Fet Exemption Certificate Form

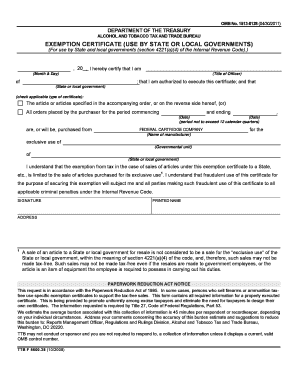

What is the Fet Exemption Certificate Form

The Fet exemption form, also known as the federal excise tax exemption certificate form, is a crucial document used by businesses to claim exemptions from federal excise taxes on specific goods and services. This form is particularly relevant for entities that qualify under certain criteria set by the Internal Revenue Service (IRS). The exemption is typically applicable to organizations that use these goods or services for exempt purposes, such as non-profit organizations or governmental entities.

How to use the Fet Exemption Certificate Form

To effectively use the fet exemption form, it is essential to understand its purpose and the specific requirements for completion. The form should be filled out accurately, providing all necessary information about the purchaser and the items being purchased. Once completed, this form can be presented to suppliers or vendors to avoid paying federal excise tax on eligible purchases. It is important to retain a copy of the completed form for your records, as it may be required for future reference or audits.

Steps to complete the Fet Exemption Certificate Form

Completing the fet exemption form involves several key steps:

- Gather necessary information, including the purchaser's name, address, and taxpayer identification number.

- Identify the specific goods or services for which the exemption is being claimed.

- Fill out the form accurately, ensuring that all fields are completed as required.

- Review the completed form for accuracy and compliance with IRS guidelines.

- Submit the form to your vendor or supplier to claim the exemption at the time of purchase.

Legal use of the Fet Exemption Certificate Form

The legal use of the fet exemption certificate form is governed by IRS regulations. To ensure compliance, it is vital that the form is used only for eligible purchases and that the information provided is truthful and complete. Misuse of the form, such as claiming exemptions for ineligible items, can lead to penalties and legal repercussions. Therefore, understanding the legal framework surrounding this form is essential for businesses seeking to utilize it correctly.

Eligibility Criteria

Eligibility for using the fet exemption form is determined by specific criteria outlined by the IRS. Generally, entities that qualify include non-profit organizations, governmental agencies, and certain educational institutions. These organizations must demonstrate that their purchases are directly related to their exempt activities. It is important to review the IRS guidelines to confirm eligibility before completing the form.

Required Documents

When filling out the fet exemption form, certain documents may be required to support the exemption claim. These documents can include:

- Proof of the purchaser's exempt status, such as a tax-exempt certificate.

- Invoices or receipts for the goods or services being purchased.

- Any additional documentation that demonstrates the connection between the purchase and the exempt purpose.

Form Submission Methods

The fet exemption form can typically be submitted through various methods, depending on the vendor's policies. Common submission methods include:

- In-person submission at the point of sale.

- Emailing a scanned copy of the completed form.

- Mailing the form directly to the vendor if required.

It is advisable to confirm the preferred submission method with the vendor to ensure proper processing of the exemption claim.

Quick guide on how to complete fet exemption certificate form

Effortlessly Prepare Fet Exemption Certificate Form on Any Device

Managing documents online has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Handle Fet Exemption Certificate Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to Modify and eSign Fet Exemption Certificate Form with Ease

- Locate Fet Exemption Certificate Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information carefully and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or mismanaged files, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Modify and eSign Fet Exemption Certificate Form to ensure excellent communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fet exemption certificate form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fet exemption form and why is it important?

The fet exemption form is a crucial document that allows businesses to claim exemptions from federal excise tax (FET) burdens. By utilizing the fet exemption form, companies can reduce their tax liabilities, which ultimately saves money and resources. Ensuring compliance with this form is essential to avoid potential penalties and audits.

-

How can airSlate SignNow help with the fet exemption form process?

airSlate SignNow streamlines the fet exemption form process by providing an easy-to-use platform for electronic signatures and document management. With our solution, businesses can quickly create, send, and track the fet exemption form, ensuring all necessary approvals are obtained efficiently. This automation saves time and reduces errors associated with manual handling.

-

Is there a cost associated with using the fet exemption form through airSlate SignNow?

Yes, airSlate SignNow offers a range of pricing plans tailored to suit different business needs. The cost associated with using the fet exemption form will depend on the selected plan and number of users. By investing in our platform, businesses can greatly enhance their document management and eSigning efficiency.

-

What features does airSlate SignNow provide for managing the fet exemption form?

airSlate SignNow provides a suite of features for managing the fet exemption form, including custom templates, automated reminders, and real-time tracking. These features help ensure that all parties involved in the signing process stay informed and engaged. Additionally, the platform supports secure storage and sharing of all completed forms.

-

Can I integrate the fet exemption form process with other applications?

Absolutely! airSlate SignNow offers seamless integrations with various applications to enhance the fet exemption form process. Popular integrations include CRM systems, project management tools, and accounting software, allowing businesses to automate workflows and maintain data consistency across platforms.

-

How does airSlate SignNow ensure the security of my fet exemption form?

Security is a top priority at airSlate SignNow. We implement industry-leading encryption methods to protect your fet exemption form and other sensitive documents during transmission and storage. Additionally, our platform complies with legal standards for electronic signatures, ensuring your documents are secure and valid.

-

Is there a mobile option for managing the fet exemption form?

Yes, airSlate SignNow offers a mobile-friendly application that allows users to manage the fet exemption form on the go. This capability enables businesses to send, sign, and track documents anytime, anywhere, providing flexibility and convenience. The mobile app retains all functionality of the desktop version, ensuring a seamless experience.

Get more for Fet Exemption Certificate Form

- Clg 006 answers form

- Usmc meritorious mast template form

- Upshur cad form

- Indiana state form 23104 fillable

- Request for replacement certification card california department of form

- Uspto petition to make special form

- Accounts receivable purchase agreement template form

- Acknowledgement of debt agreement template form

Find out other Fet Exemption Certificate Form

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation