Form 8863

What is the Form 8863

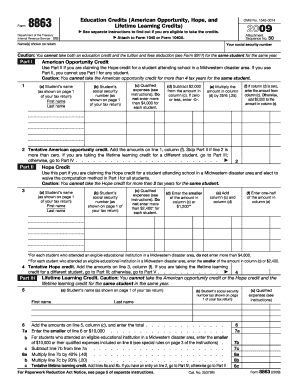

The 2009 Form 8863 is a tax form used by eligible taxpayers in the United States to claim education credits. These credits help offset the costs of higher education by reducing the amount of tax owed. The form specifically addresses the American Opportunity Credit and the Lifetime Learning Credit, both designed to assist students and their families with educational expenses. Understanding the purpose of this form is essential for those who want to take advantage of available tax benefits related to education.

How to use the Form 8863

Using the 2009 Form 8863 involves several steps to ensure that you accurately claim the education credits. First, gather all necessary documentation, including Form 1098-T, which reports tuition payments. Next, fill out the form by providing your personal information and detailing your educational expenses. Be sure to calculate the credits based on your eligible expenses and the number of years you have claimed the credits. Finally, submit the completed form along with your tax return to the IRS, either electronically or via mail.

Steps to complete the Form 8863

Completing the 2009 Form 8863 requires careful attention to detail. Follow these steps:

- Obtain Form 8863 from the IRS website or through tax preparation software.

- Fill in your personal information, including your name, Social Security number, and filing status.

- Enter the educational institution's details and the amount of qualified expenses paid.

- Calculate the American Opportunity Credit and/or Lifetime Learning Credit based on your expenses.

- Review the form for accuracy and completeness before submission.

Eligibility Criteria

To qualify for the credits claimed on the 2009 Form 8863, taxpayers must meet specific eligibility criteria. For the American Opportunity Credit, the student must be enrolled at least half-time in a degree program and must not have completed four years of higher education. The Lifetime Learning Credit is available for all years of postsecondary education and does not have a limit on the number of years it can be claimed. Additionally, income limits apply, which may reduce the credits or eliminate eligibility altogether.

Filing Deadlines / Important Dates

Filing the 2009 Form 8863 must align with the general tax filing deadlines. Typically, the deadline for filing individual tax returns is April fifteenth of the following year. However, if you need additional time, you can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. It is crucial to stay informed about any changes to deadlines that may arise due to special circumstances or IRS announcements.

Digital vs. Paper Version

When it comes to submitting the 2009 Form 8863, taxpayers have the option to file digitally or by paper. Filing electronically is often faster and more efficient, allowing for quicker processing and refunds. Additionally, electronic filing typically includes built-in error checks that can help prevent mistakes. Conversely, submitting a paper version may take longer for processing, but some individuals may prefer this method for record-keeping purposes. Regardless of the method chosen, ensure that the form is completed accurately to avoid delays.

Quick guide on how to complete form 8863

Effortlessly Prepare Form 8863 on Any Device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Form 8863 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and eSign Form 8863 Without Stress

- Locate Form 8863 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form navigation, or mistakes requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 8863 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8863

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2009 form 8863 used for?

The 2009 form 8863 is used to claim education credits for eligible students. This IRS form helps taxpayers compute the American Opportunity and Lifetime Learning credits, which can signNowly reduce the tax burden associated with higher education expenses.

-

How can airSlate SignNow assist with the 2009 form 8863?

airSlate SignNow provides an easy, efficient way to create and eSign the 2009 form 8863. Our platform allows users to securely send, sign, and store their completed forms, ensuring a smooth filing process with the IRS.

-

Is there a cost associated with using airSlate SignNow for the 2009 form 8863?

Yes, airSlate SignNow offers competitive pricing for its eSigning services. The cost varies based on the plan selected, which includes options for individuals and businesses, making it a cost-effective solution for handling the 2009 form 8863.

-

What features does airSlate SignNow offer for completing the 2009 form 8863?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure cloud storage to streamline the completion of the 2009 form 8863. This ensures that users can manage their documents efficiently and stay organized.

-

Can I integrate airSlate SignNow with other software for filing the 2009 form 8863?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software to help streamline the filing of the 2009 form 8863. This integration helps reduce manual data entry and errors, making the process quicker and easier.

-

What are the benefits of using airSlate SignNow for the 2009 form 8863 over traditional methods?

Using airSlate SignNow for the 2009 form 8863 eliminates the hassle of printing, signing, and mailing documents. The platform provides a fast, eco-friendly solution where users can eSign documents from anywhere, ensuring timely filing and peace of mind.

-

Is airSlate SignNow secure for submitting sensitive documents like the 2009 form 8863?

Yes, airSlate SignNow employs advanced security measures, including encryption and compliance with industry standards, to protect sensitive documents like the 2009 form 8863. Users can trust that their personal information is safe throughout the eSigning process.

Get more for Form 8863

- Dbs bank account opening form

- Hdfc life policy cancellation request letter form

- Ex parte order arkansas form

- The official website of the philppine embasy in doha qatar form

- Dfeh 185 eng form

- Reimbursement form pdf

- Standards for special education evaluation amp eligibility tn gov form

- Gtms yearbook order form 18 georgie tyler middle school

Find out other Form 8863

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT