Fidelity Loan Application Form

What is the Fidelity Loan Application Form

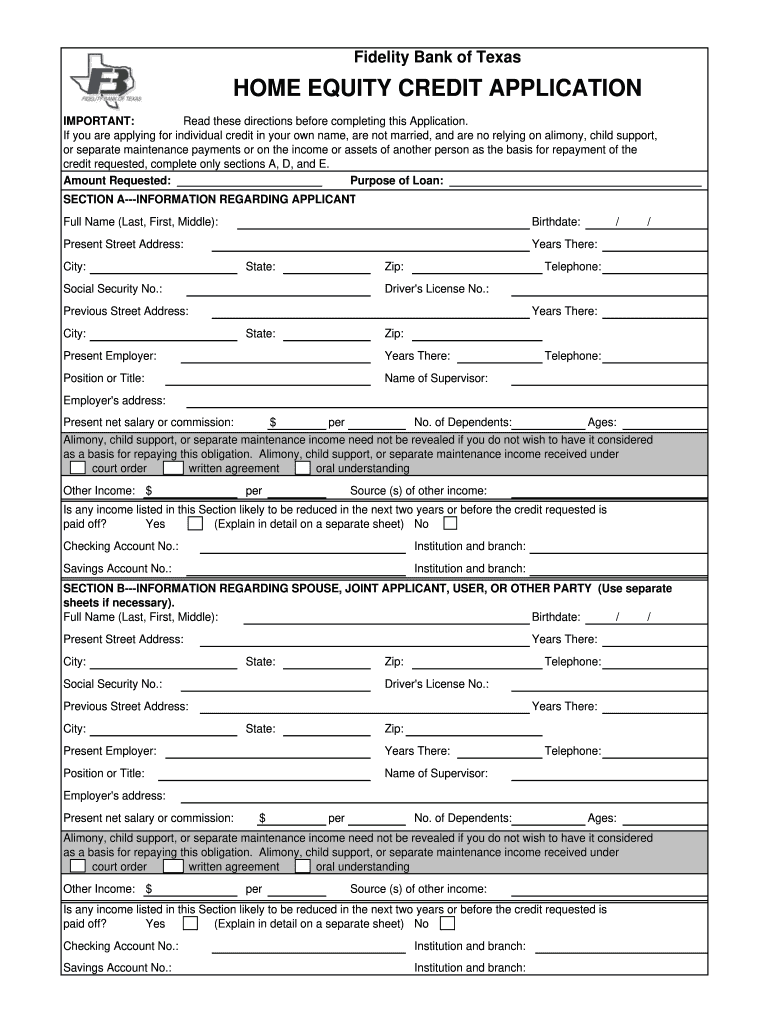

The Fidelity Loan Application Form is a crucial document used by individuals seeking to obtain a loan from Fidelity Bank. This form collects essential information about the applicant's financial status, credit history, and purpose for the loan. It serves as a formal request for financial assistance and is a key step in the loan approval process. By completing this form, applicants provide the bank with the necessary details to assess their eligibility and determine the terms of the loan.

Steps to Complete the Fidelity Loan Application Form

Completing the Fidelity Loan Application Form involves several important steps to ensure accuracy and compliance. Here is a straightforward guide:

- Gather Required Information: Collect personal details, including your name, address, Social Security number, and employment information.

- Detail Financial Information: Provide information regarding your income, existing debts, and assets to give a clear picture of your financial situation.

- Select Loan Type: Indicate the type of loan you are applying for and the amount needed.

- Review and Sign: Carefully review the completed form for accuracy before signing electronically or physically to confirm your application.

How to Obtain the Fidelity Loan Application Form

The Fidelity Loan Application Form can be obtained through various methods. Applicants can visit the official Fidelity Bank website to download the form directly. Additionally, forms are often available at local bank branches, where staff can assist with any questions. For convenience, many customers choose to fill out the application online, which allows for a quicker submission process.

Legal Use of the Fidelity Loan Application Form

The Fidelity Loan Application Form is legally binding once completed and signed. It must adhere to specific regulations governing electronic signatures, such as the ESIGN Act and UETA, ensuring that the application is valid and enforceable in a court of law. Proper completion of this form not only facilitates the loan process but also protects the rights of both the applicant and the lender.

Key Elements of the Fidelity Loan Application Form

Understanding the key elements of the Fidelity Loan Application Form is essential for applicants. The form typically includes:

- Personal Information: Name, address, and contact details.

- Employment Details: Current employer, job title, and income information.

- Financial Overview: Assets, liabilities, and credit history.

- Loan Information: Amount requested and purpose of the loan.

Form Submission Methods

Applicants can submit the completed Fidelity Loan Application Form through several methods, depending on their preference and convenience:

- Online Submission: Fill out and submit the form directly through the Fidelity Bank online portal.

- Mail: Print the completed form and send it to the designated address provided by the bank.

- In-Person: Visit a local Fidelity Bank branch to submit the form directly to a representative.

Quick guide on how to complete fidelity loan application form

Manage Fidelity Loan Application Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, enabling you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents swiftly without hassle. Handle Fidelity Loan Application Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented procedure today.

The simplest method to modify and eSign Fidelity Loan Application Form with ease

- Find Fidelity Loan Application Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional handwritten signature.

- Review the information and then click the Done button to finalize your changes.

- Select how you want to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate reprinting document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Fidelity Loan Application Form and ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fidelity loan application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fidelity loan form used for?

The fidelity loan form is utilized in the lending process to formalize loan agreements between borrowers and lenders. It outlines the specifics of the loan, including terms, conditions, and repayment schedules, ensuring clarity and compliance.

-

How can I create a fidelity loan form using airSlate SignNow?

Creating a fidelity loan form with airSlate SignNow is simple and user-friendly. You can use our customizable templates to tailor the form to your specific needs, allowing for efficient document creation and management.

-

Is there a fee for using the fidelity loan form feature on airSlate SignNow?

AirSlate SignNow offers competitive pricing plans that include the fidelity loan form feature. Our cost-effective solution ensures you get the functionality you need without hidden fees or costly subscriptions.

-

What are the benefits of using airSlate SignNow for the fidelity loan form?

Using airSlate SignNow for your fidelity loan form provides numerous benefits, such as enhanced security, faster processing times, and easy collaboration. Our platform simplifies the signing process, enabling quicker loan approvals.

-

Can I integrate airSlate SignNow with other applications to manage my fidelity loan form?

Yes, airSlate SignNow offers seamless integrations with many other applications, allowing you to effectively manage your fidelity loan form within your existing workflows. This enhances productivity and streamlines document management.

-

Is the fidelity loan form compliant with legal regulations?

Absolutely! The fidelity loan form created on airSlate SignNow is compliant with legal standards and regulations, ensuring that all signed documents are legally binding. This provides peace of mind for both lenders and borrowers.

-

How does airSlate SignNow ensure the security of my fidelity loan form?

AirSlate SignNow employs top-notch security measures, including encryption and secure cloud storage, to protect your fidelity loan form. This ensures that your sensitive information remains safe and accessible only to authorized parties.

Get more for Fidelity Loan Application Form

Find out other Fidelity Loan Application Form

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement