Business Tax Certificate 2010-2026

What is the Business Tax Certificate

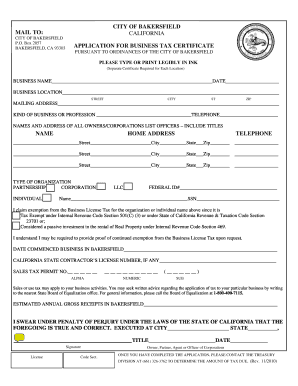

A business tax certificate is an official document that verifies a business's compliance with local tax regulations. It is often required for businesses operating in specific jurisdictions, such as cities or counties. This certificate confirms that the business is registered and has met all necessary tax obligations. In many cases, it serves as proof that the business is authorized to operate legally and collect sales tax.

How to Obtain the Business Tax Certificate

To obtain a business tax certificate, a business owner typically needs to follow a series of steps that may vary by location. Generally, the process includes:

- Researching local regulations to understand the specific requirements for the business tax certificate.

- Filling out the appropriate application form, which may be available online or at local government offices.

- Submitting the application along with any required documentation, such as proof of business registration and identification.

- Paying any applicable fees associated with the application process.

- Awaiting approval from the relevant local authority, which may involve a review of the submitted information.

Steps to Complete the Business Tax Certificate

Completing a business tax certificate application involves several important steps. These include:

- Gathering necessary information, such as the business name, address, and owner details.

- Providing information about the type of business entity, whether it is a sole proprietorship, LLC, corporation, or partnership.

- Detailing the nature of the business activities and any relevant tax identification numbers.

- Reviewing the application for accuracy before submission to prevent delays.

Legal Use of the Business Tax Certificate

The business tax certificate serves a critical legal function. It is often required for various business operations, including:

- Opening a business bank account.

- Applying for business loans or grants.

- Complying with local zoning laws.

Having a valid business tax certificate can help protect the business owner from potential legal issues related to operating without proper authorization.

Required Documents

When applying for a business tax certificate, certain documents are typically required. These may include:

- Proof of business registration, such as articles of incorporation or a fictitious business name statement.

- Identification documents for the business owner, like a driver's license or passport.

- Any relevant tax identification numbers, such as an Employer Identification Number (EIN).

Penalties for Non-Compliance

Failing to obtain or renew a business tax certificate can result in significant penalties. These may include:

- Fines imposed by local authorities.

- Legal action against the business for operating without proper authorization.

- Potential loss of business licenses or permits.

It is essential for business owners to stay informed about their compliance obligations to avoid these consequences.

Quick guide on how to complete business tax certificate

Effortlessly Prepare Business Tax Certificate on Any Device

The management of online documents has gained signNow traction among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Business Tax Certificate on any device with the airSlate SignNow mobile applications for Android or iOS and enhance any document-driven process today.

How to Modify and eSign Business Tax Certificate with Ease

- Locate Business Tax Certificate and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Adjust and eSign Business Tax Certificate and ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business tax certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a business tax certificate?

A business tax certificate is a legal document issued by a local government that allows businesses to operate within a certain jurisdiction. This document ensures that the business complies with local tax regulations. Obtaining a business tax certificate is essential for legitimizing your company and avoiding potential fines.

-

How do I obtain a business tax certificate using airSlate SignNow?

Using airSlate SignNow, you can efficiently complete and eSign your application for a business tax certificate. The platform streamlines the process by allowing easy document uploads and electronic signatures. Simply fill out the necessary forms and leverage our tools to submit your application securely.

-

What features of airSlate SignNow help with business tax certificate processing?

airSlate SignNow offers various features like customizable templates, automated workflows, and secure cloud storage, which simplify the process of obtaining a business tax certificate. These tools enable businesses to streamline documentation and ensure compliance. Additionally, the eSignature feature enhances efficiency and reduces paperwork.

-

Is airSlate SignNow cost-effective for managing business tax certificates?

Yes, airSlate SignNow is a cost-effective solution for managing your business tax certificate needs. Our pricing plans are designed to cater to businesses of all sizes without compromising quality. By minimizing paperwork and simplifying operations, you can save both time and money.

-

Can I integrate airSlate SignNow with other tools for business tax certificate management?

Absolutely! airSlate SignNow offers seamless integrations with various tools such as CRM systems, accounting software, and document management platforms. This enhances your ability to manage your business tax certificate efficiently across different applications, creating a unified workflow.

-

What are the key benefits of using airSlate SignNow for business tax certificates?

Using airSlate SignNow to manage your business tax certificate provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. The platform's ease of use allows for quick completion and eSigning of documents. Additionally, the secure environment ensures that your sensitive information remains protected.

-

How does electronic signing help speed up the business tax certificate process?

Electronic signing through airSlate SignNow greatly accelerates the business tax certificate process by eliminating waiting times associated with physical signatures. Recipients can eSign documents from anywhere, using any device, which minimizes delays. This helps you obtain your business tax certificate more quickly and efficiently.

Get more for Business Tax Certificate

- Bedbug annual filing form

- Northside financial assistance application form

- Kundali pdf form

- Nbi form no 5 download

- Contractor license and registration form eddystone borough eddystoneboro

- Scuml registration form pdf scuml registration form pdf money laundering is a serious offence in nigeria because it distorts

- Va form 2130

- Fm 1195 form

Find out other Business Tax Certificate

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast