H 3 Gov Form

What is the H 3 Gov Form

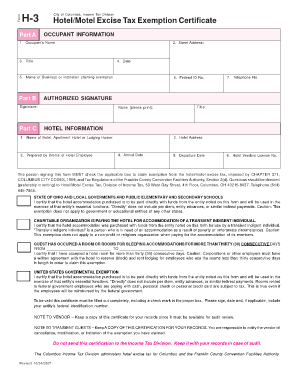

The H 3 Gov form is a specific document utilized within Columbus, Ohio, primarily for government-related processes. This form may be necessary for various applications, including permits, licenses, or regulatory compliance. Understanding the purpose of the H 3 Gov form is essential for individuals and businesses navigating local government requirements.

How to Obtain the H 3 Gov Form

To obtain the blank H 3 Gov form, individuals can visit the official website of the Columbus city government or the relevant department that oversees the specific application process. The form is often available for download in PDF format, allowing users to print and fill it out. In some cases, the form may also be accessible at local government offices, where staff can provide assistance in obtaining the necessary documentation.

Steps to Complete the H 3 Gov Form

Completing the H 3 Gov form involves several key steps:

- Begin by reading the instructions carefully to understand the requirements.

- Gather all necessary information and documentation that may be required for the form.

- Fill out the form accurately, ensuring all fields are completed as specified.

- Review the form for any errors or omissions before finalizing it.

- Sign and date the form where indicated, confirming the accuracy of the information provided.

Legal Use of the H 3 Gov Form

The H 3 Gov form is legally binding once completed and submitted according to local regulations. It is crucial to ensure that all information is truthful and accurate, as providing false information can lead to penalties or legal repercussions. Compliance with local laws and regulations surrounding the use of this form helps maintain its validity and acceptance by government authorities.

Key Elements of the H 3 Gov Form

Key elements of the H 3 Gov form typically include:

- Personal or business identification information.

- Details relevant to the specific application or request.

- Signature of the applicant or authorized representative.

- Date of submission.

Each of these components plays a vital role in ensuring that the form is processed efficiently and accurately by the relevant authorities.

Form Submission Methods

The H 3 Gov form can usually be submitted through various methods, including:

- Online submission via the official city government portal.

- Mailing the completed form to the designated government office.

- In-person submission at local government offices, where staff can provide immediate assistance.

Choosing the appropriate submission method may depend on the urgency of the request and the specific requirements outlined by the city government.

Quick guide on how to complete h 3 gov form

Complete H 3 Gov Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage H 3 Gov Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign H 3 Gov Form with ease

- Obtain H 3 Gov Form and then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign H 3 Gov Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the h 3 gov form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'blank h 3 gov columbus oh form' and how can it be used?

The 'blank h 3 gov columbus oh form' is an essential document used for various official purposes in Columbus, Ohio. With airSlate SignNow, you can easily fill out, send, and eSign this form digitally, streamlining your submission process and ensuring compliance with local regulations.

-

Is airSlate SignNow compatible with the 'blank h 3 gov columbus oh form'?

Yes, airSlate SignNow is fully compatible with the 'blank h 3 gov columbus oh form'. Our platform allows users to access, edit, and electronically sign this form, making it simple to manage your documents from start to finish without any hassles.

-

What features does airSlate SignNow offer for the 'blank h 3 gov columbus oh form'?

Our platform provides various features for the 'blank h 3 gov columbus oh form', including document templates, eSignature capabilities, team collaboration tools, and cloud storage. These features enhance your workflow, allowing for a more efficient and streamlined document management experience.

-

How does airSlate SignNow ensure the security of the 'blank h 3 gov columbus oh form'?

airSlate SignNow prioritizes the security of your documents, including the 'blank h 3 gov columbus oh form'. We use advanced encryption protocols, two-factor authentication, and compliance with industry standards to protect your sensitive information throughout the signing process.

-

What are the pricing options for using airSlate SignNow with the 'blank h 3 gov columbus oh form'?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for managing the 'blank h 3 gov columbus oh form'. Our pricing is competitive and designed to provide value, ensuring that you have access to all necessary features without breaking the bank.

-

Can I integrate airSlate SignNow with other applications to manage the 'blank h 3 gov columbus oh form'?

Absolutely! airSlate SignNow supports integration with various applications like Google Drive, Salesforce, and Microsoft Office. These integrations allow you to simplify your workflow when managing the 'blank h 3 gov columbus oh form' and other important documents.

-

What are the benefits of using airSlate SignNow for the 'blank h 3 gov columbus oh form'?

Using airSlate SignNow for the 'blank h 3 gov columbus oh form' offers numerous benefits, such as time savings, enhanced workflow efficiency, and reduced paper usage. By utilizing our eSigning solutions, you can complete your document processes faster and more environmentally friendly.

Get more for H 3 Gov Form

- Gcb foreign exchange transaction form

- Unitedhealthcare claim submission withdrawal request form

- Lesson 4 skills practice solve equations with variables on each side form

- It4 form

- Commissary order form

- Mv1 form

- Dichiarazione di corretto montaggio degli allestimenti en myhomi form

- Montana buy sell agreement template form

Find out other H 3 Gov Form

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast