form

Find out other Cra In Delware Form

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy