Ct 60 Qsss Form

What is the Form CT 60 QSSS?

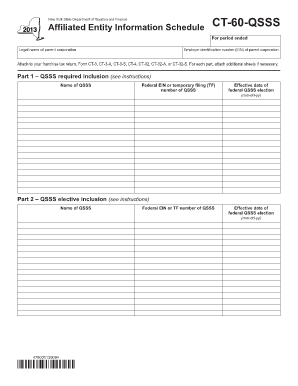

The Form CT 60 QSSS is a specific tax form used in the United States for the purpose of reporting income and expenses related to qualified subchapter S subsidiaries (QSSS). This form is crucial for businesses that operate as S corporations and have subsidiary entities. By using the CT 60 QSSS, businesses can ensure compliance with federal tax regulations while accurately reporting their financial activities. Understanding the purpose and requirements of this form is essential for any business owner involved in S corporation structures.

How to Use the Form CT 60 QSSS

Using the Form CT 60 QSSS involves several key steps. First, gather all necessary financial information related to the subsidiary, including income statements and expense reports. Next, complete the form by accurately filling in the required fields, which typically include details about the parent S corporation and its subsidiaries. Once the form is completed, it must be filed with the appropriate tax authority. It is important to ensure that all information is accurate to avoid any potential issues with compliance.

Steps to Complete the Form CT 60 QSSS

Completing the Form CT 60 QSSS requires careful attention to detail. Here are the steps to follow:

- Collect all relevant financial documentation for the subsidiary.

- Access the Form CT 60 QSSS from the appropriate tax authority's website or office.

- Fill in the form, ensuring all required fields are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or by mail.

Legal Use of the Form CT 60 QSSS

The legal use of the Form CT 60 QSSS is governed by federal tax laws. This form must be used to report the financial activities of qualified subchapter S subsidiaries accurately. Failure to use this form correctly can lead to penalties or issues with the Internal Revenue Service (IRS). It is essential for businesses to understand the legal implications of filing this form and to ensure compliance with all relevant regulations to avoid potential legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 60 QSSS can vary based on the tax year and the specific circumstances of the business. Generally, the form must be submitted by the tax filing deadline for the parent S corporation. It is important to keep track of these deadlines to ensure timely submission and avoid any late filing penalties. Businesses should also be aware of any changes in tax law that may affect filing dates.

Who Issues the Form CT 60 QSSS

The Form CT 60 QSSS is typically issued by the state tax authority or the relevant federal agency responsible for overseeing tax compliance for S corporations. It is important for businesses to obtain the most current version of the form from the appropriate issuing authority to ensure compliance with any updates or changes in tax regulations.

Quick guide on how to complete ct 60 qsss form

Effortlessly Prepare Ct 60 Qsss Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious substitute to traditional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to quickly create, modify, and eSign your documents without any delays. Manage Ct 60 Qsss Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The easiest method to edit and eSign Ct 60 Qsss Form without stress

- Find Ct 60 Qsss Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassles of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you select. Edit and eSign Ct 60 Qsss Form to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 60 qsss form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form CT 60 and how is it used?

Form CT 60 is a document used by businesses to report and comply with specific tax requirements. This form helps ensure accurate reporting of tax information to the state and can be easily filled out using airSlate SignNow's comprehensive eSignature features.

-

How does airSlate SignNow simplify filling out form CT 60?

With airSlate SignNow, users can easily fill out form CT 60 using our intuitive interface that guides them through each section. Our platform allows you to pre-fill information, reducing manual entry and potential errors, making the submission process seamless.

-

Is there a cost associated with using airSlate SignNow for form CT 60?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs. Our pricing reflects the value of enhanced features for document management, including eSigning and sharing of important documents like form CT 60.

-

What features are included in the airSlate SignNow plan for form CT 60 users?

Our airSlate SignNow plan includes an array of features such as document templates, automatic reminders, cloud storage, and integration with popular applications. These features make it easier to manage form CT 60 submissions efficiently.

-

Can team members collaborate on form CT 60 using airSlate SignNow?

Absolutely! airSlate SignNow enables multiple team members to collaborate on form CT 60. Users can assign roles and permissions, ensuring that everyone has access to the document they need while maintaining control over the signing process.

-

What benefits does airSlate SignNow provide for managing form CT 60?

Using airSlate SignNow to manage form CT 60 provides numerous benefits: improved accuracy, reduced paperwork, and expedited processing times. Our solution streamlines the entire process, ultimately saving time and enhancing productivity for businesses.

-

Does airSlate SignNow integrate with other software for form CT 60 processing?

Yes, airSlate SignNow features seamless integrations with various business applications, making it easy to manage form CT 60 alongside your existing workflows. This flexibility enhances efficiency and ensures a smoother document management process.

Get more for Ct 60 Qsss Form

Find out other Ct 60 Qsss Form

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free