Enhanced Star Nassau County 18 Form

What is the Enhanced Star Nassau County 18 Form

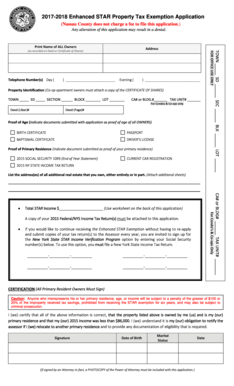

The Enhanced Star Nassau County 18 Form is a property tax exemption application specifically designed for eligible homeowners in Nassau County, New York. This form allows qualifying individuals to receive a reduction in their property taxes, making homeownership more affordable. The Enhanced Star program is aimed at providing financial relief to seniors and disabled individuals, ensuring they can maintain their homes without the burden of excessive tax costs. Understanding the purpose and benefits of this form is crucial for homeowners seeking to take advantage of available tax relief options.

How to use the Enhanced Star Nassau County 18 Form

Using the Enhanced Star Nassau County 18 Form involves several straightforward steps. First, ensure that you meet the eligibility requirements, which typically include age, income limits, and residency status. Next, obtain the form, which can be downloaded online or requested from the local tax assessor's office. Once you have the form, fill it out completely, providing accurate information about your property and personal details. After completing the form, submit it to the appropriate local authority by the specified deadline to ensure you receive the tax benefits.

Steps to complete the Enhanced Star Nassau County 18 Form

Completing the Enhanced Star Nassau County 18 Form requires careful attention to detail. Follow these steps for successful submission:

- Gather necessary documentation, such as proof of age, income statements, and property ownership records.

- Download or obtain the form from the Nassau County tax assessor's office.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or missing information.

- Submit the completed form by mail or in person to the designated office before the deadline.

Key elements of the Enhanced Star Nassau County 18 Form

Several key elements are crucial for the Enhanced Star Nassau County 18 Form. These include:

- Personal Information: This section requires details such as your name, address, and contact information.

- Eligibility Criteria: Homeowners must provide information confirming their eligibility, including age and income verification.

- Property Details: Accurate information about the property, including its location and assessed value, is essential.

- Signature: A signature is required to certify that the information provided is true and accurate.

Legal use of the Enhanced Star Nassau County 18 Form

The Enhanced Star Nassau County 18 Form is legally binding once submitted and approved by the local tax authority. It must be filled out truthfully, as any false information can lead to penalties or disqualification from the program. The form is governed by state laws regarding property tax exemptions, ensuring that only eligible homeowners benefit from the tax relief provided. Understanding the legal implications of this form is essential for maintaining compliance and avoiding issues with tax authorities.

Eligibility Criteria

To qualify for the Enhanced Star Nassau County 18 Form, applicants must meet specific eligibility criteria. Generally, these include:

- Being a homeowner in Nassau County.

- Meeting age requirements, typically being at least sixty-five years old.

- Having a household income below a certain threshold, which may vary annually.

- Occupying the property as a primary residence.

Quick guide on how to complete enhanced star nassau county 18 form

Effortlessly Prepare Enhanced Star Nassau County 18 Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, adjust, and eSign your documents swiftly without delays. Handle Enhanced Star Nassau County 18 Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The most efficient way to modify and eSign Enhanced Star Nassau County 18 Form with ease

- Obtain Enhanced Star Nassau County 18 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks, from any device you choose. Modify and eSign Enhanced Star Nassau County 18 Form to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the enhanced star nassau county 18 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Enhanced Star Nassau County 18 Form?

The Enhanced Star Nassau County 18 Form is an essential application for homeowners in Nassau County, aimed at providing property tax exemptions for eligible individuals. This form can help you save signNowly on your property taxes by qualifying for this program.

-

How do I fill out the Enhanced Star Nassau County 18 Form?

Filling out the Enhanced Star Nassau County 18 Form involves providing personal information, details about your property, and confirming your eligibility. airSlate SignNow offers an easy-to-use interface that simplifies the process, ensuring you can complete the form efficiently.

-

What are the benefits of using the Enhanced Star Nassau County 18 Form?

By utilizing the Enhanced Star Nassau County 18 Form, you can obtain property tax savings if you're a senior or disabled homeowner. This benefit not only reduces your financial burden but also ensures you are taking full advantage of available tax relief programs.

-

Is there a fee to submit the Enhanced Star Nassau County 18 Form?

Submitting the Enhanced Star Nassau County 18 Form is generally free of charge, but there might be fees associated with document processing if you use additional services. With airSlate SignNow, you can ensure that your submission is cost-effective and handles everything efficiently.

-

Can I track the status of my Enhanced Star Nassau County 18 Form submission?

Yes, airSlate SignNow allows you to track the status of your Enhanced Star Nassau County 18 Form submission. You will receive notifications about the progress, ensuring you are informed every step of the way.

-

What integrations does airSlate SignNow offer for the Enhanced Star Nassau County 18 Form?

airSlate SignNow integrates seamlessly with various applications to facilitate the process of submitting the Enhanced Star Nassau County 18 Form. This means you can work alongside other software tools you use, streamlining your workflow and maximizing efficiency.

-

How secure is the Enhanced Star Nassau County 18 Form when submitted via airSlate SignNow?

Security is a top priority for airSlate SignNow. The Enhanced Star Nassau County 18 Form is securely processed with encryption and compliance with data protection regulations, ensuring your information remains confidential and protected.

Get more for Enhanced Star Nassau County 18 Form

- Dog training registration form amazon web services

- Jep122 form

- Bcal 1243 815 child care medication permission form

- Fire department inventory spreadsheet form

- Katastar sign up form

- Anaphylaxisasthmaallergy risk minimisation plan template form

- Furniture purchase agreement template form

- Furniture sale agreement template form

Find out other Enhanced Star Nassau County 18 Form

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document