Sales Tax Exemption Wv Form

What is the Sales Tax Exemption Wv Form

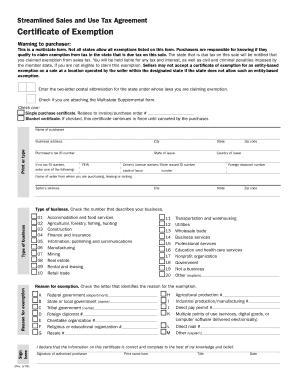

The West Virginia tax exempt form, commonly referred to as the sales tax exemption form, is a legal document that allows certain entities to purchase goods and services without paying sales tax. This form is primarily used by non-profit organizations, government agencies, and other qualifying entities that meet specific criteria set forth by the state. By completing and submitting this form, eligible organizations can ensure compliance with state tax regulations while minimizing their tax liabilities.

How to use the Sales Tax Exemption Wv Form

Using the West Virginia sales tax exemption form involves several straightforward steps. First, ensure that your organization qualifies for tax-exempt status under state law. Next, obtain the form, which can typically be found in PDF format on the West Virginia State Tax Department's website. After filling out the necessary information, including your organization’s name, address, and tax-exempt status, present the completed form to vendors when making purchases. This form serves as proof of your tax-exempt status, allowing you to avoid sales tax on eligible transactions.

Steps to complete the Sales Tax Exemption Wv Form

Completing the West Virginia tax exempt form requires careful attention to detail. Follow these steps for accurate completion:

- Obtain the form from a reliable source, ensuring it is the most current version.

- Fill in your organization’s legal name and address as registered with the state.

- Provide your tax-exempt identification number, if applicable.

- Specify the type of exemption your organization qualifies for, such as educational or charitable purposes.

- Sign and date the form to validate its authenticity.

Legal use of the Sales Tax Exemption Wv Form

The legal use of the West Virginia tax exempt form is crucial for maintaining compliance with state tax laws. This form must be used exclusively by qualifying entities, and misuse can result in penalties. It is important to ensure that the information provided is accurate and up-to-date. Vendors are required to keep a copy of the form on file for their records, which further solidifies the legal standing of the exemption during audits or inquiries by tax authorities.

Eligibility Criteria

To qualify for the West Virginia sales tax exemption, organizations must meet specific eligibility criteria. Generally, these include being a recognized non-profit organization, a government entity, or an educational institution. Additionally, the organization must demonstrate that its purchases are directly related to its exempt purpose. It is advisable to review the state’s guidelines to confirm that your organization meets all necessary requirements before applying for the exemption.

Form Submission Methods

The West Virginia tax exempt form can be submitted through various methods, depending on the preferences of the organization and the vendor. Typically, the completed form can be presented in person at the time of purchase, or it can be sent via email or fax to vendors who accept electronic copies. Some vendors may also allow submission through their online platforms. It is essential to confirm the preferred submission method with each vendor to ensure compliance and acceptance of the form.

Quick guide on how to complete sales tax exemption wv form

Prepare Sales Tax Exemption Wv Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Sales Tax Exemption Wv Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to modify and eSign Sales Tax Exemption Wv Form without hassle

- Find Sales Tax Exemption Wv Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and eSign Sales Tax Exemption Wv Form and ensure exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax exemption wv form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the wv tax exempt form and who needs it?

The wv tax exempt form is a document used by individuals and businesses in West Virginia to claim exemption from sales tax. Entities such as non-profit organizations, government agencies, and certain qualifying businesses often need this form to avoid paying sales tax on eligible purchases.

-

How can airSlate SignNow help with the wv tax exempt form?

airSlate SignNow streamlines the process of completing and signing the wv tax exempt form, allowing you to manage your documents electronically. With our easy-to-use interface, you can quickly fill out the form, get it signed, and share it with relevant parties, saving time and resources.

-

Is there a cost associated with using airSlate SignNow for the wv tax exempt form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. You can choose a plan that suits your budget while efficiently managing the wv tax exempt form and other document workflows.

-

Can I integrate airSlate SignNow with other software for managing my wv tax exempt form?

Absolutely! airSlate SignNow provides seamless integrations with popular software applications, enabling you to easily access and manage your wv tax exempt form alongside other tools you use. This improves efficiency and ensures that all your document management is centralized.

-

How secure is the airSlate SignNow platform for handling the wv tax exempt form?

Security is a top priority at airSlate SignNow. Our platform employs industry-leading security measures, including encryption and secure data storage, to ensure that your wv tax exempt form and any sensitive information remain protected throughout the signing process.

-

What are the key features of airSlate SignNow that assist with the wv tax exempt form?

Key features of airSlate SignNow include customizable templates, electronic signing capabilities, and cloud storage, all of which enhance the management of the wv tax exempt form. These features help users efficiently create and send documents for signing without hassle.

-

How long does it take to complete the wv tax exempt form using airSlate SignNow?

Completing the wv tax exempt form with airSlate SignNow can be done in a matter of minutes. With our intuitive interface, you can fill out the form, obtain necessary signatures, and share it quickly, ensuring you meet deadlines without stress.

Get more for Sales Tax Exemption Wv Form

Find out other Sales Tax Exemption Wv Form

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast