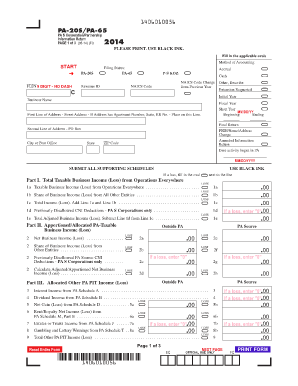

PA 20SPA 65 PA S CorporationPartnership Information Return

What is the PA 20SPA 65 PA S CorporationPartnership Information Return

The PA 20SPA 65 PA S CorporationPartnership Information Return is a tax form used by S corporations and partnerships in Pennsylvania to report income, deductions, and credits. This form is essential for ensuring compliance with state tax regulations. By filing this return, entities provide the Pennsylvania Department of Revenue with necessary financial information, which helps determine tax liabilities and eligibility for certain credits.

Steps to complete the PA 20SPA 65 PA S CorporationPartnership Information Return

Completing the PA 20SPA 65 PA S CorporationPartnership Information Return involves several key steps:

- Gather financial documents, including income statements, balance sheets, and previous tax returns.

- Fill out the form accurately, ensuring all income, deductions, and credits are reported.

- Review the completed form for accuracy and completeness.

- Sign the form, either electronically or by hand, depending on your submission method.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the PA 20SPA 65 PA S CorporationPartnership Information Return

The PA 20SPA 65 PA S CorporationPartnership Information Return is legally binding when completed and submitted according to state regulations. To ensure its validity, the form must be signed by an authorized representative of the corporation or partnership. Additionally, the form must comply with Pennsylvania tax laws and guidelines, which include accurate reporting of financial information and adherence to submission deadlines.

Filing Deadlines / Important Dates

Filing deadlines for the PA 20SPA 65 PA S CorporationPartnership Information Return are crucial for compliance. Typically, the form must be filed by the 15th day of the fourth month following the end of the tax year. For partnerships and S corporations operating on a calendar year, this means the deadline is April 15. It is essential to stay informed about any changes to these dates, as they can vary based on state regulations or specific circumstances.

Form Submission Methods (Online / Mail / In-Person)

The PA 20SPA 65 PA S CorporationPartnership Information Return can be submitted through various methods to accommodate different preferences:

- Online: Many businesses choose to file electronically through the Pennsylvania Department of Revenue's online portal, which offers a streamlined process.

- Mail: The form can be printed and mailed to the appropriate address provided by the state. Ensure that you use the correct postage and address to avoid delays.

- In-Person: Some entities may opt to deliver the form in person to a local Pennsylvania Department of Revenue office for immediate processing.

Required Documents

To complete the PA 20SPA 65 PA S CorporationPartnership Information Return, several documents are typically required. These may include:

- Income statements detailing revenue generated during the tax year.

- Balance sheets providing a snapshot of assets, liabilities, and equity.

- Previous tax returns for reference and consistency.

- Documentation for any deductions or credits claimed on the return.

Quick guide on how to complete pa 20spa 65 pa s corporationpartnership information return

Complete PA 20SPA 65 PA S CorporationPartnership Information Return easily on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and safely store it online. airSlate SignNow equips you with all the resources to create, modify, and electronically sign your documents swiftly without delays. Handle PA 20SPA 65 PA S CorporationPartnership Information Return on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign PA 20SPA 65 PA S CorporationPartnership Information Return effortlessly

- Find PA 20SPA 65 PA S CorporationPartnership Information Return and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important parts of your documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, painstaking form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in a few clicks from any device of your choice. Modify and eSign PA 20SPA 65 PA S CorporationPartnership Information Return and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa 20spa 65 pa s corporationpartnership information return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA 20SPA 65 PA S CorporationPartnership Information Return?

The PA 20SPA 65 PA S CorporationPartnership Information Return is a tax document that S corporations in Pennsylvania must file annually. It reports income, deductions, and credits, providing essential information to the Pennsylvania Department of Revenue. Understanding this return is crucial for compliance and avoiding potential penalties.

-

How can airSlate SignNow help with filing the PA 20SPA 65 PA S CorporationPartnership Information Return?

airSlate SignNow streamlines the document signing process, making it easier to prepare and file the PA 20SPA 65 PA S CorporationPartnership Information Return. Our solution allows you to gather necessary signatures quickly and securely, ensuring that your return is filed accurately and on time.

-

What are the pricing options available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to cater to various business needs, including a free trial for first-time users. Our pricing structure is designed to provide cost-effective solutions while ensuring you have all the tools necessary for submitting the PA 20SPA 65 PA S CorporationPartnership Information Return. Contact us to explore the best plan for your business.

-

What features does airSlate SignNow offer for document management?

Our platform includes features such as customizable templates, automated workflows, and real-time collaboration tools, which are invaluable for managing documents like the PA 20SPA 65 PA S CorporationPartnership Information Return. These features help improve efficiency and reduce errors during the filing process.

-

Can I integrate airSlate SignNow with other tools to assist with my tax filings?

Yes, airSlate SignNow easily integrates with a variety of business applications and accounting software to facilitate the process of filing the PA 20SPA 65 PA S CorporationPartnership Information Return. These integrations allow for seamless data transfer, enhancing accuracy and saving time for our users.

-

How secure is the signing process for the PA 20SPA 65 PA S CorporationPartnership Information Return?

The security of your documents is a top priority at airSlate SignNow. Our platform uses advanced encryption standards and complies with industry regulations to ensure that your PA 20SPA 65 PA S CorporationPartnership Information Return and other sensitive documents are protected throughout the signing process.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow enables businesses to accelerate their document workflows, enhance compliance, and improve accessibility to important forms like the PA 20SPA 65 PA S CorporationPartnership Information Return. Our cost-effective solution is designed to simplify the document management process, freeing up time for your team to focus on growth.

Get more for PA 20SPA 65 PA S CorporationPartnership Information Return

- Escrow waiver form

- Annual report of guardian of a minor child cochise county cochise az form

- Fitness reimbursement form iu health iuhealth

- Paid work experience verification form human resources division hr mnscu

- Tiaib insurance form

- Inspection and investigation division form

- Carpool parking permits allows registered applicants to park within car parking spots marked carpool special permit required form

- Psio1 information form for ivo 430kb 7 pages

Find out other PA 20SPA 65 PA S CorporationPartnership Information Return

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online