Form ST 105 General Sales Tax Exemption Certificate

What is the Form ST 105 General Sales Tax Exemption Certificate

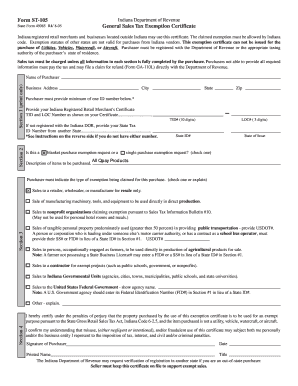

The Form ST 105 is a General Sales Tax Exemption Certificate used in Indiana. It allows eligible purchasers to buy certain items without paying sales tax. This form is primarily utilized by organizations that qualify for tax-exempt status, such as non-profit entities, government agencies, and specific businesses engaged in manufacturing or resale activities. By presenting this certificate at the time of purchase, the buyer asserts that the transaction is exempt from sales tax under Indiana law.

How to use the Form ST 105 General Sales Tax Exemption Certificate

To effectively use the Form ST 105, the purchaser must complete the certificate accurately before making a tax-exempt purchase. This involves filling out the required fields, including the purchaser's name, address, and the reason for the exemption. The completed form should then be provided to the seller at the point of sale. Sellers are required to keep a copy of the certificate on file as proof of the tax-exempt transaction. It is important to ensure that the form is used only for eligible purchases to avoid potential tax liabilities.

Steps to complete the Form ST 105 General Sales Tax Exemption Certificate

Completing the Form ST 105 involves several straightforward steps:

- Begin by downloading or obtaining a copy of the form from an authorized source.

- Fill in the purchaser's name and address accurately.

- Indicate the specific reason for the tax exemption, ensuring it aligns with Indiana tax regulations.

- Provide the seller's name and address as required.

- Sign and date the form to validate it.

After completing these steps, present the form to the seller during the transaction to ensure the purchase is processed as tax-exempt.

Legal use of the Form ST 105 General Sales Tax Exemption Certificate

The legal use of the Form ST 105 is governed by Indiana state tax laws. To be valid, the certificate must be completed in full and used for eligible purchases only. Misuse of the form, such as using it for taxable items or by ineligible purchasers, can result in penalties. Sellers must verify that the purchaser qualifies for the exemption and retain the certificate as part of their records. Compliance with these legal requirements helps protect both the buyer and seller from potential tax issues.

Key elements of the Form ST 105 General Sales Tax Exemption Certificate

Key elements of the Form ST 105 include:

- Purchaser Information: Name and address of the entity claiming the exemption.

- Seller Information: Name and address of the seller involved in the transaction.

- Reason for Exemption: A clear statement indicating the basis for the tax exemption.

- Signature: The signature of an authorized representative of the purchaser, along with the date.

These components are essential for ensuring the form is valid and compliant with Indiana tax regulations.

Eligibility Criteria

Eligibility to use the Form ST 105 is typically limited to specific types of purchasers. Common eligible entities include:

- Non-profit organizations that hold a valid tax-exempt status.

- Government agencies at the federal, state, or local level.

- Businesses engaged in the resale of goods or services.

- Manufacturers purchasing materials for production.

It is crucial for purchasers to confirm their eligibility before using the form to avoid complications with tax compliance.

Quick guide on how to complete form st 105 general sales tax exemption certificate

Prepare Form ST 105 General Sales Tax Exemption Certificate effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form ST 105 General Sales Tax Exemption Certificate on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to adjust and electronically sign Form ST 105 General Sales Tax Exemption Certificate with ease

- Locate Form ST 105 General Sales Tax Exemption Certificate and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant portions of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the data and then click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choosing. Edit and electronically sign Form ST 105 General Sales Tax Exemption Certificate to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 105 general sales tax exemption certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form ST 105 and how can it be used with airSlate SignNow?

The form ST 105 is a New York State exemption certificate used to claim sales tax exemption on certain purchases. With airSlate SignNow, you can easily fill out, sign, and send the form ST 105, ensuring a streamlined and efficient process for tax-related transactions.

-

How can airSlate SignNow simplify the process of filling out the form ST 105?

AirSlate SignNow offers user-friendly templates and a customizable signing experience that can help you fill out the form ST 105 quickly and accurately. This reduces manual errors and saves valuable time, allowing businesses to focus on what matters most.

-

Is there a cost associated with using airSlate SignNow for the form ST 105?

Yes, while airSlate SignNow offers a range of pricing plans, many businesses find the cost-effective solution worthwhile for managing documents like the form ST 105. We provide various plans to fit different needs, ensuring value for all sizes of organizations.

-

What features does airSlate SignNow provide for managing the form ST 105?

AirSlate SignNow provides features such as electronic signatures, document templates, and real-time tracking for the form ST 105. These features enhance the efficiency and security of document management, making it easier to handle essential paperwork.

-

Can I integrate airSlate SignNow with other tools while using the form ST 105?

Yes, airSlate SignNow offers integrations with popular tools such as Google Drive, Dropbox, and CRM systems. This enables you to manage the form ST 105 within your existing workflow, making it convenient to access and share important documents.

-

How does using airSlate SignNow for the form ST 105 benefit my business?

Utilizing airSlate SignNow for the form ST 105 provides several benefits, including improved efficiency in document processing and enhanced compliance with legal requirements. The electronic signature feature ensures faster transactions, which can lead to increased customer satisfaction.

-

Is airSlate SignNow secure for sending the form ST 105?

Absolutely! AirSlate SignNow prioritizes the security of your documents, including the form ST 105, by employing advanced encryption and strict compliance with privacy regulations. You can confidently send and manage sensitive information without worrying about data bsignNowes.

Get more for Form ST 105 General Sales Tax Exemption Certificate

Find out other Form ST 105 General Sales Tax Exemption Certificate

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template