Imrf Federal Withhaoding Forms

What is the IMRF Federal Withholding Forms?

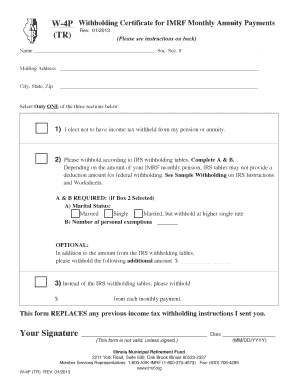

The IMRF Federal Withholding Forms are essential documents used by employers and employees in the United States to manage federal income tax withholding from employee wages. These forms help ensure that the correct amount of tax is withheld based on individual circumstances, such as marital status and number of dependents. The IMRF form W-4P is specifically designed for pension recipients, allowing them to specify their withholding preferences for federal taxes.

How to Use the IMRF Federal Withholding Forms

Using the IMRF Federal Withholding Forms involves a few straightforward steps. First, individuals must complete the appropriate form, such as the IMRF form W-4P. This includes providing personal information, such as name, address, and Social Security number. Next, individuals should indicate their withholding preferences, including any additional amounts they wish to withhold. Once completed, the form must be submitted to the employer or the IMRF for processing. It is crucial to review the form for accuracy to avoid issues with tax withholding.

Steps to Complete the IMRF Federal Withholding Forms

Completing the IMRF Federal Withholding Forms requires attention to detail. Follow these steps:

- Obtain the correct form, such as the IMRF form W-4P.

- Fill in your personal information accurately.

- Specify your filing status and any additional withholding amounts.

- Sign and date the form to certify its accuracy.

- Submit the completed form to your employer or the IMRF.

It is advisable to keep a copy of the submitted form for your records.

Legal Use of the IMRF Federal Withholding Forms

The IMRF Federal Withholding Forms are legally binding documents that help ensure compliance with federal tax regulations. When completed correctly, they provide a clear record of an individual's withholding preferences. The forms must adhere to the guidelines set forth by the IRS, ensuring that the information provided is accurate and up-to-date. Failure to use these forms properly can result in incorrect tax withholding, leading to potential penalties or tax liabilities.

Key Elements of the IMRF Federal Withholding Forms

Key elements of the IMRF Federal Withholding Forms include:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options include single, married, or head of household.

- Withholding Allowances: Number of allowances claimed that affect withholding amounts.

- Additional Withholding: Any extra amount the employee wishes to withhold from each paycheck.

- Signature: Required to validate the information provided on the form.

Form Submission Methods

The IMRF Federal Withholding Forms can be submitted through various methods, ensuring convenience for users. Common submission methods include:

- Online Submission: Many employers allow electronic submission of withholding forms through their payroll systems.

- Mail: Forms can be printed and mailed directly to the employer or IMRF office.

- In-Person: Individuals may also choose to deliver the forms in person at their employer's office or the IMRF.

Choosing the right submission method depends on individual preferences and employer policies.

Quick guide on how to complete imrf federal withhaoding forms

Handle Imrf Federal Withhaoding Forms effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents swiftly without delays. Manage Imrf Federal Withhaoding Forms on any device using airSlate SignNow's Android or iOS applications and simplify any document-based process today.

How to alter and eSign Imrf Federal Withhaoding Forms with ease

- Locate Imrf Federal Withhaoding Forms and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Imrf Federal Withhaoding Forms and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the imrf federal withhaoding forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are IMRF federal withholding forms?

IMRF federal withholding forms are essential documents used by employers to report withheld federal taxes from employee wages for the Illinois Municipal Retirement Fund. These forms help ensure compliance with federal tax regulations while providing a clear record of withholdings for employees.

-

How do I complete IMRF federal withholding forms using airSlate SignNow?

With airSlate SignNow, you can easily complete IMRF federal withholding forms by uploading them to our platform. Our user-friendly interface allows you to fill out the forms electronically, ensuring accuracy and saving time in the process.

-

Are there any fees associated with using airSlate SignNow for IMRF federal withholding forms?

airSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective solution for managing IMRF federal withholding forms. You can select a plan that fits your budget while taking advantage of our comprehensive document management features.

-

What features does airSlate SignNow offer for IMRF federal withholding forms?

airSlate SignNow provides several features specifically for IMRF federal withholding forms, including eSignature capabilities, document templates, and a seamless document sharing system. These features streamline the process, making it efficient and hassle-free for users.

-

Can I integrate airSlate SignNow with other software for IMRF federal withholding forms?

Yes, airSlate SignNow offers integration capabilities with various software solutions, allowing for easy management of IMRF federal withholding forms alongside your existing systems. This integration enhances your workflow and helps maintain consistency across platforms.

-

How can IMRF federal withholding forms benefit my business?

Utilizing IMRF federal withholding forms with airSlate SignNow helps your business remain compliant with tax regulations while reducing the chances of errors in documentation. Additionally, this efficient process enhances productivity, saving you time and resources.

-

Is airSlate SignNow secure for handling IMRF federal withholding forms?

Absolutely! airSlate SignNow employs advanced security measures to protect sensitive data, including IMRF federal withholding forms. With end-to-end encryption and secure access controls, your documents are safeguarded against unauthorized access.

Get more for Imrf Federal Withhaoding Forms

Find out other Imrf Federal Withhaoding Forms

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy