Hud Worksheet 1986-2026

What is the HUD Worksheet?

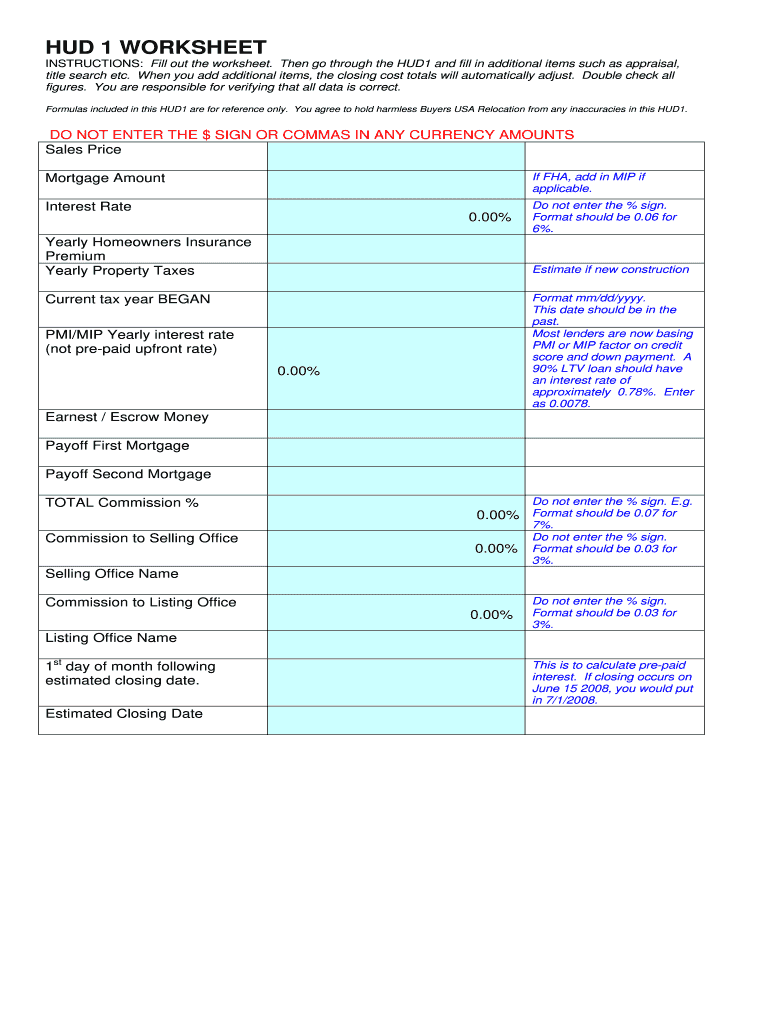

The HUD worksheet, commonly referred to as the HUD-1 worksheet, is a crucial document used in real estate transactions, particularly for federally related mortgage loans. This form provides a detailed account of the financial aspects of the transaction, including the purchase price, loan amounts, and closing costs. It is designed to ensure transparency between buyers and sellers, allowing all parties to understand the financial implications of the sale. The HUD-1 worksheet is especially important for buyers and sellers involved in transactions that include government-backed loans, as it outlines the necessary financial disclosures required by the Department of Housing and Urban Development (HUD).

How to Use the HUD Worksheet

Using the HUD worksheet effectively involves several key steps. First, gather all relevant financial information, including the purchase price, loan details, and any associated fees. Next, accurately fill out each section of the worksheet, ensuring that all required fields are completed. It's essential to double-check the figures for accuracy, as any discrepancies can lead to delays or complications during the closing process. Once completed, the HUD worksheet must be reviewed by all parties involved in the transaction to confirm that the financial details are correct and agreed upon.

Steps to Complete the HUD Worksheet

Completing the HUD worksheet requires attention to detail and adherence to specific guidelines. Start by entering the property address and the names of the buyer and seller. Next, fill in the loan information, including the loan amount and type. Proceed to detail the closing costs, which may include appraisal fees, title insurance, and other expenses. Ensure that all calculations are accurate and that totals match throughout the document. Finally, review the completed form with all parties to ensure mutual understanding and agreement before submission.

Legal Use of the HUD Worksheet

The HUD worksheet serves a legal purpose in real estate transactions, as it provides a standardized format for documenting financial details. It is essential that the form is filled out accurately and submitted in compliance with federal regulations. Failure to adhere to these guidelines can result in legal ramifications, including penalties for non-compliance. Additionally, using an outdated version of the HUD worksheet may render the document invalid, so it is crucial to ensure that the most current form is utilized in transactions.

Key Elements of the HUD Worksheet

Several key elements must be included in the HUD worksheet to ensure its validity and usefulness. These elements include:

- Property address and legal description

- Information about the buyer and seller

- Loan details, including the type and amount

- A comprehensive list of closing costs

- Adjustments for any credits or debits

Each of these components plays a vital role in providing a clear financial picture for all parties involved in the transaction.

Examples of Using the HUD Worksheet

Examples of using the HUD worksheet can be found in various real estate scenarios. For instance, when a first-time homebuyer is purchasing a property, the HUD worksheet helps them understand the total costs involved, including down payments and closing fees. Similarly, sellers can use the form to assess their net proceeds from the sale after accounting for expenses. In both cases, the HUD worksheet serves as a vital tool for facilitating transparent communication between buyers, sellers, and lenders.

Quick guide on how to complete hud 1 worksheet form

Discover the simplest method to complete and sign your Hud Worksheet

Are you still spending time preparing your official documents on paper instead of handling them online? airSlate SignNow provides a superior way to complete and sign your Hud Worksheet and similar forms for public services. Our intelligent eSignature solution delivers everything you require to manage documents efficiently and in compliance with formal standards - robust PDF editing, administration, protection, signing, and sharing tools are readily available within an easy-to-use interface.

You only need to take a few steps to complete and sign your Hud Worksheet:

- Upload the fillable template to the editor using the Get Form button.

- Review what information you need to include in your Hud Worksheet.

- Move between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the gaps with your information.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Obscure sections that are no longer relevant.

- Press Sign to generate a legally binding eSignature using any method you prefer.

- Insert the Date next to your signature and finish your task with the Done button.

Store your finalized Hud Worksheet in the Documents folder of your profile, download it, or transfer it to your preferred cloud storage. Our solution also provides adaptable form sharing. There’s no need to print out your templates when you need to submit them to the appropriate public office - send them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

FAQs

-

What is the right way to fill out Two-Earners Worksheet tax form?

Wages, in this context, are what you expect to appear in box 1 of your W-2.The IRS recommends that the additional withholding be applied to the higher-paid spouse and that the lesser-paid spouse should simply claim zero withholding allowances, as this is usually more accurate (due to the way that withholding is actually calculated by payroll programs, you may wind up with less withheld than you want if you split it).

-

For the new 2018 W-4 form, do I also print out the separate A-H worksheet and fill that out for my employer?

No, an employee is not required to give the separate worksheet to the employer. Keep it for your own records.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

Create this form in 5 minutes!

How to create an eSignature for the hud 1 worksheet form

How to make an eSignature for the Hud 1 Worksheet Form online

How to create an electronic signature for your Hud 1 Worksheet Form in Chrome

How to generate an eSignature for signing the Hud 1 Worksheet Form in Gmail

How to create an eSignature for the Hud 1 Worksheet Form from your smartphone

How to generate an eSignature for the Hud 1 Worksheet Form on iOS devices

How to make an electronic signature for the Hud 1 Worksheet Form on Android

People also ask

-

What is a Hud Worksheet and how can it benefit my business?

A Hud Worksheet is a crucial document that helps streamline the closing process of real estate transactions. By utilizing airSlate SignNow, you can easily create, send, and eSign Hud Worksheets, ensuring accuracy and compliance while saving time. This digital solution enhances collaboration among parties and simplifies the management of essential documents.

-

How does airSlate SignNow simplify the creation of Hud Worksheets?

With airSlate SignNow, creating Hud Worksheets is straightforward thanks to our user-friendly interface. You can quickly fill in necessary fields, add signatures, and share the document with stakeholders in just a few clicks. This efficiency allows you to focus more on your business rather than paperwork.

-

Is there a cost associated with using airSlate SignNow for Hud Worksheets?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, providing you with access to essential features for managing Hud Worksheets and other documents, ensuring you get great value for your investment.

-

Can I integrate airSlate SignNow with other software for managing Hud Worksheets?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms, making it easier to manage Hud Worksheets alongside your existing software. These integrations enhance workflow efficiency and ensure that all your data is synchronized across applications.

-

What security measures does airSlate SignNow have for Hud Worksheets?

airSlate SignNow prioritizes the security of your Hud Worksheets and other documents. We implement industry-standard encryption, secure data storage, and user authentication features to protect sensitive information throughout the eSigning process.

-

How can airSlate SignNow enhance collaboration on Hud Worksheets?

With airSlate SignNow, collaboration on Hud Worksheets is made simple. Multiple users can access, review, and eSign documents in real time, making it easier to finalize transactions quickly and efficiently. This collaborative approach reduces errors and accelerates the closing process.

-

Are there templates available for Hud Worksheets in airSlate SignNow?

Yes, airSlate SignNow offers a variety of templates for Hud Worksheets that can be customized to fit your needs. These templates not only save time but also ensure that you include all necessary information, improving your overall document management process.

Get more for Hud Worksheet

Find out other Hud Worksheet

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors