Dshs Self Employment Form Washington State 2009-2026

Understanding the DSHS Self Employment Form in Washington State

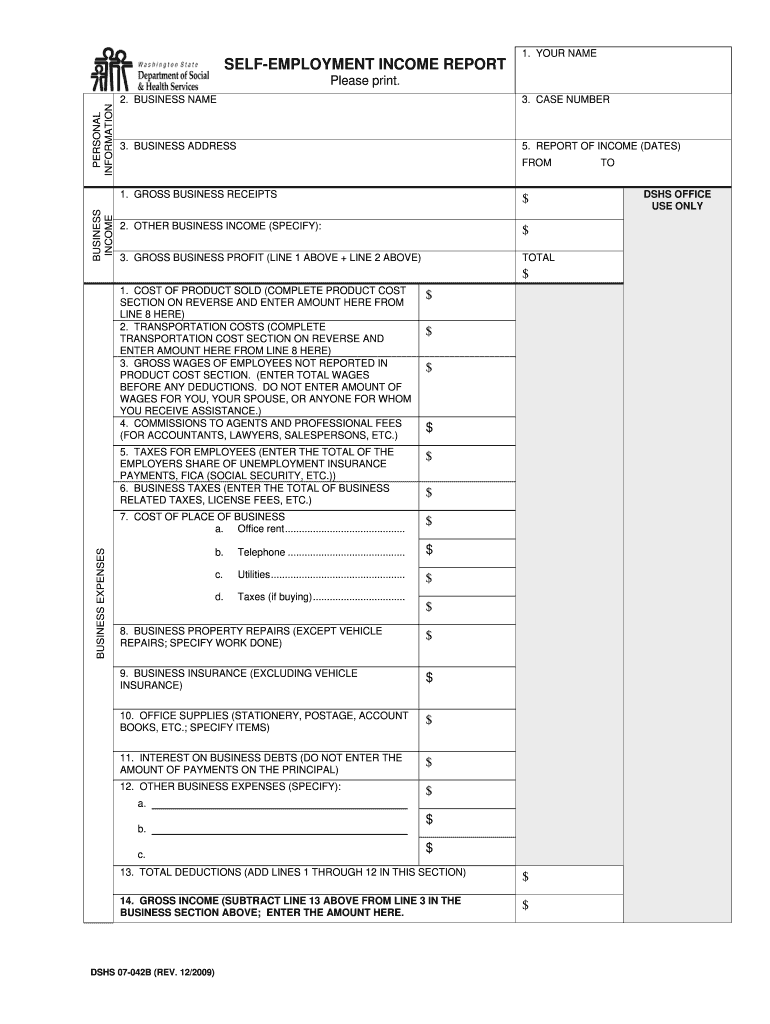

The DSHS Self Employment Form is essential for individuals in Washington State who are self-employed and seeking food assistance through SNAP (Supplemental Nutrition Assistance Program). This form collects information about your income and business activities to determine eligibility for benefits. It is crucial to provide accurate details about your earnings, expenses, and the nature of your business to ensure compliance with state regulations.

Steps to Complete the DSHS Self Employment Form

Completing the DSHS Self Employment Form involves several important steps:

- Gather necessary documentation, including income statements, expense records, and business licenses.

- Fill out personal information, including your name, address, and contact details.

- Provide detailed information about your business, including its name, type, and the services or products offered.

- Report your income accurately, detailing both gross income and allowable business expenses.

- Review the form for completeness and accuracy before submission.

Required Documents for the DSHS Self Employment Form

When submitting the DSHS Self Employment Form, you will need to provide specific documents to support your application. These may include:

- Proof of income, such as bank statements or invoices.

- Business licenses or permits.

- Expense receipts to substantiate business costs.

- Tax returns, if applicable, to verify income levels.

Legal Use of the DSHS Self Employment Form

The DSHS Self Employment Form must be completed in accordance with Washington State laws governing food assistance programs. It is important to ensure that all information provided is truthful and accurate, as providing false information can lead to penalties, including loss of benefits or legal action. Understanding the legal implications of the form helps in maintaining compliance and securing the necessary assistance.

Eligibility Criteria for Food Assistance

To qualify for food assistance through SNAP in Washington State, applicants must meet certain eligibility criteria. These include:

- Residency in Washington State.

- Meeting income limits based on household size.

- Being a U.S. citizen or a qualified non-citizen.

- Providing necessary documentation to support the self-employment income reported.

Form Submission Methods

The DSHS Self Employment Form can be submitted through various methods, making it accessible for all applicants. You can submit the form:

- Online through the DSHS website.

- By mail to your local DSHS office.

- In person at a DSHS office, where staff can assist you with the process.

Quick guide on how to complete dshs self employment form

Utilize the simpler approach for managing your Dshs Self Employment Form Washington State

The traditional methods of finalizing and approving documents consume an inordinate amount of time compared to contemporary document management tools. Previously, you would hunt for appropriate printed forms, fill them out by hand, and mail them via postal service. Now, you can locate, fill out, and sign your Dshs Self Employment Form Washington State in a single browser window with airSlate SignNow. Assembling your Dshs Self Employment Form Washington State is now more straightforward than ever.

Steps to finalize your Dshs Self Employment Form Washington State using airSlate SignNow

- Access the category page necessary and locate your state-specific Dshs Self Employment Form Washington State. Alternatively, utilize the search bar.

- Ensure the version of the form is accurate by checking the preview.

- Select Get form and enter editing mode.

- Fill your document with the required details using the editing tools.

- Review the added information and click the Sign option to validate your form.

- Choose the most suitable method to create your signature: generate it, draw your signature, or upload an image of it.

- Hit DONE to apply changes.

- Save the document to your device or proceed to Sharing settings to send it digitally.

Robust online platforms like airSlate SignNow streamline the process of completing and submitting your forms. Give it a try to discover how long document management and approval tasks are genuinely meant to take. You will save a signNow amount of time.

Create this form in 5 minutes or less

FAQs

-

What form can I fill out as a self-employed individual to make my CPA’s job easier?

A QuickBooks Trial Balance and Detailed General Ledger - printed and in Excel format. Work with your CPA to create an appropriate chart of accounts for your business. And use a good bookkeeper to keep your books. If your books look good, the CPA will ask some question to gain comfort and then accept your numbers with little further investigation.Please do not bring a boxful of crumpled receipts. You will pay more for your CPA to uncrumple them and categorize them. If you are a really small business, a legal pad sheet categorizing your receipts. If your receipts are a mess, or your books a mess, your CPA needs to ask a lot more questions and spend a lot more time gaining comfort with your books. Bad books from a shady client means a lot of grief for the CPA and a lot more fees.

-

What are some tips to fill out the kvpy self appraisal form?

You should not lie in the self-appraisal form. Professors generally do not ask anything from the self appraisal form. But if they find out some extraordinary stuffs in your form, they may ask you about those topics. And if you do not know those topics properly, you will have higher chance of NOT getting selected for the fellowship. So, DO NOT write anything that you are not sure about.If I remember properly, in the form they ask, “What is your favorite subject?” and I mentioned Biology there. Head of the interview panel saw that and asked me about my favorite field of biology. When I told genetics, two professors started asking question from genetics and did not ask anything from any other fields at all (except exactly 2 chemistry questions as I mentioned chemistry as my 2nd favorite subject). But they did not check other answers in self-appraisal form (at least in my presence).Do mention about science camps if you have attended any. Again, do not lie.All the best for interview round. :)

-

What form should I fill out if I am a UK self-employed resident invoicing the EU company?

You question is unclear. Do you mean another company in the EU, or administration of the EU like the Parliament or the Commission.

-

What form do I need to fill out when I’m a self-employee but the business belongs to my sister and mine (IRS question)?

Thanks Bruce. Edited answer below:Ok. It's time you do some reading…and if your business made decent money, get a tax accountant.Self employed / sole proprietor: 1040Self employed / LLC: must file Corp business filing and issue K1 then 1040Self employed / LLC w S Corp option: (you should have been on your own payroll) must file Corp business filing and issue K1, then 1040Self employed / C Corp: (you should have been on your own payroll) must file Corp business filing and issue 1099 DIV, then 1040.Corporate business filing and tax is due March 15. You can extend the filing, but any tax is due the March 15. If you don't pay on or before March 15, fees and interest are applied.Personal filing and tax is due April 15. You can extend the filing, but any tax is due on April 15. If you don't pay on or before April 15, fees and interest are applied.Same for your sister.Don't forget to file/pay the company's sales and use taxes, if applicable (State).You will also have to do corporate and personal filings with your state.

Create this form in 5 minutes!

How to create an eSignature for the dshs self employment form

How to create an electronic signature for the Dshs Self Employment Form in the online mode

How to make an eSignature for the Dshs Self Employment Form in Chrome

How to generate an electronic signature for putting it on the Dshs Self Employment Form in Gmail

How to make an eSignature for the Dshs Self Employment Form from your smartphone

How to make an electronic signature for the Dshs Self Employment Form on iOS devices

How to create an eSignature for the Dshs Self Employment Form on Android

People also ask

-

What is the self employment form for food stamps Florida?

The self employment form for food stamps Florida is a document required to assess income from self-employment for food assistance eligibility. This form helps the Florida Department of Children and Families determine your financial situation when applying for food stamps, ensuring you receive the correct benefits based on your actual earnings.

-

How can I obtain the self employment form for food stamps Florida?

You can obtain the self employment form for food stamps Florida directly from the Florida Department of Children and Families’ website. Alternatively, airSlate SignNow can assist you in preparing and submitting this form efficiently, simplifying the process of obtaining food stamps for self-employed individuals.

-

What information do I need to fill out the self employment form for food stamps Florida?

To fill out the self employment form for food stamps Florida, you will need to provide details of your business, including income, expenses, and the nature of your self-employment. This information is crucial to accurately evaluate your eligibility for food assistance benefits.

-

Is there a fee associated with submitting the self employment form for food stamps Florida?

Submitting the self employment form for food stamps Florida is generally free of charge. However, any costs incurred through services offered by third-party platforms, like airSlate SignNow, should be considered when seeking assistance with document preparation or e-signing.

-

What are the benefits of using airSlate SignNow for the self employment form for food stamps Florida?

Using airSlate SignNow for the self employment form for food stamps Florida simplifies the e-signing process, allowing you to quickly fill out and submit your application. The platform is user-friendly and cost-effective, ensuring you can efficiently manage your documents while accessing necessary food assistance benefits.

-

Can I track the status of my self employment form for food stamps Florida submission with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your self employment form for food stamps Florida submission. This feature ensures that you stay informed about your application progress and any necessary follow-ups, helping you maintain control over your food stamp eligibility process.

-

Are there any integrations available with airSlate SignNow for my self employment form for food stamps Florida?

AirSlate SignNow offers various integrations with popular applications that can enhance your experience when completing the self employment form for food stamps Florida. These integrations streamline document workflows, making it easier to manage your submissions and maintain organized records.

Get more for Dshs Self Employment Form Washington State

- Border patrol entrance exam answers 41368 form

- Sample retention letter to parents form

- Ibew local 46 associate member form

- Bitterness ratio chart form

- Mv3530 form

- First aid box checklist excel form

- How to fill out a limited power of attorney for eligible motor vehicle transactions form

- Request to bill tenant form city of duvall duvallwa

Find out other Dshs Self Employment Form Washington State

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement