Zs Qu2 Form

What is the Zs Qu2

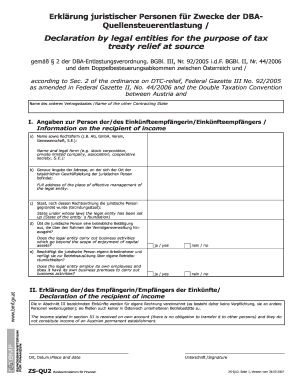

The Zs Qu2 is a specific form used primarily for documenting certain transactions or agreements within a business context. It serves as a formal record and is essential for ensuring compliance with various legal and regulatory requirements. Understanding the purpose and structure of the Zs Qu2 can help individuals and businesses navigate their obligations effectively.

How to use the Zs Qu2

Using the Zs Qu2 involves several steps to ensure that the form is filled out correctly and submitted in accordance with applicable guidelines. First, gather all necessary information and documentation required to complete the form. Next, accurately fill in each section, ensuring that all details are clear and precise. Once completed, the form can be submitted electronically or via traditional mail, depending on the requirements of the issuing authority.

Steps to complete the Zs Qu2

Completing the Zs Qu2 requires careful attention to detail. Follow these steps:

- Review the form to understand its structure and required fields.

- Collect all relevant information, including personal or business details needed for completion.

- Fill out the form, ensuring accuracy in every entry.

- Double-check the completed form for any errors or omissions.

- Submit the form through the appropriate channel, whether online or by mail.

Legal use of the Zs Qu2

The legal validity of the Zs Qu2 hinges on its proper completion and submission. To ensure compliance, it is essential to adhere to the relevant laws and regulations governing its use. This includes understanding the specific requirements for signatures, which may vary depending on the context in which the form is used. Utilizing a reliable electronic signature solution can enhance the legal standing of the form.

Key elements of the Zs Qu2

Several key elements are essential for the Zs Qu2 to be considered complete and valid. These include:

- Accurate identification of the parties involved.

- Clear description of the transaction or agreement.

- Signature fields for all required parties.

- Date of completion to establish a timeline.

- Any additional documentation or attachments that support the form.

Form Submission Methods

The Zs Qu2 can be submitted through various methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online submission via a secure portal.

- Mailing a physical copy to the designated address.

- In-person submission at the relevant office or agency.

Quick guide on how to complete zs qu2

Complete Zs Qu2 with ease on any device

Online document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents promptly without delays. Manage Zs Qu2 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to adjust and electronically sign Zs Qu2 effortlessly

- Find Zs Qu2 and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature utilizing the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your updates.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, the hassle of searching for forms, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Revise and electronically sign Zs Qu2 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the zs qu2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is zs qu2 and how does it relate to airSlate SignNow?

zs qu2 refers to our innovative features that enhance the eSigning experience with airSlate SignNow. This functionality allows users to streamline document workflows and ensure secure, legally-binding signatures. By incorporating zs qu2, businesses can boost their efficiency and productivity.

-

How much does airSlate SignNow cost with zs qu2 features?

The pricing for airSlate SignNow with zs qu2 features starts at a competitive rate that scales with your usage. We offer various plans to fit different business needs, ensuring that even small companies can leverage the power of zs qu2 without breaking the bank. Request a demo today to explore pricing options tailored to your organization.

-

What are the main features of airSlate SignNow's zs qu2?

airSlate SignNow's zs qu2 includes advanced document management, customizable workflows, and secure eSigning capabilities. These features enable users to create a seamless experience for both senders and signers, signNowly reducing turnaround times for essential documents. Experience the simplicity and power of zs qu2 today.

-

What are the benefits of using airSlate SignNow's zs qu2 for my business?

Using airSlate SignNow with zs qu2 offers numerous benefits, including enhanced efficiency, reduced paper usage, and improved collaboration among teams. This solution helps businesses save time and costs associated with traditional document management. Embrace the advantages of zs qu2 to transform your document workflows.

-

Can I integrate airSlate SignNow's zs qu2 with other software I use?

Absolutely! airSlate SignNow's zs qu2 is designed to integrate seamlessly with a variety of popular software applications. Whether you use CRM systems, project management tools, or cloud storage services, our platform ensures smooth connectivity to streamline your workflows.

-

Is the eSigning process secure with airSlate SignNow's zs qu2?

Yes, the eSigning process with airSlate SignNow's zs qu2 is highly secure. We utilize industry-standard encryption and authentication methods to safeguard your documents and signatures. Trust in zs qu2 for a safe and compliant eSigning experience that meets regulatory requirements.

-

How can I get started with airSlate SignNow's zs qu2?

Getting started with airSlate SignNow's zs qu2 is simple. Sign up for an account on our website, choose the plan that suits your needs, and explore our easy-to-use interface. Our support team is available to guide you through every step as you implement zs qu2 into your business operations.

Get more for Zs Qu2

- Deceased money bank savings printout form

- Agos 91 form

- Application for documentary collection negotiation maybank form

- Student discipline status bformb orange county schools

- Mo 1120s s corporation income tax return form

- Wage execution proceedings application order execution 781237284 form

- Employee loan agreement template form

- Hr service contract template form

Find out other Zs Qu2

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later