Tax Form 8332 Printable

What is the Tax Form 8332 Printable

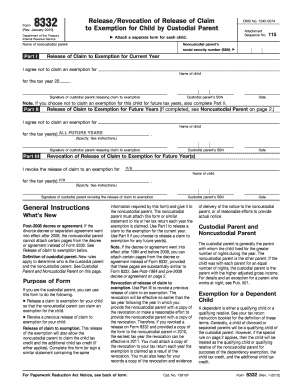

The IRS Form 8332, also known as the dependent tax form, is a document used by custodial parents to release their claim to a child's tax exemption. This form is essential for non-custodial parents who wish to claim their children as dependents on their tax returns. The form must be completed and signed by the custodial parent, allowing the non-custodial parent to benefit from the dependent exemption, which can significantly reduce their taxable income.

How to use the Tax Form 8332 Printable

To use the IRS Form 8332, the custodial parent must fill out the form accurately, providing necessary details such as the child's name, Social Security number, and the years for which the exemption is being released. Once completed, the custodial parent should sign the form and provide it to the non-custodial parent. It is crucial for the non-custodial parent to attach the signed form to their tax return when filing, ensuring compliance with IRS regulations.

Steps to complete the Tax Form 8332 Printable

Completing the IRS Form 8332 involves several straightforward steps:

- Obtain the form from the IRS website or a tax professional.

- Fill in the child's name and Social Security number in the designated fields.

- Indicate the tax years for which the exemption is being released.

- Sign and date the form as the custodial parent.

- Provide the completed form to the non-custodial parent.

Legal use of the Tax Form 8332 Printable

The legal use of IRS Form 8332 is vital for ensuring that the non-custodial parent can rightfully claim the dependent exemption. The form must be signed by the custodial parent, and it is recommended to keep a copy for personal records. The IRS requires that this form be attached to the non-custodial parent's tax return for the years specified. Failure to comply with these requirements may lead to complications during tax filing or audits.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 8332. It is essential to follow these guidelines to ensure that the form is valid. The custodial parent must be the one to sign the form, and it must clearly state the years for which the exemption is released. Additionally, the IRS may require the non-custodial parent to provide proof of the signed form when filing their tax return. Adhering to IRS guidelines helps prevent disputes and ensures a smooth tax filing process.

Filing Deadlines / Important Dates

When using IRS Form 8332, it is important to be aware of filing deadlines. The form should be completed and provided to the non-custodial parent before the tax return is filed. Typically, tax returns are due on April fifteenth each year. If the custodial parent is releasing the exemption for multiple years, they should ensure that the form is completed for each applicable year to avoid any issues with the IRS.

Quick guide on how to complete tax form 8332 printable

Prepare Tax Form 8332 Printable effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely keep it online. airSlate SignNow offers all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Tax Form 8332 Printable on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and electronically sign Tax Form 8332 Printable with ease

- Locate Tax Form 8332 Printable and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize key sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Tax Form 8332 Printable to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax form 8332 printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 8332 and why do I need it?

IRS Form 8332 is a form used to release claim to exemption for a child, allowing a non-custodial parent to claim the child as a dependent. Understanding this form is essential for accurately filing taxes and ensuring compliance with IRS guidelines. Using airSlate SignNow, you can easily eSign this form for a smooth submission process.

-

How can airSlate SignNow help me with IRS Form 8332?

airSlate SignNow offers a user-friendly platform that allows you to create, send, and eSign IRS Form 8332 quickly and securely. With advanced tracking features, you can monitor who has signed the document and when, ensuring that your important tax documents are finalized efficiently.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8332?

Yes, airSlate SignNow offers a range of pricing plans to fit your business needs, starting with a free trial. Depending on your chosen plan, you can access features that facilitate the eSigning of IRS Form 8332, giving you a cost-effective solution for your document management.

-

Can I integrate airSlate SignNow with other applications for IRS Form 8332?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRMs and cloud storage services. This integration allows you to streamline your workflow, making it easier to manage IRS Form 8332 alongside other important documents.

-

How secure is the airSlate SignNow platform for handling IRS Form 8332?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption methods and complies with industry standards to ensure that your IRS Form 8332 and other sensitive documents are protected from unauthorized access throughout the eSigning process.

-

What features does airSlate SignNow offer for processing IRS Form 8332?

airSlate SignNow comes with features such as customizable templates, automated workflows, and real-time notifications to enhance your experience when handling IRS Form 8332. These features help you efficiently prepare and sign necessary documents, saving you valuable time.

-

Can I track the status of IRS Form 8332 once sent through airSlate SignNow?

Yes, you can easily track the status of IRS Form 8332 after sending it through airSlate SignNow. The platform provides real-time updates, letting you know when the form has been viewed and signed by the relevant parties for peace of mind.

Get more for Tax Form 8332 Printable

- Fundraising request form niagara falls city school district

- Mobile phone insurance proposal form declaration sindh insurance

- Ansul distributor certification program form

- Ra 9514 pdf download form

- Delivery acknowledgement form

- Unum short term disability claim form ccrta

- Permanent identification verification form

- Zoning and development handbook city of sachse form

Find out other Tax Form 8332 Printable

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application