Cell Phone Reimbursement Form

What is the cell phone reimbursement?

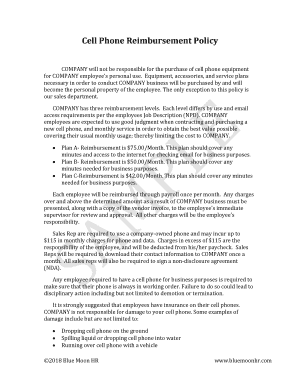

The cell phone reimbursement policy outlines the terms under which employees can receive compensation for their personal cell phone expenses incurred while performing work-related tasks. This policy is essential for businesses that require employees to use their personal devices for communication, ensuring that employees are not financially burdened by work-related phone costs. Typically, the reimbursement can cover a portion of the monthly service charges, and it may also include costs for apps or services that are necessary for work duties.

Key elements of the cell phone reimbursement

A well-defined cell phone reimbursement policy should include several key elements to ensure clarity and compliance. These elements typically encompass:

- Eligibility criteria: Specify which employees are eligible for reimbursement, such as full-time staff or specific job roles.

- Reimbursement amounts: Outline how much employees can claim, whether it is a fixed amount or a percentage of their bill.

- Documentation requirements: Detail what proof of expenses employees must provide, such as monthly bills or receipts.

- Payment process: Describe how and when reimbursements will be processed, including any necessary forms or approvals.

- Tax implications: Clarify any tax responsibilities associated with the reimbursement, ensuring employees understand the financial aspects.

How to use the cell phone reimbursement

Utilizing the cell phone reimbursement policy involves several straightforward steps. Employees should first confirm their eligibility based on the company's policy. Next, they need to track their cell phone expenses related to work, ensuring they keep detailed records of their usage. After gathering the necessary documentation, employees can fill out the mobile reimbursement form, attaching their bills and any required receipts. Finally, they submit the completed form to the appropriate department for processing. Following these steps ensures that employees receive their reimbursements in a timely manner.

Legal use of the cell phone reimbursement

For a cell phone reimbursement policy to be legally valid, it must comply with relevant federal and state laws. In the United States, various regulations govern employee reimbursements, including the Fair Labor Standards Act (FLSA) and state-specific laws such as the New York cell phone reimbursement law. Employers should ensure that their policies align with these laws to avoid potential legal issues. Additionally, maintaining clear documentation and communication regarding the policy can help protect both the employer and employees in case of disputes.

Examples of using the cell phone reimbursement

Examples of how the cell phone reimbursement policy can be applied include scenarios where employees are required to make work-related calls or use applications that facilitate their job functions. For instance, a sales representative who frequently communicates with clients via their personal phone may submit a claim for a portion of their monthly bill. Similarly, a remote worker who uses their device for video conferencing and other work-related tasks can also seek reimbursement. These examples illustrate the practical application of the policy and help employees understand its benefits.

Eligibility criteria

Determining eligibility for cell phone reimbursement is crucial for establishing a fair policy. Typically, eligibility may be based on factors such as employment status, job role, and the necessity of using a personal cell phone for work purposes. For example, employees in positions that require regular communication with clients or team members may qualify for reimbursement, while those in roles that do not necessitate phone use may not. Clear eligibility criteria help ensure that the policy is applied consistently across the organization.

Quick guide on how to complete cell phone reimbursement

Effortlessly Prepare Cell Phone Reimbursement on Any Device

The management of documents online has seen a rise in popularity among both businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed files, allowing you to find the necessary form and safely store it on the web. airSlate SignNow provides all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Handle Cell Phone Reimbursement on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The easiest method to modify and eSign Cell Phone Reimbursement with ease

- Find Cell Phone Reimbursement and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or an invitation link, or download it to your computer.

Say goodbye to misplaced or lost documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Cell Phone Reimbursement and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cell phone reimbursement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a cell phone reimbursement policy template?

A cell phone reimbursement policy template is a structured document that outlines the guidelines for reimbursing employees for their mobile phone expenses. This template helps businesses define eligibility criteria, reimbursement processes, and acceptable expenses. Using a clear policy template can streamline operations and ensure compliance.

-

How can I create a cell phone reimbursement policy using airSlate SignNow?

Creating a cell phone reimbursement policy with airSlate SignNow is simple. You can use our customizable templates to design a policy that fits your business needs. Once completed, you can easily send the document for eSignature, ensuring a quick and efficient approval process.

-

What are the benefits of using a cell phone reimbursement policy template?

Using a cell phone reimbursement policy template provides several benefits, including clarity for employees and consistency in reimbursement procedures. It minimizes misunderstandings related to expense claims and helps maintain financial control within the organization. Additionally, it promotes transparency and fairness in the reimbursement process.

-

Is there a cost associated with using the cell phone reimbursement policy template on airSlate SignNow?

While airSlate SignNow offers various pricing plans, many features, including access to policy templates, are available at an affordable rate. You can choose a plan that aligns with your organization’s needs and budget. Consider signing up for a free trial to explore the functionalities before committing.

-

Can I integrate the cell phone reimbursement policy template with other tools?

Yes, airSlate SignNow allows seamless integration with various tools and applications. This means you can connect your cell phone reimbursement policy template with platforms like Google Drive, Dropbox, and more, making document management and storage easier. Integrating these tools can enhance collaboration and efficiency.

-

How secure is the cell phone reimbursement policy template on airSlate SignNow?

Security is a top priority at airSlate SignNow. The platform implements advanced encryption methods to protect your cell phone reimbursement policy templates and other sensitive documents. Additionally, user access controls ensure that only authorized personnel can view or modify the policies.

-

Can I customize the cell phone reimbursement policy template?

Absolutely! The cell phone reimbursement policy template on airSlate SignNow is fully customizable. You can add your company’s branding, adjust the policy language, and tailor the reimbursement criteria to meet your specific business requirements. This flexibility ensures that your policy aligns perfectly with your organizational culture.

Get more for Cell Phone Reimbursement

- Past simple regular and irregular verbs language worksheets form

- Residential lease for unit in condominium or cooperative form

- Dummit and foote solutions chapter 4 form

- Letter of direction template rbc form

- Ri 7004 instructions form

- Nsu self report form

- Module 2 wellness plan form

- Private elementaryhigh school tuition form

Find out other Cell Phone Reimbursement

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple