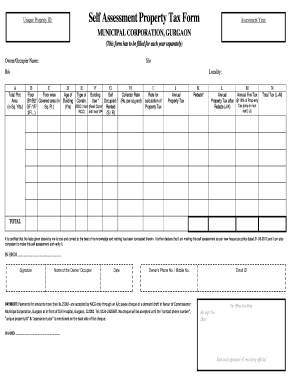

Self Assessment Property Tax Form 21 PDF

What is the Self Assessment Property Tax Form?

The self assessment property tax form is a crucial document used by property owners to report the value of their property for tax purposes. This form allows local tax authorities to determine the appropriate tax rate based on the assessed value of the property. It is essential for ensuring that property taxes are calculated fairly and accurately. In the United States, this form may vary by state, but it generally requires information about the property’s location, size, and any improvements made. Understanding the purpose and requirements of this form can help property owners fulfill their tax obligations effectively.

Steps to Complete the Self Assessment Property Tax Form

Completing the self assessment property tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including property deeds, previous tax assessments, and any records of improvements made to the property. Next, accurately fill out the form with details such as the property’s address, square footage, and current market value. After completing the form, review it for any errors or omissions. Finally, submit the form to your local tax authority by the specified deadline, either online or by mail, depending on your jurisdiction's requirements.

Legal Use of the Self Assessment Property Tax Form

The self assessment property tax form is legally binding once submitted to the appropriate tax authority. It is important to ensure that all information provided is truthful and accurate, as discrepancies can lead to penalties or legal issues. In the United States, electronic submissions of this form are considered valid under the ESIGN and UETA acts, which govern electronic signatures and records. Utilizing a reliable eSignature platform can enhance the legal standing of your submission by providing a digital certificate and maintaining compliance with these regulations.

Filing Deadlines and Important Dates

Filing deadlines for the self assessment property tax form can vary significantly by state and locality. Typically, property owners are required to submit their forms annually, often by a date set in the spring. It is crucial to check with your local tax authority for specific deadlines to avoid late fees or penalties. Additionally, some jurisdictions may have different deadlines for residential and commercial properties, so understanding these nuances can help ensure timely compliance.

Required Documents for Submission

To complete the self assessment property tax form, certain documents are typically required. These may include:

- Property deed or title

- Previous tax assessment notices

- Records of any renovations or improvements

- Photographs of the property

- Market analysis or appraisal documents

Having these documents ready can streamline the completion process and ensure that all necessary information is accurately reported.

Form Submission Methods

The self assessment property tax form can usually be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission via the local tax authority's website

- Mailing a physical copy of the form

- In-person delivery at designated tax offices

Choosing the appropriate submission method can depend on personal preference and the specific requirements of your local tax authority.

Quick guide on how to complete self assessment property tax form 21 pdf

Complete Self Assessment Property Tax Form 21 Pdf effortlessly on any device

Online document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-conscious substitute to conventional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without interruptions. Handle Self Assessment Property Tax Form 21 Pdf on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related procedure today.

How to adjust and eSign Self Assessment Property Tax Form 21 Pdf with ease

- Obtain Self Assessment Property Tax Form 21 Pdf and click Get Form to initiate.

- Utilize the tools we offer to finalize your form.

- Highlight pertinent sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details and click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text (SMS), invitation link, or downloading it to your computer.

Stop worrying about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Self Assessment Property Tax Form 21 Pdf to guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the self assessment property tax form 21 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the self assessment form for property tax?

The self assessment form for property tax is a document used by property owners to assess and declare the value of their property to local tax authorities. It helps determine your property tax liability and can influence future tax rates. Using airSlate SignNow, you can easily complete and eSign your self assessment form for property tax, ensuring a smooth submission process.

-

How does airSlate SignNow support the self assessment form for property tax?

airSlate SignNow provides a user-friendly platform that streamlines the process of filling out and signing your self assessment form for property tax. With features like templates, easy document sharing, and secure eSigning, airSlate SignNow makes the task hassle-free and efficient.

-

What are the pricing options for using airSlate SignNow for property tax self assessment forms?

AirSlate SignNow offers flexible pricing plans to accommodate individual users and businesses needing to complete self assessment forms for property tax. You can choose from monthly or annual subscriptions, with various features available at each tier to meet your needs.

-

Is the self assessment form for property tax legally binding when eSigned?

Yes, the self assessment form for property tax signed electronically using airSlate SignNow is legally binding. The platform complies with eSignature laws, ensuring that your electronically signed documents hold the same legal weight as traditional handwritten signatures.

-

Can I integrate airSlate SignNow with other tools for my self assessment form for property tax?

Absolutely! airSlate SignNow offers integrations with various popular business applications, allowing you to seamlessly incorporate your self assessment form for property tax processing into your existing workflows. These integrations enhance productivity and reduce the need for manual data entry.

-

What benefits can I expect using airSlate SignNow for my property tax self assessment?

By using airSlate SignNow for your self assessment form for property tax, you can enjoy signNow time savings, reduce paperwork, and enhance organization. The digital platform ensures that all documents are stored securely and accessible anytime, streamlining the entire tax assessment process.

-

How secure is airSlate SignNow when handling my self assessment form for property tax?

airSlate SignNow takes security seriously, employing advanced encryption and compliance with data protection regulations. Your self assessment form for property tax will be protected at all times, ensuring that your sensitive information is kept safe from unauthorized access.

Get more for Self Assessment Property Tax Form 21 Pdf

- Rose bowl swim lessons form

- Land title verification of identity form

- Properties of equalities worksheet form

- Brakebush application form

- Sports facility rental agreement template 787747800 form

- Standard rental agreement template form

- Static caravan rental agreement template form

- Storage locker rental agreement template form

Find out other Self Assessment Property Tax Form 21 Pdf

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP