Missouri 941c Form

What is the Missouri 941c

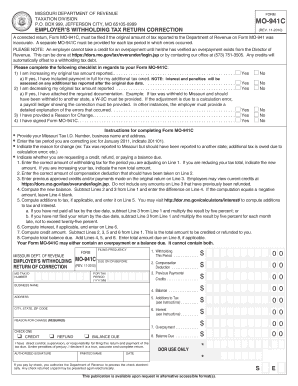

The Missouri 941c is a tax form used by employers in the state of Missouri to report withholding taxes on wages paid to employees. This form is essential for businesses to comply with state tax regulations and ensure accurate reporting of income tax withheld. It is typically filed quarterly and provides the state with information about the total wages paid, the amount of tax withheld, and any adjustments that may be necessary. Understanding the purpose and requirements of the Missouri 941c is crucial for maintaining compliance with state tax laws.

Steps to complete the Missouri 941c

Completing the Missouri 941c involves several key steps to ensure accuracy and compliance. First, gather all necessary payroll records for the reporting period, including total wages paid and the corresponding tax withheld. Next, fill out the form by entering the required information in the designated fields. This includes reporting the total number of employees, total wages, and total tax withheld. After completing the form, review all entries for accuracy before submitting. Finally, ensure that the form is submitted by the due date to avoid any penalties.

Legal use of the Missouri 941c

The legal use of the Missouri 941c is governed by state tax laws, which require employers to accurately report withholding taxes. Failure to comply with these regulations can result in penalties and interest on unpaid taxes. It is important for employers to understand their legal obligations when filing the Missouri 941c. This includes ensuring that all information reported is accurate and complete, as discrepancies can lead to audits or other legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Missouri 941c are critical for compliance. Employers must submit the form quarterly, with specific due dates typically falling on the last day of the month following the end of each quarter. For example, the deadlines for the first quarter (January to March) would be April 30. It is important to keep track of these dates to avoid late filing penalties and ensure timely reporting of withholding taxes.

Form Submission Methods

The Missouri 941c can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient option, allowing for quicker processing and confirmation of receipt. Employers can also choose to mail the completed form to the appropriate state tax office or deliver it in person. Each submission method has its own advantages, and employers should select the one that best fits their needs and resources.

Key elements of the Missouri 941c

Key elements of the Missouri 941c include essential information that must be reported accurately. This includes the employer's identification number, total wages paid, total income tax withheld, and any adjustments for prior periods. Additionally, the form requires the signature of the person responsible for filing, affirming that the information provided is true and correct. Understanding these elements is vital for ensuring that the form is completed correctly and submitted on time.

Quick guide on how to complete missouri 941c

Easily Prepare Missouri 941c on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without inconvenience. Manage Missouri 941c on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

Effortlessly Modify and eSign Missouri 941c

- Obtain Missouri 941c and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or obscure confidential information with tools specifically designed for that purpose, available at airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred delivery method for the form, whether by email, SMS, or an invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes requiring new copies to be printed. airSlate SignNow caters to all your document management needs with just a few clicks from any device you choose. Edit and eSign Missouri 941c to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the missouri 941c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Missouri 941C form?

The Missouri 941C form is used for reporting withheld income and employment taxes by employers in Missouri. It allows businesses to accurately document their tax obligations and ensure compliance with state regulations. Properly filing the Missouri 941C is essential to avoid penalties and maintain good standing with tax authorities.

-

How can airSlate SignNow help with the Missouri 941C form?

airSlate SignNow offers an easy-to-use platform that allows businesses to electronically sign and send the Missouri 941C form quickly and securely. With its intuitive interface, users can streamline their document workflows and ensure all necessary signatures are captured efficiently. This helps in reducing paperwork, saving time, and ensuring compliance with submission deadlines.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a range of pricing plans to cater to different business needs, starting from basic plans to more comprehensive solutions. Companies can choose a plan that fits their budget while gaining access to essential features for managing documents like the Missouri 941C. Additionally, airSlate SignNow provides a free trial, so potential customers can test the service before committing.

-

What features does airSlate SignNow include for managing the Missouri 941C?

Key features of airSlate SignNow suitable for managing the Missouri 941C include customizable templates, secure electronic signatures, and automated reminders for deadlines. These features allow businesses to enhance their document management processes, ensuring that all necessary forms are sent, signed, and stored appropriately. This ultimately promotes efficiency and accuracy in tax reporting.

-

Are there integrations available with airSlate SignNow?

Yes, airSlate SignNow offers several integrations with popular business applications, making it easier to manage documents like the Missouri 941C seamlessly. Users can integrate with CRMs, accounting software, and more to enhance their workflow. This flexibility helps businesses streamline their operations, ensuring that all relevant data and documents are connected.

-

What are the benefits of using airSlate SignNow for the Missouri 941C?

Using airSlate SignNow for the Missouri 941C provides numerous benefits, including improved efficiency in document handling and reduced paper usage. The platform's electronic signing capabilities reduce the turnaround time, allowing businesses to submit their forms promptly. Additionally, the secure storage features ensure that sensitive information remains protected.

-

Can multiple users collaborate on the Missouri 941C form using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on the Missouri 941C form, making it easy for teams to work together. This collaborative feature allows colleagues to review, comment, and sign documents in real time, enhancing overall productivity and ensuring that everyone's input is captured efficiently.

Get more for Missouri 941c

- Dom to chose insurance new mexico form

- Clear form import data submit form division of athleticsactivities and accreditation parent permission form field trip field

- Navy siq chit pdf form

- Ccp 0345 clerk of the circuit court of cook county form

- Psychiatric evaluation questionnaire children annexure b to indian passport application identity certificate form

- Lost property report word template form

- Hearusa provider form

- Lfo interest waiver guide january aclu wa form

Find out other Missouri 941c

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free