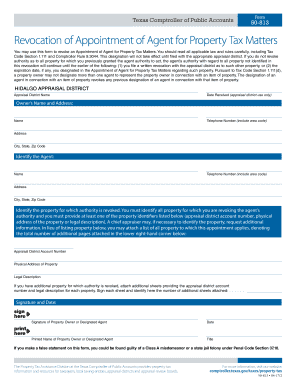

Form 50 813

What is the Form 50 813

The Form 50 813 is a specific document used in various administrative processes. It is essential for individuals and businesses to understand its purpose and requirements. This form is often associated with specific applications or requests that require official documentation. The correct completion and submission of the Form 50 813 are crucial for ensuring compliance with relevant regulations.

How to use the Form 50 813

Using the Form 50 813 involves several key steps. First, ensure you have the correct version of the form, as outdated versions may not be accepted. Next, carefully read the instructions accompanying the form to understand the required information. Fill out the form accurately, providing all necessary details to avoid delays in processing. Once completed, you can submit the form through the designated channels, whether online, by mail, or in person, depending on the specific requirements.

Steps to complete the Form 50 813

Completing the Form 50 813 requires attention to detail. Follow these steps for a successful submission:

- Obtain the latest version of the Form 50 813.

- Read the instructions thoroughly to understand what information is needed.

- Gather all required documents and information before starting to fill out the form.

- Complete the form, ensuring all fields are filled accurately.

- Review the completed form for any errors or omissions.

- Submit the form through the appropriate method, ensuring you keep a copy for your records.

Legal use of the Form 50 813

The legal use of the Form 50 813 is determined by compliance with applicable laws and regulations. It is important to ensure that the form is filled out correctly and submitted in accordance with legal requirements. Utilizing electronic signatures is permissible, provided that the signatures meet the standards set by laws such as the ESIGN Act and UETA. This ensures that the form holds legal weight in any administrative or legal context.

Key elements of the Form 50 813

Understanding the key elements of the Form 50 813 is essential for proper completion. Important components typically include:

- Identification information of the individual or business submitting the form.

- Details regarding the specific request or application being made.

- Signature lines for the necessary parties, which may include electronic signature options.

- Any additional documentation that may need to accompany the form.

Form Submission Methods

Submitting the Form 50 813 can be done through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission through a designated portal.

- Mailing the completed form to the appropriate address.

- In-person delivery at designated offices or agencies.

Quick guide on how to complete form 50 813

Easily Prepare Form 50 813 on Any Device

Digital document management has gained signNow traction among companies and individuals. It offers a superb eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without hold-ups. Manage Form 50 813 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Alter and eSign Form 50 813 Effortlessly

- Find Form 50 813 and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight essential parts of your documents or redact sensitive details using the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhaustive form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Form 50 813 and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 50 813

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 50 813 and how is it used?

Form 50 813 is a crucial document used in various business transactions for documentation purposes. It allows organizations to collect essential information, ensuring compliance and accuracy. By utilizing airSlate SignNow, you can easily manage and eSign your form 50 813 to streamline your processes.

-

How can airSlate SignNow enhance the management of form 50 813?

airSlate SignNow provides an intuitive platform that simplifies the creation, sharing, and signing of form 50 813. With features like real-time tracking and notifications, businesses can ensure all necessary parties have completed the document efficiently. Our solution promotes a smoother workflow and enhances document accuracy.

-

What are the pricing options for using airSlate SignNow for form 50 813?

airSlate SignNow offers flexible pricing plans tailored to suit different business needs, especially when handling documents like form 50 813. Plans vary based on features and number of users, ensuring you get the best value for your workflow. Contact us to find the perfect plan for your organization.

-

Can I integrate form 50 813 with other software using airSlate SignNow?

Yes, airSlate SignNow allows seamless integration with various applications, enhancing how you manage form 50 813. You can connect with popular CRM systems, cloud storage, and productivity tools to create a cohesive workflow. This interoperability helps eliminate manual processes and saves time.

-

What features does airSlate SignNow offer for form 50 813?

For form 50 813, airSlate SignNow includes an array of features such as electronic signatures, custom templates, and audit trails. These tools simplify document management, enhance security, and ensure compliance. Additionally, our mobile-friendly platform means you can manage documents on-the-go.

-

Are there any benefits to using airSlate SignNow for form 50 813 over traditional methods?

Utilizing airSlate SignNow for form 50 813 offers signNow benefits over traditional paper methods, such as increased efficiency, reduced costs, and enhanced security. With instant access to signed documents and automatic reminders, your team can spend less time on paperwork and more on core activities. Experience the digital transformation today.

-

How does airSlate SignNow ensure the security of my form 50 813?

airSlate SignNow prioritizes the security of your documents, including form 50 813, through advanced encryption and compliance with industry standards. We implement strict access controls and ensure that all signed documents are securely stored. This commitment to security helps protect sensitive information and fosters trust.

Get more for Form 50 813

- Susie tweed cranbrook form

- Deer predation or starvation form

- First convenience bank direct deposit form 529223369

- Allgakids form

- Dusom abuja form

- B10 notice of change in directorssecretaries form to be completed where director or secretary is being appointed or resigned

- Ukr rus medical card application form hse ie

- Firearms form 30 38 application for a visitors permit to

Find out other Form 50 813

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form