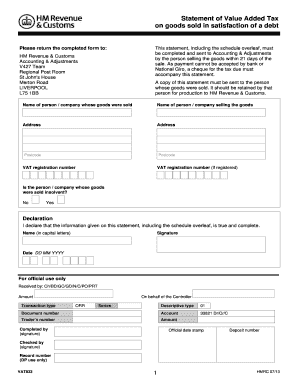

Vat 833 Form

What is the Vat 833

The Vat 833 form is a crucial document used in the United States for specific tax-related purposes. It is primarily utilized by businesses to report and manage sales tax obligations. Understanding its function is essential for compliance with state tax regulations. The form is designed to streamline the reporting process, ensuring that businesses accurately account for their sales tax liabilities.

How to use the Vat 833

Using the Vat 833 form involves several steps to ensure proper completion and submission. First, gather all necessary financial records related to sales transactions. This includes invoices, receipts, and any relevant documentation that supports the reported figures. Next, fill out the form accurately, ensuring that all information aligns with your financial records. Finally, submit the completed form to the appropriate state tax authority, either electronically or by mail, depending on state requirements.

Steps to complete the Vat 833

Completing the Vat 833 form requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant sales documentation.

- Access the Vat 833 form through the appropriate state tax authority's website.

- Fill in your business information, including name, address, and tax identification number.

- Report total sales and calculate the sales tax owed based on the applicable rates.

- Review the form for accuracy before submission.

- Submit the form according to your state’s guidelines.

Legal use of the Vat 833

The legal use of the Vat 833 form is governed by state tax laws. It is essential for businesses to ensure compliance with these regulations to avoid penalties. The form serves as an official record of sales tax obligations and must be completed accurately. Failure to adhere to the legal requirements can result in fines or other legal repercussions, making it crucial for businesses to understand their responsibilities regarding this form.

Filing Deadlines / Important Dates

Filing deadlines for the Vat 833 form vary by state and can significantly impact business operations. It is important to be aware of these dates to ensure timely submission. Most states require the form to be filed quarterly or annually, depending on the volume of sales. Marking these deadlines on your calendar can help prevent late submissions and associated penalties.

Required Documents

When completing the Vat 833 form, several documents are required to support the reported information. These typically include:

- Sales invoices and receipts.

- Records of exempt sales or purchases.

- Previous tax returns, if applicable.

- Any correspondence with state tax authorities.

Having these documents ready can facilitate a smoother completion process and ensure compliance with state regulations.

Quick guide on how to complete vat 833

Prepare Vat 833 seamlessly on any device

Digital document management has become increasingly popular among corporations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as users can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Vat 833 on any device using the airSlate SignNow apps available for Android or iOS, and simplify any document-related processes today.

How to edit and eSign Vat 833 with ease

- Obtain Vat 833 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign feature, which takes just a few seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click the Done button to finalize your changes.

- Choose your preferred method to share your form, whether by email, SMS, or invite link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Vat 833 and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat 833

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is vat833 and how does it relate to airSlate SignNow?

VAT833 is a specific compliance requirement for businesses dealing with VAT submissions. airSlate SignNow simplifies the process of signing and sending documents related to VAT833, ensuring your business stays compliant effortlessly.

-

How does airSlate SignNow handle VAT833 document security?

AirSlate SignNow takes document security seriously, employing advanced encryption and authentication methods to safeguard your VAT833 submissions. This ensures that all sensitive information remains protected, giving you peace of mind.

-

What features does airSlate SignNow offer for managing VAT833?

AirSlate SignNow includes features such as customizable templates, automated workflows, and easy document tracking specifically for VAT833. This streamlines the process of eSigning and submitting these important documents.

-

Is airSlate SignNow cost-effective for handling multiple VAT833 documents?

Yes, airSlate SignNow provides a cost-effective solution for businesses handling multiple VAT833 documents. Our pricing tiers are designed to accommodate various business sizes, ensuring you get the most value for your investment.

-

Can airSlate SignNow integrate with accounting software for VAT833 submissions?

Absolutely! AirSlate SignNow integrates seamlessly with popular accounting software, allowing you to manage your VAT833 submissions directly from your existing systems. This integration enhances efficiency and workflow for your tax compliance.

-

What are the benefits of using airSlate SignNow for VAT833?

Using airSlate SignNow for VAT833 provides benefits such as increased speed in document processing, enhanced security, and compliance with tax regulations. Our platform offers a user-friendly experience, making VAT submission straightforward.

-

How can I access customer support when using airSlate SignNow for VAT833?

AirSlate SignNow offers robust customer support for all users, including those dealing with VAT833. You can access help via live chat, email, or phone, ensuring you receive timely assistance whenever needed.

Get more for Vat 833

- North carolina school fire inspection form

- Transfer of billing responsibilities e mailfaxback form cmich

- Adesa power of attorney form

- Child support guidelines worksheet iowa form

- Pdfiller 52460397 form

- Sky zone fort wayne waiver doc cornerstoneyc form

- City of gatlinburg tennessee gross receipts tax form

- Child visitation without court agreement template form

Find out other Vat 833

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement