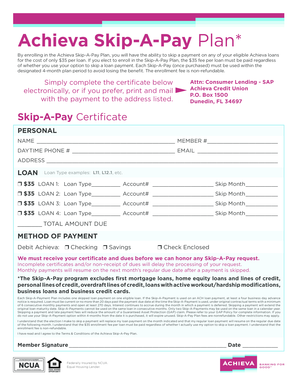

Achieva Skip a Pay Form

What is the Achieva Skip A Pay

The Achieva Skip A Pay program allows borrowers to temporarily defer their loan payments for a specified period, providing financial relief during challenging times. This option is typically available for various loan types, including personal loans and auto loans. By participating in this program, borrowers can manage their finances more effectively without the immediate pressure of monthly loan payments.

How to Use the Achieva Skip A Pay

To utilize the Achieva Skip A Pay program, borrowers must first confirm their eligibility. This often involves reviewing the terms of their loan agreement and ensuring they have made timely payments prior to the request. Once eligibility is established, borrowers can submit a request through the designated channel, which may include an online form or a direct communication with customer service.

Steps to Complete the Achieva Skip A Pay

Completing the Achieva Skip A Pay process involves several key steps:

- Review your loan agreement for eligibility criteria.

- Gather necessary documentation, such as proof of income or financial hardship.

- Access the Skip A Pay request form through the Achieva website or customer service.

- Fill out the form with accurate information regarding your loan and personal details.

- Submit the form and await confirmation from Achieva regarding your request.

Legal Use of the Achieva Skip A Pay

The Achieva Skip A Pay program is legally binding, meaning that both the borrower and Achieva must adhere to the terms outlined in the agreement. It is essential for borrowers to understand the implications of skipping a payment, including any potential fees or changes to the loan term. Compliance with federal and state regulations is also crucial to ensure that the process remains valid and enforceable.

Key Elements of the Achieva Skip A Pay

Several key elements define the Achieva Skip A Pay program:

- Eligibility Criteria: Borrowers must meet specific requirements to qualify.

- Duration: The program typically allows for one or two skipped payments within a year.

- Fees: Some loans may incur a fee for participating in the program.

- Impact on Loan Term: Skipping a payment may extend the loan term or increase total interest paid.

Examples of Using the Achieva Skip A Pay

Borrowers may find the Achieva Skip A Pay program beneficial in various scenarios, such as:

- Experiencing temporary job loss or reduced income.

- Facing unexpected medical expenses that strain finances.

- Managing seasonal income fluctuations, particularly for self-employed individuals.

Quick guide on how to complete achieva loan payment

Complete achieva loan payment effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage achieva loan payment on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to modify and eSign achieva skip a pay with ease

- Find achieva loan payment and then click Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your updates.

- Choose how you want to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign achieva skip a pay and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to achieva loan payment

Create this form in 5 minutes!

How to create an eSignature for the achieva skip a pay

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask achieva skip a pay

-

What is the achieva loan payment process?

The achieva loan payment process is designed to be straightforward and efficient. Users can submit their payments online through the airSlate SignNow platform, ensuring a secure transaction. Simply log in, select the loan payment option, and follow the prompts to complete your achieva loan payment.

-

How can I make my achieva loan payment using airSlate SignNow?

To make your achieva loan payment using airSlate SignNow, start by accessing your account. From there, choose the payment option, fill in the required details, and sign the necessary documents electronically. This streamlined approach saves time and enhances your payment experience.

-

Are there any fees associated with achieva loan payments?

There may be minimal fees associated with achieva loan payments, depending on the payment method you choose. With airSlate SignNow, you can review all potential fees before completing your transaction. Always check the details to ensure you are informed of any costs that may apply.

-

Can I schedule my achieva loan payment in advance?

Yes, airSlate SignNow allows users to schedule their achieva loan payments in advance. This feature helps you manage your finances better by giving you control over when payments are made. Simply navigate to the scheduling options during the payment process.

-

What are the benefits of using airSlate SignNow for achieva loan payments?

Using airSlate SignNow for achieva loan payments offers numerous benefits, including enhanced security and convenience. The platform provides a user-friendly interface, making it easy to complete transactions quickly. Plus, documents are securely stored and easily retrievable for your records.

-

Is it possible to track my achieva loan payment status?

Yes, airSlate SignNow offers a tracking feature for your achieva loan payment status. After submitting your payment, you can easily check the progress within your account dashboard. This transparency helps you stay informed and assured that your payment is processed.

-

What documentation is needed for achieva loan payments?

For achieva loan payments, you typically need your account details and any corresponding payment information. airSlate SignNow simplifies this process by providing clear guidelines on the necessary documentation during the payment submission stage. Make sure all required forms are complete for a successful transaction.

Get more for achieva loan payment

Find out other achieva skip a pay

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF