Ptax 203b Form

What is the Ptax 203b

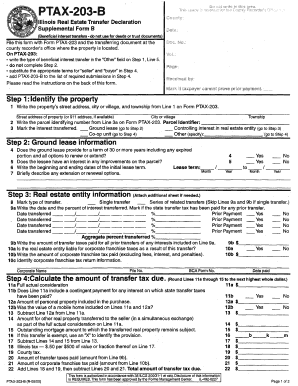

The Ptax 203b form is a tax-related document used in the United States to report property tax information. It is primarily utilized by property owners to provide details about their property assessments and any exemptions they may qualify for. This form plays a crucial role in ensuring accurate property tax calculations and compliance with state regulations.

How to use the Ptax 203b

Using the Ptax 203b form involves several steps to ensure accurate completion. First, gather all necessary information regarding your property, including its assessed value and any applicable exemptions. Next, fill out the form with the required details, ensuring that all information is accurate and up to date. Once completed, submit the form to the appropriate local tax authority by the specified deadline.

Steps to complete the Ptax 203b

Completing the Ptax 203b form involves a systematic approach:

- Gather information: Collect all relevant property details, including ownership information and assessment values.

- Fill out the form: Carefully enter the required information, ensuring accuracy in all fields.

- Review: Double-check the completed form for any errors or omissions.

- Submit: Send the form to your local tax authority, either electronically or via mail, ensuring it is submitted by the deadline.

Legal use of the Ptax 203b

The Ptax 203b form is legally recognized as a valid document for property tax reporting. To ensure its legal standing, it must be completed accurately and submitted to the appropriate authorities within the designated time frame. Compliance with local laws and regulations is essential for the form to be considered valid in any legal context.

Filing Deadlines / Important Dates

Filing deadlines for the Ptax 203b form can vary by state and local jurisdiction. It is crucial to be aware of these deadlines to avoid penalties. Generally, property owners should check with their local tax authority for specific dates related to submission and any applicable exemptions. Staying informed about these deadlines helps ensure compliance and avoids potential issues with property tax assessments.

Required Documents

When completing the Ptax 203b form, certain documents may be required to support the information provided. Commonly needed documents include:

- Proof of property ownership, such as a deed or title.

- Previous property tax statements for reference.

- Documentation supporting any exemptions claimed, such as income statements or disability documentation.

Who Issues the Form

The Ptax 203b form is typically issued by local tax authorities or county assessors. These offices are responsible for managing property assessments and ensuring compliance with state tax laws. Property owners should contact their local tax authority for specific information regarding the issuance and submission of the Ptax 203b form.

Quick guide on how to complete ptax 203b

Complete Ptax 203b seamlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage Ptax 203b on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and eSign Ptax 203b effortlessly

- Obtain Ptax 203b and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from the device of your choosing. Modify and eSign Ptax 203b to ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 203b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ptax 203b and how does it work?

The ptax 203b is a form used for reporting residential real estate transactions in certain jurisdictions. With airSlate SignNow, you can easily complete and eSign the ptax 203b form online, ensuring a smooth and efficient document workflow. Utilizing our platform reduces paperwork and speeds up the submission process.

-

What are the key features of airSlate SignNow for ptax 203b?

airSlate SignNow offers a variety of features for managing the ptax 203b form, including eSignature capabilities, document templates, and secure cloud storage. These features provide an efficient way to fill out and manage your ptax 203b forms without the hassle of traditional paperwork. Our user-friendly interface makes navigation simple for all users.

-

Is airSlate SignNow cost-effective for handling ptax 203b forms?

Yes, airSlate SignNow is a cost-effective solution for managing the ptax 203b forms, offering competitive pricing plans to fit various business budgets. By reducing the need for physical document handling and enabling remote signing, businesses can save both time and money. Check our pricing page for more details on subscription plans.

-

How secure is airSlate SignNow for ptax 203b document management?

AirSlate SignNow prioritizes security for all document management needs, including the ptax 203b forms. We employ advanced encryption and secure cloud storage, ensuring that your sensitive information remains protected. Users can confidently eSign their ptax 203b forms knowing that data security is our top priority.

-

Can airSlate SignNow integrate with other tools for ptax 203b processing?

Yes, airSlate SignNow offers seamless integration with various productivity tools and software that can enhance the processing of ptax 203b forms. It connects with popular platforms like Google Drive, Microsoft Office, and various CRM systems, making it easier to manage your documents within your existing workflow. This integration capability streamlines the overall process.

-

How can I get started with airSlate SignNow for ptax 203b?

Getting started with airSlate SignNow for your ptax 203b forms is easy. Simply sign up for an account, and you can begin creating, editing, and eSigning your documents in minutes. Our onboarding resources will guide you through the platform's features to help you leverage its full potential.

-

What support options are available for users of airSlate SignNow working with ptax 203b?

AirSlate SignNow offers various support options for users managing ptax 203b forms. Our customer support team is available via chat, email, and phone to assist with any questions or issues. Additionally, we provide extensive online resources and tutorials to help you navigate the platform effectively.

Get more for Ptax 203b

- Barmer bonusprogramm pdf form

- Omb no 1110 0026 form

- Sdr2 stamp duty return for conveyance or transfer of any stocks ireland form

- Ncb dispute form

- Fillable injury report form

- Fillable online immunization worksheet for pre kday care for form

- Hhc 2844 restoration form 1 4 16

- Medicaid offers electronic funds transfer for provider form

Find out other Ptax 203b

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now