Vermont Sales Tax Exemption Form S 3

What is the Vermont Sales Tax Exemption Form S 3

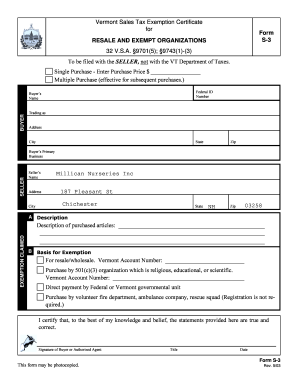

The Vermont Sales Tax Exemption Form S 3 is a document used by businesses and individuals in Vermont to claim an exemption from sales tax on certain purchases. This form is particularly important for organizations that qualify for tax-exempt status, such as non-profits, government entities, and certain educational institutions. By submitting this form, eligible parties can avoid paying sales tax on items that are necessary for their operations, thereby reducing their overall costs.

How to use the Vermont Sales Tax Exemption Form S 3

Using the Vermont Sales Tax Exemption Form S 3 involves several steps. First, ensure that you qualify for a sales tax exemption under Vermont law. Next, download or obtain the form from the appropriate state resources. Fill out the form with accurate information, including your organization's details and the specific items for which you are claiming exemption. Once completed, present the form to the vendor at the time of purchase to avoid sales tax charges.

Steps to complete the Vermont Sales Tax Exemption Form S 3

Completing the Vermont Sales Tax Exemption Form S 3 requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source.

- Fill in your name, address, and tax-exempt status.

- List the items you are purchasing that qualify for exemption.

- Sign and date the form to certify its accuracy.

After completing the form, provide it to the seller to ensure that the sales tax is not applied to your purchase.

Legal use of the Vermont Sales Tax Exemption Form S 3

The legal use of the Vermont Sales Tax Exemption Form S 3 is governed by state tax laws. To be valid, the form must be completed correctly and submitted at the time of purchase. Misuse of the form, such as claiming exemptions for ineligible items or providing false information, can lead to penalties. It is essential to understand the specific legal requirements and ensure compliance to maintain the integrity of the exemption process.

Eligibility Criteria

To qualify for using the Vermont Sales Tax Exemption Form S 3, applicants must meet specific eligibility criteria set forth by the state. Generally, eligible entities include non-profit organizations, government agencies, and educational institutions. Each category has its own requirements, such as proof of tax-exempt status or documentation demonstrating the purpose of the purchase. It is crucial to review these criteria before submitting the form to avoid potential issues.

Form Submission Methods

The Vermont Sales Tax Exemption Form S 3 can typically be submitted in various ways, depending on the vendor's policies. Common submission methods include:

- Presenting the completed form in person at the point of sale.

- Submitting the form via email or fax if the vendor allows electronic submission.

- Mailing the form to the vendor if required.

Always confirm the preferred submission method with the vendor to ensure proper processing of the exemption.

Quick guide on how to complete vermont sales tax exemption form s 3

Complete Vermont Sales Tax Exemption Form S 3 effortlessly on any device

Online document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents quickly without delays. Manage Vermont Sales Tax Exemption Form S 3 on any device with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Vermont Sales Tax Exemption Form S 3 effortlessly

- Locate Vermont Sales Tax Exemption Form S 3 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose your preferred method for submitting your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Vermont Sales Tax Exemption Form S 3 and ensure exceptional communication at any stage of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vermont sales tax exemption form s 3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form s 3 vermont?

The form s 3 vermont is a tax document required by the state for reporting certain business activities. It is crucial for compliance and ensures that your business meets Vermont reporting requirements. Filling out the form s 3 vermont correctly can help you avoid penalties and streamline your tax processes.

-

How can airSlate SignNow help with the form s 3 vermont?

airSlate SignNow simplifies the process of completing the form s 3 vermont by providing electronic signatures and document management features. Our platform allows you to fill out, sign, and send the form efficiently and securely, ensuring that you remain compliant with state regulations. This streamlines your operations and saves time.

-

What are the pricing options for using airSlate SignNow for the form s 3 vermont?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs, starting with a free trial to test the service. Our subscription plans include features such as unlimited eSignatures and customizable workflows, which can streamline the creation and submission of the form s 3 vermont. You'll find our pricing is competitive and cost-effective for every size of business.

-

Are there any integrations available for the form s 3 vermont?

Yes, airSlate SignNow integrates seamlessly with various platforms, enhancing your ability to manage the form s 3 vermont efficiently. You can connect with tools like Google Drive, Salesforce, and more to automate document workflows. This integration helps ensure that all necessary data is accessible and organized when filling out your form s 3 vermont.

-

What features does airSlate SignNow offer for managing the form s 3 vermont?

airSlate SignNow includes features such as customizable templates, workspaces, and secure storage for managing the form s 3 vermont. Our intuitive interface allows users to easily navigate through the document creation process. Additionally, advanced analytics can help you track the status of your form submissions.

-

Is airSlate SignNow secure for submitting the form s 3 vermont?

Absolutely! airSlate SignNow employs industry-leading security measures, including encryption and secure access protocols for submitting the form s 3 vermont. Your sensitive data is protected, ensuring compliance with privacy regulations. Trust us to keep your information safe while you manage your documents.

-

Can I access airSlate SignNow on mobile devices for the form s 3 vermont?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing users to manage the form s 3 vermont on the go. This means you can fill out, sign, and send documents from your smartphone or tablet anytime, making it convenient for busy professionals. Our mobile app ensures you never miss a deadline.

Get more for Vermont Sales Tax Exemption Form S 3

Find out other Vermont Sales Tax Exemption Form S 3

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document