Hotel Tax Quarterly Report Monroe County Co Monroe Pa Form

What is the Monroe County Hotel Tax Quarterly Report?

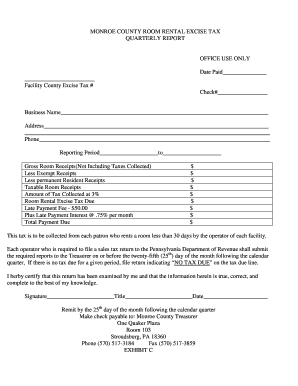

The Monroe County Hotel Tax Quarterly Report is a formal document required by the local government to track and collect hotel room rental excise taxes. This report provides detailed information about the rental income generated by hotels, motels, and similar establishments within Monroe County. It is essential for ensuring compliance with local tax regulations and contributes to funding various community services and infrastructure projects.

Steps to Complete the Monroe County Hotel Tax Quarterly Report

Completing the Monroe County Hotel Tax Quarterly Report involves several key steps to ensure accuracy and compliance:

- Gather all necessary financial records, including rental income statements and previous tax filings.

- Calculate the total taxable rental income for the reporting period.

- Apply the appropriate hotel tax rate to determine the total tax owed.

- Fill out the report form, ensuring all sections are completed accurately.

- Review the report for any errors or omissions before submission.

How to Obtain the Monroe County Hotel Tax Quarterly Report

The Monroe County Hotel Tax Quarterly Report can typically be obtained from the Monroe County government website or the local tax office. It may be available in both digital and paper formats. For those preferring digital access, downloading the form from the official website ensures that you have the most current version, which is crucial for compliance.

Legal Use of the Monroe County Hotel Tax Quarterly Report

The Monroe County Hotel Tax Quarterly Report serves a legal purpose by documenting the tax obligations of hotel operators. This report must be completed and submitted in accordance with local laws to avoid potential penalties. Accurate reporting is vital for maintaining good standing with tax authorities and ensuring that the funds collected are appropriately allocated for community services.

Filing Deadlines for the Monroe County Hotel Tax Quarterly Report

Filing deadlines for the Monroe County Hotel Tax Quarterly Report are typically set on a quarterly basis. It is important for hotel operators to be aware of these dates to ensure timely submission and avoid late fees. Generally, reports are due within a specific timeframe following the end of each quarter, so keeping a calendar of these deadlines can help maintain compliance.

Penalties for Non-Compliance with the Monroe County Hotel Tax Quarterly Report

Failure to submit the Monroe County Hotel Tax Quarterly Report on time or inaccuracies in the report can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for hotel operators to adhere to all filing requirements to avoid these consequences and maintain a positive relationship with local tax authorities.

Quick guide on how to complete monroe county room rental excise tax quarterly report

Complete monroe county room rental excise tax quarterly report effortlessly on any device

Online document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your files swiftly without delays. Manage monroe county hotel tax certificate on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and eSign monroe county room rental excise tax quarterly report with ease

- Obtain monroe county hotel room excise tax certificate and then click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and then click on the Done button to preserve your changes.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you choose. Edit and eSign monroe county hotel tax certificate and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to monroe county hotel room excise tax certificate

Create this form in 5 minutes!

How to create an eSignature for the monroe county hotel tax certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask monroe county hotel room excise tax certificate

-

What is the Monroe County room rental excise tax quarterly report?

The Monroe County room rental excise tax quarterly report is a document that property owners must submit to report the rental income generated from transient accommodations. It details the amount of excise tax collected and ensures compliance with local regulations. Understanding this report is crucial for maintaining accurate financial records and avoiding potential penalties.

-

How does airSlate SignNow help with the Monroe County room rental excise tax quarterly report?

airSlate SignNow simplifies the process of managing and submitting the Monroe County room rental excise tax quarterly report, allowing users to eSign documents effortlessly. Our platform offers templates and automated workflows, making it easier to track rental income and ensure that reports are filed on time. With our solution, you can spend less time on paperwork and more time focusing on your business.

-

What are the costs associated with using airSlate SignNow for tax reporting?

The pricing for airSlate SignNow is competitive and designed to fit the needs of various businesses handling documents like the Monroe County room rental excise tax quarterly report. We offer different subscription tiers, ensuring you only pay for the features you need. signNow out to our sales team for a customized quote based on your requirements.

-

Can I integrate airSlate SignNow with my existing accounting software?

Yes, airSlate SignNow can integrate seamlessly with many popular accounting software systems, enabling you to manage your financial records alongside the Monroe County room rental excise tax quarterly report. Our integration capabilities streamline data transfer and enhance overall workflow efficiency. Check our integration page to see the compatible systems available.

-

What features does airSlate SignNow provide to support tax compliance?

airSlate SignNow offers features such as document templates, electronic signatures, and real-time tracking to support tax compliance, including the Monroe County room rental excise tax quarterly report. Our platform ensures your documents are securely stored and easily accessible when you need them. Additionally, automated reminders help you stay on top of filing deadlines.

-

Is airSlate SignNow secure for handling sensitive tax information?

Absolutely, airSlate SignNow prioritizes the security of your sensitive tax information, including data related to the Monroe County room rental excise tax quarterly report. We implement robust encryption, two-factor authentication, and strict compliance with data protection regulations. Your documents remain safe and confidential throughout the entire signing process.

-

How quickly can I get started with airSlate SignNow for filing my tax report?

Getting started with airSlate SignNow is quick and easy. You can create an account and begin managing your documents for the Monroe County room rental excise tax quarterly report in minutes. Our intuitive interface and onboarding resources will guide you through the setup process, ensuring you're ready to file your reports without delay.

Get more for monroe county hotel tax certificate

- Clinic acceptance and commitment agreement duquesne university form

- Externship acceptance and commitment duquesne university form

- For the fall there are two2 2500 scholarships available to students who would duq form

- Kaleida health form

- Hfs 2538b form

- Form 511b request for excursion approval by bb deca ontario

- Resource lines 9 10 pdf form

- Ba7 notice of completion bayswater wa gov form

Find out other monroe county room rental excise tax quarterly report

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now