Itf Form 7a

What is the Itf Form 7a

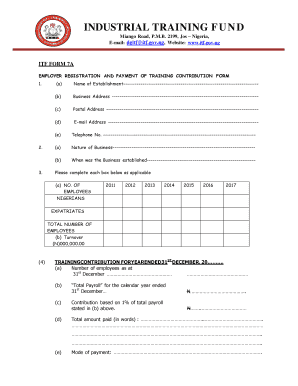

The Itf Form 7a is a specific document used in various legal and administrative processes within the United States. This form is primarily associated with international trade and finance, facilitating the reporting of certain transactions. It serves as an essential tool for compliance with federal regulations, ensuring that businesses and individuals adhere to the necessary legal frameworks. Understanding the purpose and requirements of the Itf Form 7a is crucial for anyone involved in international commerce or financial dealings.

How to use the Itf Form 7a

Using the Itf Form 7a involves several key steps to ensure accurate completion and submission. First, identify the specific purpose for which the form is required, as this will guide the information you need to provide. Gather all necessary documentation and details related to the transaction or activity being reported. Next, carefully fill out the form, ensuring that all fields are completed accurately. Once completed, review the form for any errors before submitting it to the appropriate agency or institution. Following these steps helps maintain compliance and facilitates smooth processing.

Steps to complete the Itf Form 7a

Completing the Itf Form 7a involves a systematic approach to ensure all necessary information is accurately provided. Begin by gathering relevant information, including personal details, transaction specifics, and any supporting documentation. Next, follow these steps:

- Read the instructions accompanying the form to understand the requirements.

- Fill in your personal information, ensuring accuracy in names, addresses, and contact details.

- Provide details about the transaction, including amounts, dates, and parties involved.

- Attach any required supporting documents that validate the information provided.

- Review the completed form for accuracy and completeness.

- Sign and date the form where indicated.

By following these steps, you can ensure that the Itf Form 7a is completed correctly, minimizing the risk of delays or compliance issues.

Legal use of the Itf Form 7a

The Itf Form 7a holds legal significance in the context of international trade and finance. Its proper use ensures compliance with federal regulations, which can help avoid penalties and legal complications. When filled out accurately and submitted on time, the form serves as a formal declaration of the transactions it reports. This legal standing is crucial for businesses and individuals engaged in international dealings, as it provides a record that can be referenced in case of audits or disputes.

Key elements of the Itf Form 7a

Understanding the key elements of the Itf Form 7a is essential for accurate completion. The form typically includes sections for:

- Personal identification information, such as name and address.

- Details of the transaction, including amounts and dates.

- Signatures of the parties involved, confirming the accuracy of the information.

- Any additional documentation required to support the reported transaction.

Each of these elements plays a vital role in ensuring that the form meets legal requirements and accurately reflects the transaction being reported.

Form Submission Methods

The Itf Form 7a can be submitted through various methods, depending on the requirements of the agency or institution requesting it. Common submission methods include:

- Online submission through designated portals, which may offer faster processing times.

- Mailing a physical copy of the completed form to the appropriate address.

- In-person submission at designated offices or agencies.

Choosing the right submission method is important for ensuring timely processing and compliance with any deadlines associated with the form.

Quick guide on how to complete itf form 7a

Effortlessly Prepare Itf Form 7a on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Itf Form 7a on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

The easiest method to modify and electronically sign Itf Form 7a effortlessly

- Locate Itf Form 7a and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, either via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, laborious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign Itf Form 7a to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the itf form 7a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the itf form 7a and how can airSlate SignNow help with it?

The itf form 7a is a specific document required for certain legal and administrative purposes. airSlate SignNow allows users to easily eSign and send the itf form 7a, streamlining the process and ensuring compliance. With our intuitive platform, you can manage your documents efficiently and securely.

-

What features does airSlate SignNow offer for managing the itf form 7a?

airSlate SignNow provides a range of features ideal for the itf form 7a such as customizable templates, automated workflows, and real-time tracking. These features enhance productivity and reduce the time spent managing your documents. With eSigning capabilities, your itf form 7a can be signed and processed quickly.

-

Is airSlate SignNow cost-effective for handling the itf form 7a?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing documents like the itf form 7a. Our competitive pricing plans cater to varying needs and budgets, allowing businesses of all sizes to utilize our services. This ensures that you can eSign the itf form 7a without overspending.

-

Can I integrate airSlate SignNow with other applications for the itf form 7a?

Absolutely! airSlate SignNow offers seamless integrations with popular applications and tools, making it easy to manage the itf form 7a. Whether you use CRM systems, cloud storage, or other document management software, our integrations facilitate a smoother workflow and enhance overall efficiency.

-

What are the benefits of using airSlate SignNow for the itf form 7a?

Using airSlate SignNow for the itf form 7a offers several benefits such as enhanced security, speed, and convenience. Our platform ensures that your documents are protected with advanced encryption and compliance standards. Additionally, you can expedite the signing process, helping you to meet your deadlines.

-

Is electronic signing of the itf form 7a legally binding?

Yes, the electronic signing of the itf form 7a through airSlate SignNow is legally binding under the Electronic Signatures in Global and National Commerce (ESIGN) Act. This means you can confidently use our platform for eSigning your documents, knowing they hold the same validity as traditional signatures.

-

How can I get started with airSlate SignNow for the itf form 7a?

Getting started with airSlate SignNow for the itf form 7a is simple! Sign up for an account on our website and choose the plan that suits your needs. Once registered, you can start uploading, sending, and eSigning your itf form 7a documents within minutes.

Get more for Itf Form 7a

- Atestado da autoridade fiscal brasileira form

- Agent39s escrow checklist ticor title form

- Praktikumsbescheinigung englisch vorlage form

- Somaliland visa application form

- 18882994181 form

- Levy refund request form saskatchewan cattlemens association

- Crm no building act building regulations 201 form

- Restaurant purchase agreement template form

Find out other Itf Form 7a

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free