Form 499 R 4 1

What is the Form 499 R 4 1

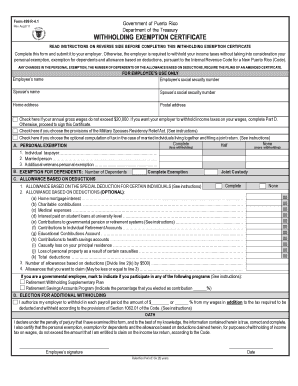

The Form 499 R 4 1 is a specific document used primarily in the context of regulatory compliance and reporting within certain industries. It is essential for businesses that need to provide detailed information regarding their operations, often related to financial or operational metrics. Understanding the purpose and requirements of this form is crucial for ensuring that businesses remain compliant with applicable regulations.

How to use the Form 499 R 4 1

Using the Form 499 R 4 1 involves several key steps. First, gather all necessary information that pertains to the reporting requirements outlined by the form. This may include financial data, operational details, or other relevant metrics. Next, complete the form accurately, ensuring that all sections are filled out according to the guidelines provided. Once completed, the form can be submitted electronically or via traditional mail, depending on the specific requirements set forth by the issuing authority.

Steps to complete the Form 499 R 4 1

To effectively complete the Form 499 R 4 1, follow these steps:

- Review the form's instructions thoroughly to understand the required information.

- Collect all necessary data, including financial statements and operational reports.

- Fill out the form carefully, ensuring accuracy in all entries.

- Double-check the completed form for any errors or omissions.

- Submit the form according to the specified submission method, either online or by mail.

Legal use of the Form 499 R 4 1

The legal use of the Form 499 R 4 1 is governed by specific regulations that dictate how and when the form must be completed and submitted. Compliance with these regulations is essential to avoid penalties or legal repercussions. Businesses must ensure that their submissions are accurate and timely, as any discrepancies could lead to audits or increased scrutiny from regulatory bodies.

Filing Deadlines / Important Dates

Filing deadlines for the Form 499 R 4 1 can vary based on the specific requirements set by the issuing authority. It is important for businesses to be aware of these deadlines to ensure timely submission. Missing a deadline may result in penalties or complications in compliance status. Regularly check for updates on deadlines to stay informed and avoid any issues.

Form Submission Methods (Online / Mail / In-Person)

The Form 499 R 4 1 can typically be submitted through various methods, including online submission, mailing a physical copy, or delivering it in person. Online submission is often the most efficient method, allowing for quicker processing and confirmation of receipt. However, businesses should choose the method that best suits their operational needs and complies with the requirements set forth by the regulatory authority.

Quick guide on how to complete form 499 r 4 1

Complete Form 499 R 4 1 effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without any delays. Manage Form 499 R 4 1 on any platform using airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to edit and eSign Form 499 R 4 1 without effort

- Obtain Form 499 R 4 1 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, frustrating form navigation, or mistakes necessitating the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 499 R 4 1 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 499 r 4 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 499 R 4 1 and how does airSlate SignNow facilitate its use?

Form 499 R 4 1 is a critical document often used in business transactions. airSlate SignNow simplifies the process of filling and signing this form, providing a user-friendly interface that allows for quick eSigning and secure document management, ensuring compliance and efficiency.

-

What are the pricing options for using airSlate SignNow with Form 499 R 4 1?

Pricing for airSlate SignNow varies depending on the plan you choose, offering flexible options for businesses of all sizes. Each plan includes features for managing documents like Form 499 R 4 1, making it a cost-effective solution to streamline your business processes.

-

Can I integrate other tools with airSlate SignNow for Form 499 R 4 1?

Yes, airSlate SignNow offers a variety of integrations with tools like Google Drive, Salesforce, and others. This allows you to easily upload and manage Form 499 R 4 1, making it a versatile solution to fit your business needs.

-

What are the key features of airSlate SignNow for handling Form 499 R 4 1?

airSlate SignNow includes essential features such as templates, automated workflows, and real-time tracking for Form 499 R 4 1. These tools enhance document accessibility and ensure that you can efficiently manage the entire signing process without hassle.

-

What benefits can we expect from using airSlate SignNow for Form 499 R 4 1?

Using airSlate SignNow for Form 499 R 4 1 brings numerous benefits, including faster turnaround times, reduced paperwork, and improved accuracy. It also enhances collaboration among team members, as documents can be signed from anywhere, anytime.

-

Is it secure to use airSlate SignNow for signing Form 499 R 4 1?

Absolutely! airSlate SignNow employs industry-leading security measures to protect your documents, including Form 499 R 4 1, throughout the signing process. With features like encryption and authentication, you can trust that your data is safe.

-

How does airSlate SignNow compare to other eSignature solutions for Form 499 R 4 1?

airSlate SignNow stands out due to its cost-effectiveness, user-friendly interface, and comprehensive features tailored for documents like Form 499 R 4 1. Compared to other solutions, it offers better integration options and an intuitive experience for users.

Get more for Form 499 R 4 1

- Rpd 41286 form

- Motion to accept late filing immigration court sample form

- Ryerson university transcript request form

- Ny ucc pdf complete form

- Bronson financial assistance form

- Mnm1503 form

- General information if you are unable to pay the full amount due with your individual income tax return you may request an

- Behind the wheel btw instruction outline form

Find out other Form 499 R 4 1

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF