Horry County Form Pr 26 Tax Year

What is the Horry County Form Pr 26 Tax Year

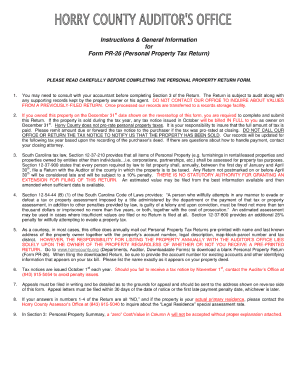

The Horry County Form Pr 26 is a personal property return form used for reporting personal property taxes in Horry County, South Carolina. This form is essential for individuals and businesses to declare their personal property, which may include vehicles, boats, and other tangible assets. The tax year for this specific form is 2019, and it is crucial for ensuring compliance with local tax regulations. Accurate completion of this form helps the county assess property taxes appropriately, based on the declared value of the personal property.

How to use the Horry County Form Pr 26 Tax Year

Using the Horry County Form Pr 26 involves several steps that ensure accurate reporting of personal property. First, gather all necessary information regarding the personal property you own, including descriptions and values. Next, access the form, which can be obtained from the Horry County website or local tax office. Fill out the form carefully, ensuring all details are accurate and complete. Once completed, submit the form to the appropriate tax authority by the specified deadline to avoid any penalties.

Steps to complete the Horry County Form Pr 26 Tax Year

Completing the Horry County Form Pr 26 requires a methodical approach:

- Gather documentation for all personal property, including purchase records and valuations.

- Obtain the form from the Horry County website or local tax office.

- Fill in your personal information, including name, address, and contact details.

- List each item of personal property, providing descriptions and estimated values.

- Review the form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Horry County Form Pr 26 Tax Year

The Horry County Form Pr 26 is legally binding once submitted to the appropriate tax authority. It must be filled out truthfully, as providing false information can lead to penalties or legal repercussions. Compliance with local tax laws is essential, and the form serves as a declaration of your personal property for tax assessment purposes. Understanding the legal implications of this form ensures that taxpayers fulfill their obligations while protecting their rights.

Filing Deadlines / Important Dates

Filing deadlines for the Horry County Form Pr 26 are critical to avoid penalties. Typically, the form must be submitted by a specific date each year, often aligned with the tax year. For 2019, it is essential to check with the Horry County tax office for the exact deadline. Late submissions may incur fines or interest on unpaid taxes, making timely filing crucial for compliance.

Form Submission Methods (Online / Mail / In-Person)

The Horry County Form Pr 26 can be submitted through various methods to accommodate taxpayers' preferences. Options typically include:

- Online submission through the Horry County tax office website.

- Mailing the completed form to the designated tax office address.

- In-person submission at the local tax office during business hours.

Each method has its own advantages, such as immediate confirmation for online submissions or personal assistance when submitting in person.

Quick guide on how to complete horry county form pr 26 tax year

Complete Horry County Form Pr 26 Tax Year effortlessly on any device

Managing documents online has gained substantial traction among organizations and individuals alike. It offers a perfect eco-friendly substitute to conventional printed and signed papers, allowing you to obtain the appropriate format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without complications. Manage Horry County Form Pr 26 Tax Year on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to edit and eSign Horry County Form Pr 26 Tax Year with ease

- Find Horry County Form Pr 26 Tax Year and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and press the Done button to save your changes.

- Choose how you wish to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Horry County Form Pr 26 Tax Year to ensure excellent communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the horry county form pr 26 tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Horry County form PR 26 for the tax year 2019?

The Horry County form PR 26 for the tax year 2019 is a tax document required for reporting specific financial information to local authorities. This form is essential for taxpayers who need to meet their tax obligations accurately and efficiently. By using airSlate SignNow, you can easily eSign and submit the Horry County form PR 26 for the tax year 2019.

-

How can airSlate SignNow help with the Horry County form PR 26 for the tax year 2019?

airSlate SignNow simplifies the process of completing and submitting the Horry County form PR 26 for the tax year 2019. Our platform allows users to fill out, eSign, and send the document securely, saving time and ensuring compliance. You’ll benefit from a seamless experience tailored for tax forms like the Horry County form PR 26.

-

Is there a fee to use airSlate SignNow for the Horry County form PR 26 tax year 2019?

Yes, airSlate SignNow offers competitive pricing plans that provide access to eSigning features for documents like the Horry County form PR 26 for the tax year 2019. Pricing varies based on the level of features needed, ensuring you choose a plan that best fits your budget and business requirements. Start with a free trial to evaluate the service.

-

What features does airSlate SignNow offer for completing the Horry County form PR 26 tax year 2019?

airSlate SignNow provides various features to facilitate completing the Horry County form PR 26 for the tax year 2019, including templates, customizable fields, and secure eSigning. The platform also allows document tracking and reminders, ensuring you never miss a deadline. These robust features streamline the tax filing process.

-

Can I integrate airSlate SignNow with other tools for managing the Horry County form PR 26 tax year 2019?

Absolutely! airSlate SignNow offers integrations with popular software applications that can assist in managing tasks related to the Horry County form PR 26 for the tax year 2019. You can connect it with CRM systems, cloud storage, and more to create a workflow that fits your needs seamlessly.

-

Is airSlate SignNow secure for submitting the Horry County form PR 26 for the tax year 2019?

Yes, security is a top priority at airSlate SignNow. We implement industry-standard encryption and authentication measures to guard your confidential information while submitting the Horry County form PR 26 for the tax year 2019. Rest assured that your documents are protected throughout the entire process.

-

What are the benefits of using airSlate SignNow for the Horry County form PR 26 tax year 2019?

Using airSlate SignNow for the Horry County form PR 26 for the tax year 2019 offers numerous benefits. You can streamline your workflow, reduce processing time, and improve accuracy while filing. With user-friendly tools and reliable customer support, businesses can tackle their tax forms confidently.

Get more for Horry County Form Pr 26 Tax Year

Find out other Horry County Form Pr 26 Tax Year

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template