Sanmateocountytaxcollector Form

What is the Sanmateocountytaxcollector

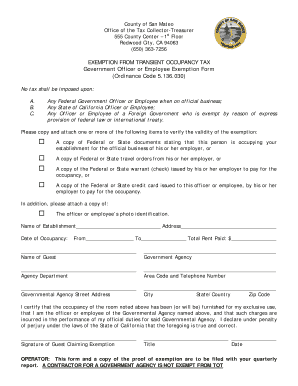

The Sanmateocountytaxcollector refers to the official entity responsible for collecting taxes within San Mateo County, California. This office manages various tax-related functions, including property tax collection, assessment, and distribution of tax revenues to local governments and services. Understanding the role of the Sanmateocountytaxcollector is essential for residents and businesses to ensure compliance with local tax laws and regulations.

How to use the Sanmateocountytaxcollector

Using the Sanmateocountytaxcollector services involves several steps. First, individuals and businesses should familiarize themselves with the types of taxes applicable in San Mateo County, such as property taxes and business taxes. Next, users can access the Sanmateocountytaxcollector's official website to find necessary forms, payment options, and deadlines. Completing and submitting the required forms accurately is crucial for compliance and avoiding penalties.

Steps to complete the Sanmateocountytaxcollector

Completing the Sanmateocountytaxcollector form involves a systematic approach:

- Gather necessary documents, including property assessments and previous tax returns.

- Access the Sanmateocountytaxcollector website to download the required form.

- Fill out the form with accurate information, ensuring all fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form online or via mail, following the submission guidelines provided.

Legal use of the Sanmateocountytaxcollector

The legal use of the Sanmateocountytaxcollector form is governed by state and local tax laws. It is essential for users to ensure that their submissions comply with the relevant regulations to avoid legal issues. Electronic submissions are legally recognized, provided they meet the requirements set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act and other applicable laws. Using a reliable eSignature solution can enhance the legal standing of the submitted documents.

Key elements of the Sanmateocountytaxcollector

Key elements of the Sanmateocountytaxcollector form include:

- Taxpayer Identification: Accurate identification of the taxpayer is crucial.

- Property Information: Details about the property being taxed must be included.

- Assessment Values: The assessed value of the property should be clearly stated.

- Payment Information: Instructions for payment must be followed to ensure timely processing.

Form Submission Methods (Online / Mail / In-Person)

The Sanmateocountytaxcollector form can be submitted through various methods to accommodate different preferences:

- Online: Users can complete and submit the form electronically through the Sanmateocountytaxcollector website.

- Mail: Completed forms can be printed and sent via postal service to the designated address.

- In-Person: Taxpayers may also visit the San Mateo County Tax Collector's office to submit forms directly.

Quick guide on how to complete sanmateocountytaxcollector

Complete Sanmateocountytaxcollector with ease on any device

Managing documents online has gained popularity among companies and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Sanmateocountytaxcollector on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Sanmateocountytaxcollector effortlessly

- Obtain Sanmateocountytaxcollector and click Get Form to initiate the process.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Sanmateocountytaxcollector and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sanmateocountytaxcollector

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of the San Mateo County Tax Collector?

The San Mateo County Tax Collector is responsible for collecting property taxes and other assessments within the county. They ensure timely processing of payments and provide necessary information regarding tax bills. Understanding the role of the San Mateo County Tax Collector can help you meet your tax obligations and avoid penalties.

-

How can I easily pay my taxes to the San Mateo County Tax Collector?

You can conveniently pay your taxes to the San Mateo County Tax Collector online through their official website. Additionally, airSlate SignNow can assist by allowing you to securely sign and send any necessary documents related to your tax payments. Online payment options save time and can enhance compliance with payment deadlines.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow offers powerful features like electronic signatures, document templates, and secure cloud storage for managing tax-related documents. You can easily create, edit, and send agreements to and from the San Mateo County Tax Collector with just a few clicks. This streamlines your workflow, ensuring efficiency in managing critical documents.

-

Is airSlate SignNow a cost-effective solution for small businesses dealing with the San Mateo County Tax Collector?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small enterprises. With flexible pricing plans and a user-friendly interface, it simplifies the process of managing documents related to the San Mateo County Tax Collector. This affordability allows smaller businesses to maintain compliance without overspending.

-

Can I integrate airSlate SignNow with other applications for tax management?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enhancing your tax management capabilities when dealing with the San Mateo County Tax Collector. This integration ensures that you can efficiently handle tasks such as document signing and payment processing without switching between multiple platforms.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents ensures you have an efficient, secure, and legally compliant method for signing and sending necessary documents to the San Mateo County Tax Collector. The platform helps prevent errors, reduces processing time, and maximizes your productivity. These benefits can lead to better overall tax management.

-

How does airSlate SignNow enhance the customer experience with the San Mateo County Tax Collector?

airSlate SignNow enhances the customer experience by providing a user-friendly platform that simplifies document management with the San Mateo County Tax Collector. By enabling fast and secure electronic signatures, users can quickly complete necessary tax forms without unnecessary delays. This improved experience fosters better relationships with tax authorities.

Get more for Sanmateocountytaxcollector

- Occupational health enrollment form uh

- Myuhid form

- Ub parent family orientation waiver form parent and family orientation waiver form

- Images for what need to knowtasf20myuh iduniversity of houston tasfa reference guide 20192020be sure to complete all sections form

- Igetc_02 03 napa valley college napavalley form

- Non custodial parents form us domestic 2020 21 academic year non custodial parents form

- Athletics formshouston community college hcc

- Carol knapp jobpostings form

Find out other Sanmateocountytaxcollector

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile