Mortgage Deed Form

What is the Mortgage Deed

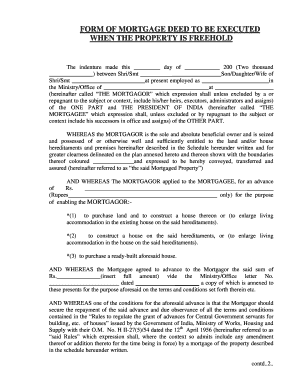

A mortgage deed is a legal document that outlines the terms and conditions of a loan secured by real estate. It serves as a binding agreement between the borrower and the lender, detailing the borrower's promise to repay the loan and the lender's right to take possession of the property if the borrower defaults. The mortgage deed includes essential information such as the names of the parties involved, the property description, the loan amount, interest rate, and repayment terms. Understanding what a mortgage deed looks like is crucial for anyone involved in real estate transactions, as it lays the groundwork for the mortgage process.

Key Elements of the Mortgage Deed

Several key elements are typically included in a mortgage deed. These elements ensure the document is legally binding and enforceable. Important components include:

- Parties Involved: The names and addresses of both the borrower and lender.

- Property Description: A detailed description of the property being mortgaged, including its address and legal description.

- Loan Amount: The total amount of money being borrowed.

- Interest Rate: The rate at which interest will accrue on the loan.

- Repayment Terms: Details on how and when the borrower will repay the loan.

- Signatures: The signatures of both parties, indicating their agreement to the terms.

Steps to Complete the Mortgage Deed

Completing a mortgage deed involves several steps to ensure its validity and compliance with legal requirements. Here are the typical steps involved:

- Gather Necessary Information: Collect all relevant details about the property and the parties involved.

- Draft the Deed: Use a standard mortgage deed format or template to draft the document, ensuring all key elements are included.

- Review the Document: Both parties should review the document for accuracy and clarity before signing.

- Sign the Deed: Both the borrower and lender must sign the document in the presence of a notary public to ensure its legality.

- Record the Deed: Submit the signed mortgage deed to the appropriate local government office for recording, which provides public notice of the mortgage.

Legal Use of the Mortgage Deed

The legal use of a mortgage deed is crucial in protecting the interests of both the borrower and the lender. It establishes the lender's claim to the property in case of default and provides the borrower with a clear understanding of their obligations. For the mortgage deed to be legally binding, it must comply with state-specific laws and regulations. This includes proper execution, notarization, and recording with the appropriate local authorities. Failure to adhere to these legal requirements can result in disputes or the unenforceability of the mortgage.

How to Obtain the Mortgage Deed

Obtaining a mortgage deed typically involves working with a lender or financial institution when securing a mortgage. Once the loan is approved, the lender will provide the mortgage deed as part of the closing process. Borrowers can also find templates or samples of mortgage deeds online for reference. However, it is advisable to consult with a legal professional to ensure that the document meets all legal requirements and is tailored to the specific transaction.

Digital vs. Paper Version

In today's digital age, mortgage deeds can be executed in both paper and electronic formats. While traditional paper versions require physical signatures and notarization, digital mortgage deeds can be signed electronically using secure eSignature solutions. Both formats are legally valid if they comply with relevant laws, such as the ESIGN Act and UETA. Digital versions offer convenience, faster processing, and easier storage, making them an increasingly popular choice for many borrowers and lenders.

Quick guide on how to complete mortgage deed 43758280

Effortlessly Prepare Mortgage Deed on Any Device

Digital document management has gained prominence among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, alter, and electronically sign your documents quickly and without delays. Handle Mortgage Deed on any device using airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to Modify and Electronically Sign Mortgage Deed with Ease

- Find Mortgage Deed and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your edits.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any preferred device. Alter and electronically sign Mortgage Deed to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage deed 43758280

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does a mortgage deed look like?

A mortgage deed typically includes the borrower's information, lender details, property description, and the terms of the loan. It serves as a legal document that secures the loan against the property. In essence, it outlines the rights and obligations of both parties involved.

-

How can airSlate SignNow help with mortgage deeds?

airSlate SignNow provides a streamlined platform for creating, sending, and signing mortgage deeds digitally. This not only enhances efficiency but also ensures that all documents are securely stored and easily accessible. It's an excellent tool for both lenders and borrowers to manage their mortgage-related paperwork.

-

What features does airSlate SignNow offer for mortgage documentation?

With airSlate SignNow, you can create templates for mortgage deeds, add eSignature capabilities, and integrate with other business applications. This enables a smooth workflow for drafting and executing mortgage deeds. Also, advanced tracking features help users monitor the signing progress.

-

Is there a cost associated with using airSlate SignNow for mortgage deeds?

Yes, airSlate SignNow offers various pricing plans based on the number of users and features needed. You can choose a plan that best suits your business needs for managing mortgage deeds. Additionally, they often provide a free trial, allowing users to assess the service before committing financially.

-

Can I integrate airSlate SignNow with other tools for mortgage processing?

Absolutely! airSlate SignNow provides integrations with various CRM platforms, document management systems, and cloud storage solutions. This makes it easier to manage the end-to-end process of mortgage deeds and enhances collaboration across teams.

-

Are mortgage deeds created digitally secure on airSlate SignNow?

Yes, documents including mortgage deeds are stored securely on airSlate SignNow. The platform employs top-notch encryption methods and authentication features to ensure that sensitive information remains protected. This ensures peace of mind for both lenders and borrowers.

-

What benefits do I get from using airSlate SignNow for mortgage documents?

Using airSlate SignNow for mortgage documents increases efficiency, reduces paperwork, and cuts down on processing times. The platform allows for easily accessible digital records and streamlined signing processes, making it convenient for all parties involved in mortgage agreements.

Get more for Mortgage Deed

Find out other Mortgage Deed

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement