Tax Application Form

What is the tax application?

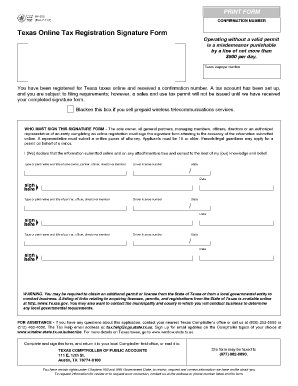

The tax application form is a crucial document used by individuals and businesses to report their income and calculate the taxes owed to the government. This form serves as a formal request for tax-related benefits or obligations and is typically submitted to the Internal Revenue Service (IRS) or state tax authorities. Understanding the purpose of the tax application is essential for compliance with tax laws and regulations.

Steps to complete the tax application

Filling out the tax application form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, such as W-2s, 1099s, and other income statements. Next, carefully read the instructions provided with the form to understand the requirements. Fill in your personal information, including your Social Security number, and report your income accurately. After completing the form, review it for any errors before submitting it to the appropriate tax authority.

Legal use of the tax application

The tax application form must be completed in accordance with federal and state regulations to be considered legally binding. This includes providing accurate information and adhering to the guidelines set forth by the IRS. Electronic submission of the form is permissible, provided it meets the requirements of the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws. Ensuring compliance with these legal standards is vital to avoid penalties and ensure the validity of your tax application.

Required documents

Before submitting your tax application form, it is essential to gather all required documents. Commonly needed items include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of other income, such as rental or investment income

- Receipts for deductible expenses

- Proof of health insurance coverage

Having these documents ready will streamline the process and help ensure that your tax application is complete and accurate.

Form submission methods

There are several methods available for submitting your tax application form. You can choose to file your application online through the IRS e-file system, which is the fastest and most efficient method. Alternatively, you may opt to mail a paper version of the form to the appropriate tax authority. In some cases, in-person submission may be available at local tax offices. Each method has its own advantages, so consider your preferences and circumstances when deciding how to submit your tax application.

Filing deadlines / important dates

It is crucial to be aware of the filing deadlines for your tax application to avoid penalties. Typically, individual tax returns are due on April fifteenth each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Businesses may have different deadlines based on their entity type. Marking these important dates on your calendar can help ensure timely submission of your tax application.

IRS guidelines

The IRS provides comprehensive guidelines for completing and submitting the tax application form. These guidelines include instructions on eligibility, required documentation, and specific deductions or credits that may apply. Familiarizing yourself with these guidelines is essential for ensuring that your application is accurate and meets all necessary requirements. You can find detailed information in the instructions accompanying the tax application form or on the IRS website.

Quick guide on how to complete tax application

Complete Tax Application effortlessly on any device

Online document administration has gained popularity among businesses and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Tax Application across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Tax Application without hassle

- Obtain Tax Application and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Annotate important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and eSign Tax Application while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax application form?

A tax application form is a document used by individuals and businesses to report income and calculate tax obligations. It is essential for filing taxes accurately and can often include various financial details. Utilizing airSlate SignNow can help streamline the processing of your tax application form.

-

How can airSlate SignNow help with my tax application form?

airSlate SignNow allows you to easily send and eSign your tax application form, ensuring that all necessary signatures are obtained quickly. The platform provides templates and customization options to suit your needs, making completing your tax paperwork much simpler. Digital storage of completed forms also helps keep your documents organized.

-

Is there a cost associated with using airSlate SignNow for tax application forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for businesses with frequent use of tax application forms. These plans are competitive and often more cost-effective than traditional printing and mailing methods. Detailed pricing information can be found on our website.

-

What features does airSlate SignNow offer for managing tax application forms?

airSlate SignNow provides several features that enhance the management of your tax application form, including eSignature capabilities, document tracking, and secure storage. The platform's user-friendly interface makes it easy to navigate, and you can customize workflows for approval processes to expedite tax submissions.

-

Can airSlate SignNow integrate with accounting software for tax application forms?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, enabling you to manage your tax application forms more effectively. This integration allows for synchronized data entry and helps eliminate manual errors, making the tax filing process smoother and more efficient.

-

How secure is airSlate SignNow when handling tax application forms?

Security is a top priority at airSlate SignNow. The platform employs industry-leading encryption and compliance measures to protect your sensitive tax application forms. You can confidently use airSlate SignNow knowing that your data is safe during transmission and storage.

-

What benefits can I expect from using airSlate SignNow for distributing tax application forms?

Using airSlate SignNow to distribute your tax application forms offers several advantages, including speed, efficiency, and reduced paperwork. You'll benefit from timely signatures, instant delivery, and automated reminders, ensuring that your forms are completed and submitted on time, thereby avoiding possible penalties.

Get more for Tax Application

- Moduli disdetta vodafone form

- Temporary protective order maryland state court system courts state md form

- Care for older adult coa assessment form

- Cda lesson plan example form

- City and guilds level 2 hairdressing textbook online form

- Vaccine order form 71598180

- Grec background clearance application 525486317 form

- Social work licensing board rosterarkansas department form

Find out other Tax Application

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy