Nj W 3m Form

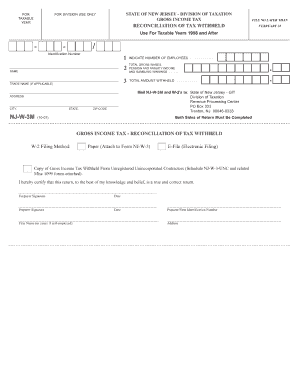

What is the NJ W-3M?

The NJ W-3M is a state-specific tax form used in New Jersey for reporting income and withholding information for employers. This form is essential for businesses that need to submit annual reconciliation of wages and taxes withheld from their employees. It serves as a summary of the W-2 forms issued to employees, ensuring that the state receives accurate information regarding payroll taxes. The NJ W-3M is particularly important for compliance with state tax regulations and helps maintain proper records for both employers and employees.

How to Use the NJ W-3M

Using the NJ W-3M requires careful attention to detail to ensure that all information is accurately reported. Employers must gather all W-2 forms issued to employees for the tax year and compile the necessary data, including total wages paid and total taxes withheld. Once this information is collected, it can be entered into the NJ W-3M form. It is crucial to review the completed form for accuracy before submission, as errors can lead to penalties or delays in processing. Employers can file the NJ W-3M electronically or via mail, depending on their preference and the requirements set by the New Jersey Division of Taxation.

Steps to Complete the NJ W-3M

Completing the NJ W-3M involves several key steps:

- Gather all W-2 forms issued to employees during the tax year.

- Calculate total wages paid to employees and total taxes withheld.

- Fill out the NJ W-3M form with the collected data, ensuring accuracy.

- Review the form for any errors or omissions.

- Submit the completed form either electronically or by mail to the New Jersey Division of Taxation.

Following these steps carefully will help ensure compliance with state tax laws and avoid potential issues.

Legal Use of the NJ W-3M

The NJ W-3M must be used in accordance with New Jersey tax laws and regulations. It is legally binding and serves as a formal declaration of the wages and taxes reported by employers. Accurate completion of the form is essential, as discrepancies can lead to audits, fines, or other legal repercussions. Employers should maintain copies of submitted forms and related documents for their records, as they may be required for future reference or in the event of an audit.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the NJ W-3M to ensure timely submission. Typically, the form is due by the last day of February following the end of the tax year. For example, for the tax year ending December 31, the NJ W-3M must be filed by February 28 of the following year. Employers should also be aware of any changes to deadlines that may occur due to state regulations or specific circumstances, such as extensions granted by the New Jersey Division of Taxation.

Required Documents

To complete the NJ W-3M, employers need to have several documents on hand:

- All W-2 forms issued to employees for the tax year.

- Records of total wages paid to employees.

- Documentation of total taxes withheld from employee wages.

Having these documents readily available will streamline the process of completing and filing the NJ W-3M.

Quick guide on how to complete nj w 3m

Effortlessly prepare Nj W 3m on any device

Digital document management has gained traction with both businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage Nj W 3m on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

Steps to modify and eSign Nj W 3m easily

- Obtain Nj W 3m and then click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for that task.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Nj W 3m and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj w 3m

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is nj w 3m and how does it relate to airSlate SignNow?

The nj w 3m is an essential tax form used in New Jersey for employee withholding. airSlate SignNow simplifies the process of signing and managing nj w 3m documents electronically, ensuring compliance and efficiency in your business operations.

-

How can airSlate SignNow help with nj w 3m processing?

With airSlate SignNow, you can easily create, send, and eSign nj w 3m forms, making it a breeze to handle employee tax documentation. The platform ensures that all signatures are collected safely and securely, while also allowing for efficient tracking of the form's status.

-

What are the pricing options for using airSlate SignNow for nj w 3m forms?

airSlate SignNow offers various pricing plans tailored to meet different business needs, starting with a free trial. These plans include features specifically helpful for managing documents like the nj w 3m, ensuring that you get great value for your investment.

-

Does airSlate SignNow integrate with other software for managing nj w 3m forms?

Yes, airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Dropbox, and CRM systems. This allows you to manage your nj w 3m forms alongside other business documents, enhancing your overall productivity and workflow.

-

What are the benefits of using airSlate SignNow for nj w 3m documentation?

Using airSlate SignNow for your nj w 3m documentation streamlines the process, reduces paper clutter, and saves time for your business. You'll benefit from enhanced security, legally binding eSignatures, and easy access to your documents from anywhere at any time.

-

Is airSlate SignNow compliant with NJ regulations for nj w 3m forms?

Absolutely, airSlate SignNow is designed to comply with NJ regulations for nj w 3m forms. This ensures that when you eSign these documents, they are valid and recognized, giving you peace of mind in your tax document management.

-

Can I customize nj w 3m forms in airSlate SignNow?

Yes, airSlate SignNow allows you to easily customize nj w 3m forms to fit your specific business needs. You can add branding, tailor fields, and adjust the workflow to streamline the signing process for your team and clients.

Get more for Nj W 3m

Find out other Nj W 3m

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy