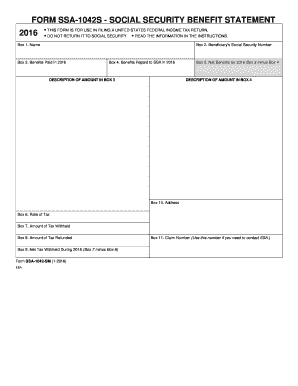

Ssa 1042s Form

What makes the ssa 1042s form legally valid?

Because the world takes a step away from in-office working conditions, the execution of paperwork increasingly happens online. The ssa 1042s form isn’t an any different. Working with it using digital tools is different from doing so in the physical world.

An eDocument can be considered legally binding on condition that particular requirements are satisfied. They are especially crucial when it comes to signatures and stipulations associated with them. Entering your initials or full name alone will not guarantee that the organization requesting the sample or a court would consider it executed. You need a reliable solution, like airSlate SignNow that provides a signer with a digital certificate. Furthermore, airSlate SignNow keeps compliance with ESIGN, UETA, and eIDAS - leading legal frameworks for eSignatures.

How to protect your ssa 1042s form when completing it online?

Compliance with eSignature regulations is only a portion of what airSlate SignNow can offer to make document execution legal and secure. Furthermore, it gives a lot of possibilities for smooth completion security wise. Let's rapidly run through them so that you can be certain that your ssa 1042s form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are set to protect online user data and payment details.

- FERPA, CCPA, HIPAA, and GDPR: leading privacy regulations in the USA and Europe.

- Two-factor authentication: provides an extra layer of security and validates other parties identities through additional means, such as an SMS or phone call.

- Audit Trail: serves to catch and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: transmits the information safely to the servers.

Submitting the ssa 1042s form with airSlate SignNow will give greater confidence that the output document will be legally binding and safeguarded.

Quick guide on how to complete ssa 1042s

Complete Ssa 1042s effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can locate the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without unnecessary delays. Manage Ssa 1042s across any platform using airSlate SignNow applications for Android or iOS and simplify any document-related procedure today.

How to edit and eSign Ssa 1042s with ease

- Find Ssa 1042s and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the files or obscure sensitive information with tools that airSlate SignNow provides specifically for such tasks.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you prefer to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and eSign Ssa 1042s and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ssa 1042s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1099-SA form used for?

File Form 1099-SA to report distributions made from a: Health savings account (HSA). Archer Medical Savings Account (Archer MSA). Medicare Advantage Medical Savings Account (MA MSA).

-

What is 1099-SA tax form?

File Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA, to report distributions made from a health savings account (HSA), Archer medical savings account (Archer MSA), or Medicare Advantage MSA (MA MSA).

-

Who is the payer for 1099-SA tax form?

Form 1099-SA will list the financial institution or the insurance company that holds the account as a payer.

-

How do I get a 1099-B form?

Form 1099-B can be downloaded on the IRS website....Information on Form 1099-B includes: Issuer's information. Taxpayer's information. A description of each investment. The purchase date and price. The sale date and price. The resulting gain or loss3.

-

Do I have to report my 1099-SA?

Amounts shown on Form 1099-SA must be reported on the taxpayer's federal income tax form.

-

What is a 1099-B form?

If you sold stock, bonds or other securities through a broker or had a barter exchange transaction (exchanged property or services rather than paying cash), you will likely receive a Form 1099-B. Regardless of whether you had a gain, loss, or broke even, you must report these transactions on your tax return.

-

How do I get my 1099-SA form?

For the most recent version, go to IRS.gov/Form1099SA. Online fillable forms. Due to the very low volume of paper Forms 1099-SA and 5498-SA received and processed by the IRS each year, these forms have been converted to an online fillable format.

-

How does a 1099-SA affect my taxes?

The IRS requires you to prepare Form 8889 and attach it to your tax return when you take a distribution from an HSA. However, if your 1099-SA indicates you did not use the distribution for qualified medical expenses, you will pay income tax on the portion you used for nonqualified expenses.

Get more for Ssa 1042s

- Kitsap county energy code worksheet form

- Lewis and clark community college transcript form

- Llc1 and con29 forms pdf 34kb south holland district council sholland gov

- File of life template 100073276 form

- Osha written respiratory protection program template form

- Application is made to lease property located at for monthly form

- New student enrollment form warrick county school corporation

- Car rental terms and conditions agreement template form

Find out other Ssa 1042s

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation