Daycare Income and Expense Worksheet Form

What is the daycare income and expense worksheet?

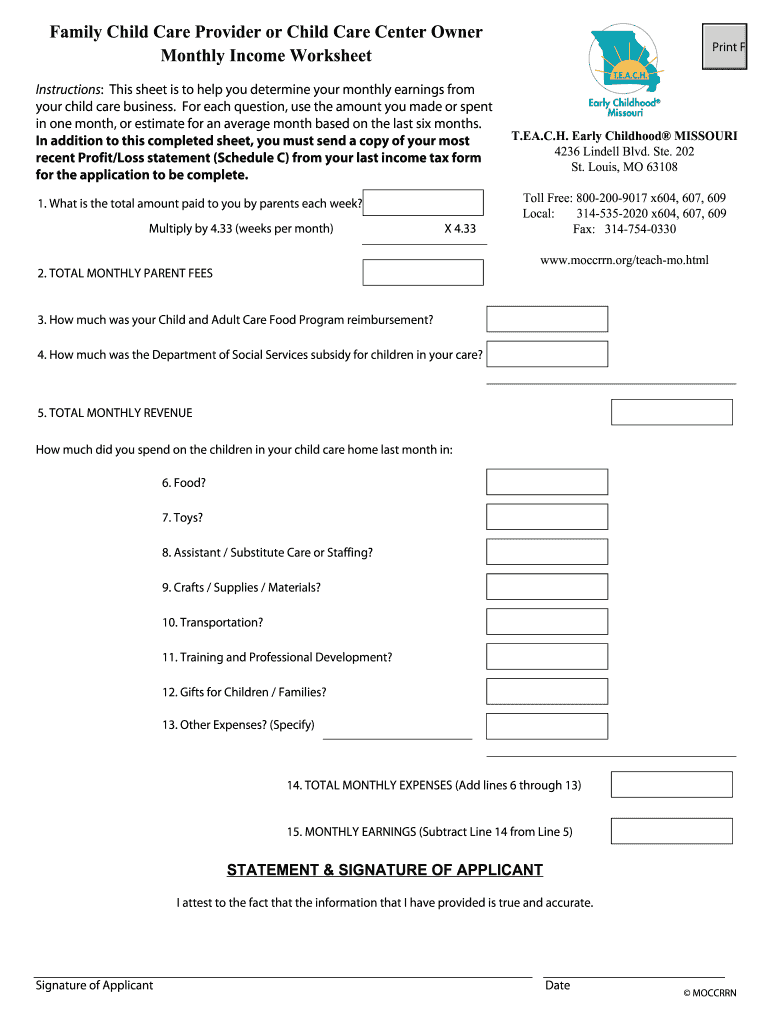

The daycare income and expense worksheet is a vital document for home daycare providers in the United States. It helps track all income generated from childcare services and the associated expenses incurred in running a daycare. This worksheet is essential for accurately reporting taxable income and claiming deductions on your tax returns. By maintaining a clear record of income and expenses, providers can ensure compliance with IRS regulations and maximize potential tax benefits.

How to use the daycare income and expense worksheet

Using the daycare income and expense worksheet involves several straightforward steps. First, gather all relevant financial documents, including receipts, invoices, and bank statements. Next, categorize your income and expenses into clear sections, such as child care fees, supplies, utilities, and other operational costs. Record each item in the appropriate section of the worksheet, ensuring accuracy in amounts and dates. Regularly updating the worksheet throughout the year can simplify the tax preparation process and provide a comprehensive overview of your daycare's financial health.

Steps to complete the daycare income and expense worksheet

Completing the daycare income and expense worksheet requires careful attention to detail. Follow these steps:

- Start by entering your total income from all sources related to your daycare services.

- List all expenses, categorizing them into direct costs like supplies and indirect costs such as utilities.

- Calculate the total for each category and then sum the totals to determine your overall income and expenses.

- Subtract total expenses from total income to find your net profit or loss for the year.

- Keep a copy of the completed worksheet for your records and for use during tax preparation.

IRS guidelines

The IRS provides specific guidelines for home daycare providers regarding income reporting and allowable deductions. It is crucial to understand what qualifies as deductible expenses, such as costs for food, supplies, and utilities directly related to the daycare operation. Additionally, the IRS requires that all income be reported, regardless of whether it was received in cash or through other means. Familiarizing yourself with IRS Publication 587 can provide further insights into the requirements for home daycare tax deductions.

Required documents

To effectively complete the daycare income and expense worksheet, several documents are necessary. These include:

- Receipts for all expenses related to the daycare operation.

- Bank statements showing income deposits.

- Invoices issued to clients for childcare services.

- Any relevant tax forms, such as the Schedule C, which reports profit or loss from business.

Having these documents organized and readily available can streamline the process of filling out the worksheet and ensure accurate reporting.

Penalties for non-compliance

Non-compliance with IRS regulations regarding income reporting and expense deductions can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential audits. It is essential for daycare providers to maintain accurate records and ensure all income and expenses are reported correctly to avoid these repercussions. Regularly reviewing IRS guidelines and consulting with a tax professional can help mitigate risks associated with non-compliance.

Quick guide on how to complete child care provider monthly income worksheet child care aware

Prepare Daycare Income And Expense Worksheet effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your files swiftly without delays. Manage Daycare Income And Expense Worksheet on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Daycare Income And Expense Worksheet with ease

- Locate Daycare Income And Expense Worksheet and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or mislaid documents, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Daycare Income And Expense Worksheet and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How many percentage of my monthly income should go to child care? And when it makes sense to put the child in a child care facility V.S being a stay home mom.

That’s a really tough question and it comes down to what you can afford.For example, I make about $30/hour before taxes. In looking at care(.)com for a nanny or babysitter, many charged $15–20/hour for one kid. At that rate, I would actually be losing money to go to work. So I picked up fewer hours and opted to change my schedule so only family was watching our son. It’s hard to find daycare that is inexpensive. Not every family can afford to do that.

-

How can we raise awareness about how maternal care contributes to a child's growth?

By paying attention when their have an opinion and lesson when something is bothering them in school. Like a fucked up mean teacher. Knowing that their can come to Daddy and trust me to tell me anything ,not being afraid when it's something really bad they did, and explaining that school is part of life that you have to go in and face that teacher that may not like her. Showing that I am on my child’s side even though she started the shit, who to believe first, my child first, and explaining everything and all things straight honest.

-

As a child removed from their parent's care, due to abuse, and put in some sort of foster care, how did things work out for you in the end?

I was removed from my parent’s home at Age thirteen. I couldn’t have been more relieved. Nine months later I returned home, but things were never the same. The first time my Dad and Stepmother became upset with me and my sister they threatened foster care. And, that’s just what happened. I was back in foster care, tried living with my biological mother, then back into foster care. I went through a lot. Something in me kept pushing me along though. I never felt satisfied with what I saw, and believed their had to be more out there than what I saw.In the end, I’d have to say things did work out, relatively speaking. Of course, I had my share of issues. I had next to no support system, and still in the process of trying to figure out who I was, where I belonged, and of all those fun things. But, there are some major game changers that I was able to avoid.I grew up with a strong work ethic, so that worked in my favor. When I graduated from high school at eighteen. I already had a job and was able to rent an apartment the day following graduation. With out this, who knows what direction I could have gone. Maybe I would have went the homeless route, or welfare.I also never became pregnant until much later in life. Had I - my whole life would have turned upside down.My friends and I, during some of my teenage years, were into plenty of drugs and alcohol. It was the 70’s after all. While there were fun times, most were not if I was to be honest. I eventually left that world too. About ten years later, my best friend from that time consequently died from complications of drinking.With everything I experienced up until the age of eighteen, I could have easily gone down a different road.Ultimately, we do choose the direction in which we want to go. But so many factors play into those decisions and some adolescents truly aren’t capable of making right choices when they need to. I believe it would be completely unfair of me to credit myself for things working out the way they did.A couple big problems is that many foster children have never been taught to think of themselves in a worthy way; they often have little to no self value. Loving parental guidance is often a foreign concept. Well, the list goes on.Success for us, and/or things turning out good in the end, can look different from let’s say, a child in the Beaver Cleaver household. And don’t let anyone tell you that doesn’t exist. It does! I’ve met them. But I digress…In my late twenties I finally went to college and became an elementary teacher. Ironically, I was the first of five siblings to go to college.I want to acknowledge God in all of this. I don’t know where I’d be without him!

-

What problems would a mother be going through if she had to raise a child and take care of monthly income, all by herself?

There are problems surely but not insurmountable. There are many single mothers who have raised their child beautifully and in an examplary way. In fact single or couple , parenting is a huge responsibility. And then if you are a working mother, you have no one to offer any help. But nothing to get discouraged. Every problem can be sorted out . You could take help of your parents or could take help of a crèche, so that you can feel safe about the child . There are companies who allow you work from home. Try to get such a job. But remember if you are a loving mother,the child will soon understand you and will always be proud of you. And that would be the wonderful reward which will make your life worth living. All the best. Thanks for A2A.

-

Is it possible for a child to grow up homeless and the government not be aware of their existence until something happens and they are put into foster care? If so, how would they find out said child's name?

I had a foster kid who was captured by Social Services as a 10 yo male prostitute, with a bad enough huffing habit that his face was eroded. He had no idea what his last name was, or the names of his parents. Social Services gifted him with the last name “Brown”. He ran away from every home they put him in, getting by on his own for periods of years before recapture. When he came to me, a 17 yo remanded by the court for underage drinking, he did not know what toilet paper was for, but he was incredibly intelligent and a voracious reader. He played guitar like rain falls from the sky.His one desire in life was to do enough drugs that his intelligence, and understanding of the world, could be destroyed, and he could live in peace. He stayed, mostly straight, until adulthood freed him to pursue his dream, which he promptly did. He is now slightly brain damaged, clean and sober, and in a committed relationship of some years. He cleans carpets for a national firm. He can no longer play guitar, but he is happy.

-

Day care providers make a lot of decisions as to what you child experiences through the day. How communicative is your day care about what happens through the day with your child?

New age, new technology!But let me first start by saying I do not depend on the technology (read childcare centre’s app) to find out about whats happening.Since this is my first interaction with a day care, I did not know what to expect or to not expect. Luckily I found the most amazing child care providers, from the administrators to the people who stay by my baby’s side all day, 5 days a week.I remember when he first started day care, he used to cry and ask for mommy, and won’t eat. Since we have certain diet restrictions, the centre provided him vegetarian food, and he would come home hungry and starving.But then these super nice girls/women, who were all ECEs or in the process to be one. They made sure to keep me posted about his day, they would call me as per my instructions if he would go over the board. One specific girl would sit with him by the window as he stood there for hours, waiting for mommy.They would provide me with ‘accident reports’ if he slipped or got a scratch. I was not expecting all these documents because again this was my first experience.They send daily emails, with a general description of the day, the food, nap durations, number of pees/poos, with pictures of the activities performed during the day. They send monthly calendars of the future events/special days.Moreover, every day when I pick him up, the girls generally provide me a brief summary of his day and the conversations since he likes to tell stories about the day before to everyone.And then there is the app that has daily photos, plus details of activities.My child has had an amazing leap of learning. I have watched him on cameras and through peep holes. He has transformed into an amazing human being, learnt manners, etiquettes, interactions, and loads of ‘please’ and ‘thank you’.Financially, it definitely is a lot of money that I pay, but the care and learning is beyond words. No regrets and 100% satisfaction!!

-

How do Scandinavian countries help with child care, given the need for parents to make an income?

With the following:In Scandinavia, the mother, and the father receive money for a certain period after the baby has been born. The maternal leave period can vary from 13 to 69 weeks and the paternal leave from 2 to 12. It’s mostly the social security that pays up.(Parental leave)Hope this helped!

Create this form in 5 minutes!

How to create an eSignature for the child care provider monthly income worksheet child care aware

How to create an eSignature for your Child Care Provider Monthly Income Worksheet Child Care Aware online

How to generate an eSignature for your Child Care Provider Monthly Income Worksheet Child Care Aware in Google Chrome

How to make an eSignature for signing the Child Care Provider Monthly Income Worksheet Child Care Aware in Gmail

How to generate an eSignature for the Child Care Provider Monthly Income Worksheet Child Care Aware from your smartphone

How to create an electronic signature for the Child Care Provider Monthly Income Worksheet Child Care Aware on iOS

How to create an eSignature for the Child Care Provider Monthly Income Worksheet Child Care Aware on Android devices

People also ask

-

What is the in home daycare tax deduction worksheet?

The in home daycare tax deduction worksheet is a tool that helps daycare providers track expenses and calculate eligible deductions for their in-home daycare operations. This worksheet simplifies the tax preparation process, ensuring that you don't miss out on any potential tax benefits. With accurate documentation, you can maximize your deductions and minimize your tax liability.

-

How can I obtain the in home daycare tax deduction worksheet?

You can easily obtain the in home daycare tax deduction worksheet by visiting our website and downloading it from the resources section. It's available for free to help daycare providers keep track of their expenses efficiently. Additionally, airSlate SignNow allows you to eSign any necessary documents associated with your tax preparations to streamline the process.

-

What expenses can I include on the in home daycare tax deduction worksheet?

The in home daycare tax deduction worksheet allows you to include various expenses such as utilities, supplies, food, and any depreciation on your property. By keeping comprehensive records, you can input these costs into the worksheet to calculate your tax deductions accurately. This ensures you maximize your eligible deductions during tax season.

-

Is there a cost associated with using the in home daycare tax deduction worksheet?

There is no cost associated with using the in home daycare tax deduction worksheet, as it is provided free on our website. However, if you choose to use airSlate SignNow for document management and e-signatures, there are various pricing plans tailored to fit your needs. This robust platform enhances your overall tax preparation experience.

-

How does the in home daycare tax deduction worksheet help me save money?

The in home daycare tax deduction worksheet helps you save money by identifying and optimizing all potential tax deductions related to your daycare operations. By accurately documenting your expenses, you can signNowly reduce your taxable income. This vital tool ensures you make the most out of available tax benefits specific to in-home daycare providers.

-

Can I integrate the in home daycare tax deduction worksheet with other accounting tools?

Yes, you can integrate the in home daycare tax deduction worksheet with various accounting tools for streamlined expense tracking. Many accounting software options allow for easy data import, which can simplify the deduction calculation process. This integration complements airSlate SignNow’s features, making your overall experience more efficient.

-

What are the benefits of using airSlate SignNow in conjunction with the in home daycare tax deduction worksheet?

Using airSlate SignNow in conjunction with the in home daycare tax deduction worksheet enhances your efficiency in managing paperwork and tax preparations. It allows you to securely eSign documents and store them all in one place while keeping track of your deductions seamlessly. This integration saves time and reduces stress during tax season.

Get more for Daycare Income And Expense Worksheet

Find out other Daycare Income And Expense Worksheet

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure