Form 941af Me

What is the Form 941af Me

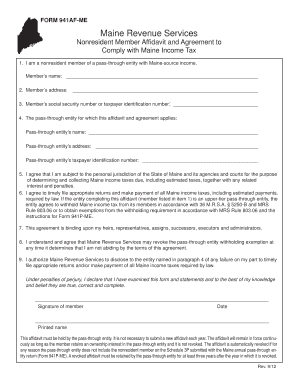

The Form 941af Me is a tax document used by employers in the United States to report and pay federal payroll taxes. This form is specifically designed for businesses that operate in Maine and need to comply with state and federal tax regulations. It includes information about wages paid, tips, and other compensation, as well as the taxes withheld from employee paychecks. Understanding this form is crucial for maintaining compliance with tax obligations and avoiding penalties.

How to use the Form 941af Me

Using the Form 941af Me involves several steps to ensure accurate reporting of payroll taxes. First, gather all necessary information, including employee wages and tax withholdings. Next, fill out the form by entering the required data in the appropriate fields. It is important to double-check all entries for accuracy before submission. Once completed, the form can be submitted electronically or via mail, depending on your preference and compliance requirements. Utilizing digital tools can streamline this process, making it easier to manage and submit your forms securely.

Steps to complete the Form 941af Me

Completing the Form 941af Me requires careful attention to detail. Begin by downloading the fillable version of the form. Follow these steps:

- Enter your business information, including name, address, and Employer Identification Number (EIN).

- Report the total number of employees and the wages paid during the reporting period.

- Calculate the total taxes withheld from employees’ paychecks.

- Complete any additional sections based on your specific payroll circumstances.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 941af Me

The legal use of the Form 941af Me is essential for employers to remain compliant with federal and state tax laws. This form must be filed accurately and on time to avoid penalties. Electronic submission of the form is legally recognized, provided that the eSignature used meets the requirements set by the ESIGN Act and UETA. Ensuring that the form is completed correctly and submitted within the designated deadlines is crucial for legal compliance.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines when submitting the Form 941af Me. Typically, the form is due quarterly, with deadlines falling on the last day of the month following the end of each quarter. For example, the deadlines for the first, second, third, and fourth quarters are April 30, July 31, October 31, and January 31, respectively. Missing these deadlines can result in penalties and interest on unpaid taxes, making timely submission critical for all employers.

Form Submission Methods (Online / Mail / In-Person)

The Form 941af Me can be submitted through various methods, providing flexibility for employers. The most efficient method is electronic submission, which allows for quick processing and confirmation of receipt. Alternatively, employers can choose to mail the completed form to the appropriate IRS address or submit it in person at designated locations. Each method has its own advantages, and employers should select the one that best fits their operational needs.

Quick guide on how to complete form 941af me

Complete Form 941af Me seamlessly on any device

Digital document management has become a favored choice among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, amend, and eSign your documents swiftly without complications. Manage Form 941af Me on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to alter and eSign Form 941af Me effortlessly

- Locate Form 941af Me and click Get Form to get going.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to submit your form, via email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or mistakes that necessitate producing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form 941af Me and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 941af me

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 941AF ME and how does airSlate SignNow assist with it?

Form 941AF ME is a payroll tax form used to report taxes withheld from employee wages. airSlate SignNow provides a user-friendly platform to eSign and manage your Form 941AF ME, ensuring compliance and efficiency in handling your payroll documentation.

-

Is there a cost associated with using airSlate SignNow for Form 941AF ME?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to eSigning capabilities for Form 941AF ME and other documents, ensuring you choose the most cost-effective option for your organization.

-

What features does airSlate SignNow offer for handling Form 941AF ME?

airSlate SignNow includes features like customized templates, document sharing, and real-time tracking. These functionalities make it simple to fill out and eSign your Form 941AF ME, streamlining your business’s tax reporting process.

-

Can I integrate airSlate SignNow with other software for Form 941AF ME?

Absolutely! airSlate SignNow supports integrations with various business tools such as CRM systems, cloud storage, and accounting software. This ensures that you can seamlessly manage your Form 941AF ME alongside your other business processes.

-

What are the benefits of eSigning Form 941AF ME with airSlate SignNow?

eSigning Form 941AF ME with airSlate SignNow speeds up the process and reduces paperwork, enabling quicker submissions. Additionally, it enhances security and provides a verifiable audit trail, ensuring your tax documents are handled accurately and securely.

-

How can airSlate SignNow improve the efficiency of my Form 941AF ME submissions?

With airSlate SignNow, you can prepare, sign, and send Form 941AF ME in a fraction of the time compared to traditional methods. The platform's intuitive interface reduces the likelihood of errors, promoting faster and more accurate submissions.

-

Is airSlate SignNow secure for signing sensitive documents like Form 941AF ME?

Yes, airSlate SignNow is designed with high-level security measures to protect your sensitive documents, including Form 941AF ME. Industry-standard encryption and compliance with regulations ensure that your data remains confidential and secure.

Get more for Form 941af Me

- Costco direct deposit form

- Youth fellowship fund application seneca cayuga tribe of form

- Form au 196 10 department of taxation and finance new york

- Access pass application form 11209563

- U s fish and wildlife service form 3 202 12 migratory bird and eagle acquisition and transfer request forms fws

- Msds hand sanitizer form

- Rental license agreement template form

- Rental management agreement template form

Find out other Form 941af Me

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later