Irs Hardship Letter Sample Form

What is the IRS hardship letter sample?

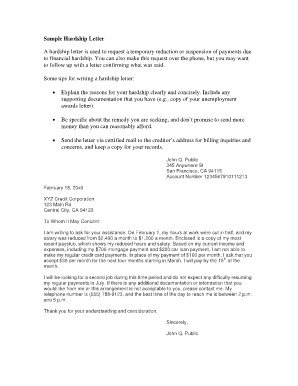

The IRS hardship letter sample is a template designed to assist individuals in communicating their financial difficulties to the Internal Revenue Service (IRS). This letter serves as a formal request for tax relief or other considerations due to financial hardship. It typically outlines the taxpayer's current financial situation, including income, expenses, and any extenuating circumstances that have contributed to their inability to meet tax obligations. By using a hardship letter sample, taxpayers can ensure they include all necessary details in a clear and organized manner.

Key elements of the IRS hardship letter sample

When drafting an IRS hardship letter, certain key elements should be included to enhance its effectiveness. These elements typically comprise:

- Personal Information: Include your full name, address, and taxpayer identification number.

- Subject Line: Clearly state the purpose of the letter, such as "Request for Hardship Relief."

- Financial Overview: Provide a detailed account of your current financial situation, including income sources and monthly expenses.

- Explanation of Hardship: Describe the circumstances leading to your financial difficulties, such as job loss, medical emergencies, or other significant life events.

- Request for Consideration: Clearly state what relief you are seeking, whether it is a payment plan, reduced tax liability, or other forms of assistance.

- Supporting Documentation: Mention any attached documents that support your claims, such as pay stubs, medical bills, or bank statements.

Steps to complete the IRS hardship letter sample

Completing the IRS hardship letter sample involves several steps to ensure clarity and effectiveness. Follow these steps:

- Gather Information: Collect all relevant financial documents and details about your situation.

- Use the Template: Start with the hardship letter sample to structure your letter appropriately.

- Fill in Personal Details: Enter your personal information at the beginning of the letter.

- Detail Your Situation: Clearly explain your financial difficulties using concise language.

- Review and Edit: Proofread your letter for clarity, grammar, and completeness.

- Attach Supporting Documents: Include any necessary documentation that substantiates your claims.

- Send the Letter: Submit your letter to the appropriate IRS address, either by mail or electronically, if applicable.

Legal use of the IRS hardship letter sample

The legal use of the IRS hardship letter sample is crucial for ensuring that the letter meets all necessary requirements. The letter must comply with IRS guidelines and accurately represent the taxpayer's situation. It is important to provide truthful information and avoid exaggeration, as any discrepancies could lead to penalties or denial of the request. Additionally, maintaining a professional tone throughout the letter can enhance its credibility and effectiveness.

Examples of using the IRS hardship letter sample

Examples of using the IRS hardship letter sample can provide valuable insights into how to structure your own letter effectively. For instance, a taxpayer facing job loss might detail their reduced income and increased expenses, while someone dealing with medical issues may focus on unexpected medical bills. Each example should illustrate the specific circumstances that warrant consideration from the IRS, helping to personalize the letter and make a compelling case for relief.

Eligibility criteria for IRS hardship relief

To qualify for IRS hardship relief, taxpayers must meet specific eligibility criteria. Generally, the IRS considers factors such as:

- Income Level: Your income must fall below a certain threshold relative to your expenses.

- Financial Hardship: You must demonstrate that your financial situation prevents you from fulfilling your tax obligations.

- Supporting Documentation: You need to provide evidence of your financial difficulties, such as pay stubs, bank statements, or medical bills.

Meeting these criteria does not guarantee relief, but it is essential for a successful request.

Quick guide on how to complete irs hardship letter sample

Easily Prepare Irs Hardship Letter Sample on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Irs Hardship Letter Sample on any device using the airSlate SignNow apps for Android or iOS, and enhance your document-centered processes today.

Edit and eSign Irs Hardship Letter Sample Effortlessly

- Locate Irs Hardship Letter Sample and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and has the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device. Edit and eSign Irs Hardship Letter Sample to ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs hardship letter sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS hardship letter sample?

An IRS hardship letter sample is a template that taxpayers can use to request relief from the IRS for their tax obligations due to financial hardship. This document serves as a formal request explaining your situation and is essential for clarity and professionalism. Using an IRS hardship letter sample can help streamline the process of communication with the IRS.

-

How can airSlate SignNow help with creating an IRS hardship letter?

airSlate SignNow provides users with customizable document templates, including an IRS hardship letter sample. Our platform allows you to easily edit, sign, and send letters electronically. This makes managing your correspondence with the IRS efficient and straightforward.

-

Is there a cost associated with using airSlate SignNow for IRS hardship letters?

Yes, airSlate SignNow offers various pricing plans tailored to fit different needs, including features for creating documents like IRS hardship letters. Our plans cater to individuals and businesses, ensuring you only pay for what you need. The investment in our platform can ultimately save you time and effort in document management.

-

Are there any integrations available with airSlate SignNow for financial management tools?

Absolutely! airSlate SignNow integrates seamlessly with a variety of financial management tools that can simplify the process of preparing your IRS hardship letter sample. These integrations allow for efficient data management and enhance your overall document workflow, making it easier to compile necessary information for the IRS.

-

What are the key benefits of using airSlate SignNow for IRS hardship letters?

Using airSlate SignNow for IRS hardship letters provides several benefits. You gain access to customizable templates, electronic signing capabilities, and secure document storage. This ensures that your letters are professionally presented while also being convenient and organized.

-

Can I use my mobile device to create and send an IRS hardship letter sample?

Yes, airSlate SignNow is mobile-friendly, allowing users to create and send an IRS hardship letter sample from their smartphones or tablets. This flexibility enables you to manage your documents on the go, ensuring that you don't miss any critical deadlines with the IRS.

-

What do I need to include in my IRS hardship letter sample?

An effective IRS hardship letter sample should include your personal information, a detailed explanation of your financial situation, and any supporting documents that substantiate your claims. airSlate SignNow's templates guide you through this process, ensuring you include all necessary information for a compelling case.

Get more for Irs Hardship Letter Sample

- Davidson young scholars form

- Medical application form

- The school board of broward county florida business deerfieldbeachmiddle form

- Immunization verification form for holland college healthcare

- Mds2 form hn 1

- Www rivierabch comgovernmentlibraryresearch ampamp information riviera beach florida fl

- Mwr reciprocity exemptionaffidavit of residency form

- Notion contract template form

Find out other Irs Hardship Letter Sample

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking