990t Worksheets Form

What is the 990t Worksheets Form

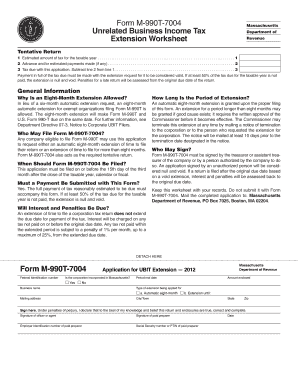

The 990t Worksheets Form is a tax document used by organizations to report unrelated business income and calculate the tax owed on that income. This form is primarily utilized by tax-exempt entities, such as charities and non-profits, to ensure compliance with IRS regulations regarding income that is not related to their exempt purpose. The form helps the IRS determine whether these organizations are fulfilling their obligations under the tax code and provides a clear record of any taxable income generated.

How to use the 990t Worksheets Form

Using the 990t Worksheets Form involves several steps to ensure accurate reporting. First, organizations must gather all relevant financial information related to their unrelated business activities. This includes income from sales, services, and any other sources that do not align with their tax-exempt status. Next, the organization should fill out the form by entering the total unrelated business income, deductions, and any applicable credits. Finally, it is essential to review the completed form for accuracy before submission to avoid penalties or compliance issues.

Steps to complete the 990t Worksheets Form

Completing the 990t Worksheets Form requires careful attention to detail. Here are the key steps:

- Gather financial records: Collect all income and expense documentation related to unrelated business activities.

- Fill out the form: Enter the total unrelated business income and applicable deductions in the appropriate sections.

- Calculate tax owed: Use the IRS guidelines to determine the amount of tax owed based on the reported income.

- Review the form: Check for any errors or omissions to ensure compliance with IRS requirements.

- Submit the form: File the completed form with the IRS by the designated deadline.

Legal use of the 990t Worksheets Form

The legal use of the 990t Worksheets Form is crucial for maintaining compliance with federal tax laws. Organizations must accurately report any unrelated business income to avoid penalties and potential loss of tax-exempt status. The IRS requires that all income generated from activities not directly related to the organization's exempt purpose be reported. Failure to do so can result in significant fines and legal repercussions, making it essential for organizations to understand their obligations under the tax code.

Filing Deadlines / Important Dates

Organizations must adhere to specific filing deadlines for the 990t Worksheets Form to remain compliant. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization's tax year. For example, if the tax year ends on December thirty-first, the form would be due by May fifteenth of the following year. It is important to stay informed about any changes to these deadlines, as late submissions can incur penalties and interest on any taxes owed.

Required Documents

To complete the 990t Worksheets Form accurately, organizations need to prepare various documents. These typically include:

- Financial statements: Income statements and balance sheets detailing unrelated business income and expenses.

- Supporting documentation: Receipts, invoices, and other records substantiating income and deductions.

- Prior year tax returns: Reference documents from previous filings can help ensure consistency and accuracy.

Quick guide on how to complete 990t worksheets form

Complete 990t Worksheets Form seamlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, as you can obtain the necessary form and securely archive it online. airSlate SignNow provides you with all the tools necessary to design, modify, and eSign your documents quickly and efficiently. Handle 990t Worksheets Form on any system with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign 990t Worksheets Form effortlessly

- Obtain 990t Worksheets Form and click on Get Form to commence.

- Employ the tools we provide to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Revise and eSign 990t Worksheets Form and ensure outstanding communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 990t worksheets form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 990t Worksheets Form?

The 990t Worksheets Form is a key document used by tax-exempt organizations to report unrelated business income. This form allows organizations to calculate tax liabilities for income derived from activities not directly related to their core mission.

-

How can airSlate SignNow help with 990t Worksheets Form?

airSlate SignNow simplifies the process of preparing and signing 990t Worksheets Form by providing an intuitive platform for document management. Users can easily upload, edit, and electronically sign their forms, ensuring compliance with tax regulations in a fraction of the time.

-

Is there a cost associated with using the 990t Worksheets Form feature?

Yes, utilizing the 990t Worksheets Form feature involves a subscription fee. However, airSlate SignNow offers affordable pricing plans that provide excellent value for businesses seeking to streamline their document signing processes.

-

What are the benefits of using airSlate SignNow for the 990t Worksheets Form?

Using airSlate SignNow for the 990t Worksheets Form enhances efficiency by eliminating paperwork and reducing the risk of errors. The platform ensures that all signatures are collected securely and quickly, which can save valuable time during tax season.

-

Can I integrate airSlate SignNow with other software to manage my 990t Worksheets Form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing for smooth data transfer and management of the 990t Worksheets Form. This feature enhances productivity and helps maintain organized records.

-

What features does airSlate SignNow offer for electronically signing 990t Worksheets Form?

airSlate SignNow includes features such as customizable templates, bulk sending options, and real-time tracking for the 990t Worksheets Form. These features enhance user experience and simplify the process of document collaboration.

-

Is there customer support available for issues related to the 990t Worksheets Form?

Yes, airSlate SignNow provides dedicated customer support for any inquiries related to the 990t Worksheets Form. Whether you need assistance with technical issues or general questions, their support team is available to help.

Get more for 990t Worksheets Form

Find out other 990t Worksheets Form

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation