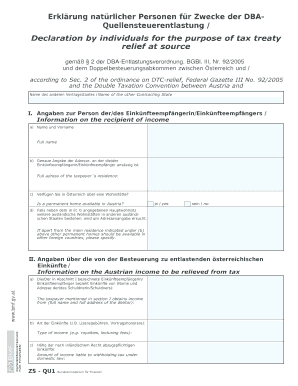

Zsqu1 Form

What is the Zsqu1

The Zsqu1 is a specific form used in various administrative and legal processes. It serves as a crucial document for individuals and businesses alike, facilitating the collection and submission of essential information. Understanding the purpose and requirements of the Zsqu1 is vital for ensuring compliance with relevant regulations.

How to use the Zsqu1

Using the Zsqu1 involves several straightforward steps. First, gather all necessary information required to complete the form accurately. This may include personal identification details, financial information, or other relevant data. Next, fill out the form carefully, ensuring all sections are completed to avoid delays. Finally, submit the form through the designated method, whether online, by mail, or in person, as specified by the issuing authority.

Steps to complete the Zsqu1

Completing the Zsqu1 effectively requires a systematic approach:

- Review the form to understand all required fields.

- Collect necessary documents and information beforehand.

- Fill in the form, ensuring accuracy in every section.

- Double-check for any errors or omissions.

- Submit the completed form via the appropriate channel.

Legal use of the Zsqu1

The Zsqu1 must be used in accordance with legal standards to ensure its validity. This includes adhering to specific guidelines set forth by regulatory bodies. When completed correctly, the Zsqu1 can serve as a legally binding document, provided it meets all necessary criteria for signatures and submissions.

Key elements of the Zsqu1

Several key elements are essential for the Zsqu1 to be valid:

- Accurate personal or business information.

- Proper signatures or initials where required.

- Compliance with any specific instructions related to the form.

- Submission within designated timeframes.

Required Documents

When completing the Zsqu1, certain documents may be required to support the information provided. These can include:

- Identification documents (e.g., driver's license, passport).

- Financial statements or tax returns.

- Any other documentation specified by the issuing authority.

Form Submission Methods

The Zsqu1 can typically be submitted through various methods, including:

- Online submission via designated portals.

- Mailing the completed form to the appropriate address.

- In-person submission at specified locations.

Quick guide on how to complete zsqu1

Complete Zsqu1 effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without interruption. Handle Zsqu1 on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The easiest way to modify and eSign Zsqu1 with ease

- Locate Zsqu1 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the document or obscure sensitive information using the tools specifically available through airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the worry of lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign Zsqu1 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the zsqu1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to zsqu1?

airSlate SignNow is a powerful platform designed to streamline the process of sending and eSigning documents. It offers an intuitive interface that enhances productivity, and its integration of the keyword 'zsqu1' indicates its focus on providing efficient electronic signature solutions.

-

What are the key features of airSlate SignNow related to zsqu1?

Key features of airSlate SignNow include customizable templates, document tracking, and multi-party signing. The platform's design emphasizes user experience with a focus on 'zsqu1', ensuring that businesses can manage their eSigning requirements seamlessly and effectively.

-

How does the pricing structure of airSlate SignNow work concerning zsqu1?

airSlate SignNow offers a flexible pricing structure that caters to various business needs while keeping costs low. By choosing the 'zsqu1' plan, users can access essential features without overspending, making it a budget-friendly eSigning solution.

-

What benefits does airSlate SignNow offer for businesses using zsqu1?

Businesses using airSlate SignNow experience enhanced efficiency and improved workflow with its eSigning capabilities. With 'zsqu1', companies can reduce turnaround times for documents, leading to faster transactions and increased customer satisfaction.

-

Can airSlate SignNow integrate with other tools and software related to zsqu1?

Yes, airSlate SignNow integrates seamlessly with various business applications, enhancing its functionality. By leveraging 'zsqu1', businesses can connect their existing tools and enjoy a cohesive experience while managing document workflows.

-

Is airSlate SignNow secure for handling sensitive information in relation to zsqu1?

Absolutely! airSlate SignNow employs top-notch security measures to protect sensitive information during the eSigning process. With a commitment to 'zsqu1', the platform ensures compliance with industry standards, providing users with peace of mind regarding their data.

-

How can I get started with airSlate SignNow and the zsqu1 features?

Getting started with airSlate SignNow is easy! Simply sign up for an account and explore the features of 'zsqu1' that cater to your eSigning needs. The user-friendly interface will guide you through setting up your documents and workflows effectively.

Get more for Zsqu1

- School pittsburgh public schools form

- Riversource 37856forms com

- Employee information sheet complete this form for each employee

- Print forrest form amended return select if filing

- 1 gross proceeds from lottery this quarter from li form

- Iowa state tax information

- Owners last name form

- Get in te vullen door de kandidaat huurder verhuurder form

Find out other Zsqu1

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service