Standard Deduction Worksheet Line 40 Form

Understanding the Standard Deduction Worksheet Line 40 Form

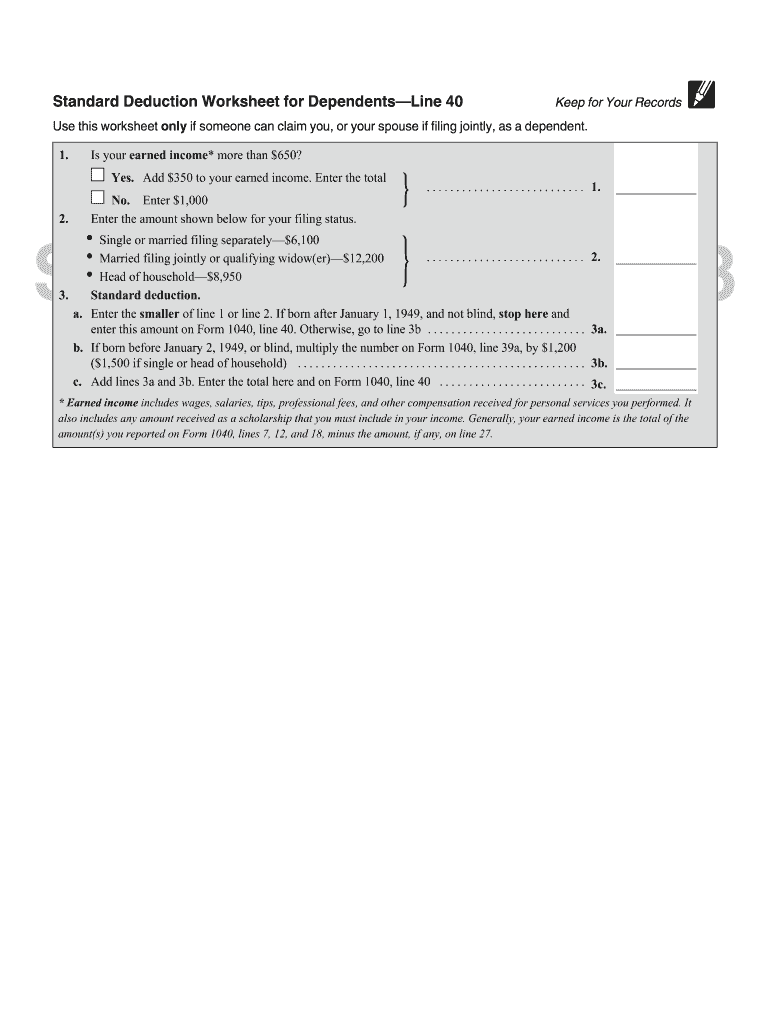

The Standard Deduction Worksheet Line 40 Form is a crucial document for taxpayers who claim the standard deduction on their federal tax returns. This form helps individuals determine the amount of their standard deduction based on various factors, including filing status and income. It is particularly important for dependents, as their eligibility for certain deductions may differ from that of independent taxpayers. By accurately completing this worksheet, dependents can ensure they maximize their tax benefits while remaining compliant with IRS regulations.

Steps to Complete the Standard Deduction Worksheet Line 40 Form

Completing the Standard Deduction Worksheet Line 40 Form involves several key steps:

- Gather necessary documents, including your Social Security number, income statements, and any other relevant financial information.

- Identify your filing status, as this will determine the standard deduction amount you may claim.

- Follow the instructions on the worksheet carefully, filling in each line accurately based on your financial situation.

- Double-check your entries for accuracy to avoid potential issues with your tax return.

- Keep a copy of the completed worksheet for your records, as it may be needed for future reference or in case of an audit.

IRS Guidelines for the Standard Deduction Worksheet Line 40 Form

The IRS provides specific guidelines for using the Standard Deduction Worksheet Line 40 Form. These guidelines outline eligibility criteria, including income limits and filing statuses that affect the standard deduction amount. It is essential to review the most current IRS publications and instructions related to the standard deduction to ensure compliance. The IRS updates these guidelines annually, reflecting changes in tax law and inflation adjustments, so staying informed is vital for accurate tax preparation.

Legal Use of the Standard Deduction Worksheet Line 40 Form

The legal use of the Standard Deduction Worksheet Line 40 Form hinges on its proper completion and submission as part of your federal tax return. It is legally binding when filled out accurately and submitted to the IRS. Any misrepresentation or errors can lead to penalties or audits. Therefore, it is crucial to understand the legal implications of the information provided on this form. Utilizing a reliable electronic signature platform can also enhance the legitimacy of your submission, ensuring compliance with eSignature laws.

Examples of Using the Standard Deduction Worksheet Line 40 Form

Examples of how to use the Standard Deduction Worksheet Line 40 Form can clarify its application. For instance, a dependent who is a college student may need to complete this worksheet to determine their eligibility for the standard deduction based on their part-time income. Another example includes a dependent child who has earned income from a summer job. By accurately filling out the worksheet, these dependents can ensure they claim the correct amount on their tax returns, potentially resulting in a lower tax liability or a refund.

Required Documents for the Standard Deduction Worksheet Line 40 Form

To complete the Standard Deduction Worksheet Line 40 Form, several documents are typically required:

- Social Security number for the taxpayer and any dependents.

- W-2 forms from employers detailing earned income.

- Any 1099 forms for other income sources.

- Documentation of any adjustments to income, such as student loan interest or contributions to retirement accounts.

Having these documents readily available will streamline the completion process and help ensure accuracy when filling out the form.

Quick guide on how to complete standard deduction worksheet line 40 form

Complete Standard Deduction Worksheet Line 40 Form effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as a flawless eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the right template and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without holdups. Manage Standard Deduction Worksheet Line 40 Form on any platform using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The simplest method to modify and eSign Standard Deduction Worksheet Line 40 Form with ease

- Find Standard Deduction Worksheet Line 40 Form and click Get Form to begin.

- Employ the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new paper copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Modify and eSign Standard Deduction Worksheet Line 40 Form and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What is the right way to fill out Two-Earners Worksheet tax form?

Wages, in this context, are what you expect to appear in box 1 of your W-2.The IRS recommends that the additional withholding be applied to the higher-paid spouse and that the lesser-paid spouse should simply claim zero withholding allowances, as this is usually more accurate (due to the way that withholding is actually calculated by payroll programs, you may wind up with less withheld than you want if you split it).

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

How do I write qualification details in order to fill out the AIIMS application form if a student is appearing in 12th standard?

There must be provision in the form for those who are taking 12 th board exam this year , so go through the form properly before filling it .

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

Create this form in 5 minutes!

How to create an eSignature for the standard deduction worksheet line 40 form

How to generate an eSignature for your Standard Deduction Worksheet Line 40 Form online

How to make an electronic signature for the Standard Deduction Worksheet Line 40 Form in Chrome

How to create an electronic signature for putting it on the Standard Deduction Worksheet Line 40 Form in Gmail

How to create an eSignature for the Standard Deduction Worksheet Line 40 Form from your mobile device

How to create an electronic signature for the Standard Deduction Worksheet Line 40 Form on iOS devices

How to generate an electronic signature for the Standard Deduction Worksheet Line 40 Form on Android devices

People also ask

-

What is the Standard Deduction Worksheet Line 40 Form?

The Standard Deduction Worksheet Line 40 Form is a tax document that helps individuals calculate their standard deduction for tax purposes. This form is crucial for determining the amount you can deduct from your taxable income, thereby reducing your overall tax liability. Understanding how to fill out this form correctly can signNowly impact your tax return.

-

How can airSlate SignNow help with the Standard Deduction Worksheet Line 40 Form?

airSlate SignNow provides an efficient platform for electronically signing and sending the Standard Deduction Worksheet Line 40 Form. With our user-friendly interface, you can easily complete and share your tax documents securely and quickly. This streamlines the process, saving you time during tax season.

-

Is there a cost associated with using airSlate SignNow for the Standard Deduction Worksheet Line 40 Form?

Yes, there is a cost associated with using airSlate SignNow, but it provides a cost-effective solution for managing your documents, including the Standard Deduction Worksheet Line 40 Form. We offer various pricing plans tailored to different business needs, ensuring you get the best value for your document management and eSigning requirements.

-

What features does airSlate SignNow offer for managing tax forms like the Standard Deduction Worksheet Line 40 Form?

airSlate SignNow offers several features tailored for managing tax forms such as the Standard Deduction Worksheet Line 40 Form. These include customizable templates, secure cloud storage, and real-time collaboration options. Our platform ensures that you can efficiently manage, sign, and share your tax documents with ease.

-

Can I integrate airSlate SignNow with other software for my Standard Deduction Worksheet Line 40 Form?

Absolutely! airSlate SignNow seamlessly integrates with various software applications to enhance your workflow when managing the Standard Deduction Worksheet Line 40 Form. Whether you're using accounting software or CRM systems, our integrations help streamline your document processes and improve efficiency.

-

How secure is my information when using airSlate SignNow for the Standard Deduction Worksheet Line 40 Form?

Security is a top priority at airSlate SignNow. When you use our platform to manage the Standard Deduction Worksheet Line 40 Form, your information is protected through advanced encryption and secure data storage. We adhere to strict compliance standards to ensure your sensitive tax information remains safe.

-

Can I access the Standard Deduction Worksheet Line 40 Form on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is fully accessible on mobile devices, allowing you to manage the Standard Deduction Worksheet Line 40 Form on the go. Whether you're in the office or traveling, you can easily complete, sign, and send your tax documents from your smartphone or tablet.

Get more for Standard Deduction Worksheet Line 40 Form

- Tsp 81 form pdf

- 3 on 3 basketball tournament registration form amp waiver

- Prenuptial agreement ontario template form

- Nutrition and the ageing brain moving towards clinical form

- Grocerylists org form

- Ignou acknowledgement slip download form

- Amazon receipt template form

- For youth 17 years old and younger form

Find out other Standard Deduction Worksheet Line 40 Form

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online