Instructions for Completing PV ST Sales and Use Tax Payment Voucher Form

Understanding the Instructions for Completing PV ST Sales and Use Tax Payment Voucher

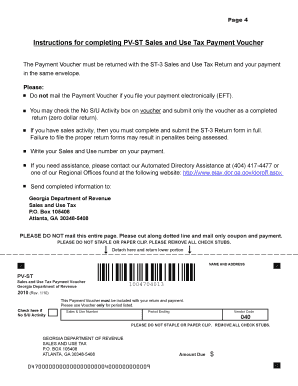

The Instructions for Completing PV ST Sales and Use Tax Payment Voucher provide essential guidance for individuals and businesses in the United States who need to report and remit sales and use tax. This form is crucial for ensuring compliance with state tax regulations. It outlines the necessary steps to accurately fill out the voucher, including required information and calculations. Understanding the purpose of this form helps taxpayers navigate their obligations effectively.

Steps to Complete the PV ST Sales and Use Tax Payment Voucher

Completing the PV ST Sales and Use Tax Payment Voucher involves several key steps:

- Gather necessary information, including your business details and tax identification number.

- Calculate the total sales and use tax owed based on your transactions.

- Fill in the voucher with accurate figures, ensuring all required fields are completed.

- Review the completed voucher for any errors or omissions.

- Sign and date the voucher, as required.

Each step is vital for ensuring the form is processed correctly by the relevant tax authorities.

Legal Use of the PV ST Sales and Use Tax Payment Voucher

The legal use of the PV ST Sales and Use Tax Payment Voucher is governed by state tax laws. This form serves as an official document for reporting sales and use tax liabilities. To be considered valid, the completed voucher must be submitted according to the guidelines provided by the state tax authority. It is essential to ensure that all information is accurate and that the form is submitted by the specified deadlines to avoid potential penalties.

Filing Deadlines and Important Dates

Filing deadlines for the PV ST Sales and Use Tax Payment Voucher vary by state and may be influenced by specific business activities. Generally, taxpayers should be aware of the following:

- Monthly, quarterly, or annual filing requirements based on sales volume.

- Specific due dates for submitting the voucher to avoid late fees.

- Any changes in deadlines due to state holidays or other considerations.

Staying informed about these dates is crucial for maintaining compliance and avoiding penalties.

Required Documents for Submission

When completing the PV ST Sales and Use Tax Payment Voucher, certain documents may be required to support your submission. These can include:

- Sales records and receipts that detail taxable transactions.

- Previous tax returns, if applicable, for reference.

- Any correspondence from the tax authority regarding your account.

Having these documents ready can streamline the completion process and ensure accuracy in reporting.

Examples of Using the PV ST Sales and Use Tax Payment Voucher

Examples of using the PV ST Sales and Use Tax Payment Voucher can help clarify its application. For instance:

- A retail business must report sales tax collected from customers on a monthly basis.

- An online seller needs to remit use tax on items purchased for resale that were not taxed at the time of purchase.

These scenarios illustrate the versatility of the voucher in different business contexts and highlight the importance of accurate reporting.

Quick guide on how to complete instructions for completing pv st sales and use tax payment voucher

Complete Instructions For Completing PV ST Sales And Use Tax Payment Voucher effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Instructions For Completing PV ST Sales And Use Tax Payment Voucher on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and electronically sign Instructions For Completing PV ST Sales And Use Tax Payment Voucher without effort

- Locate Instructions For Completing PV ST Sales And Use Tax Payment Voucher and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and electronically sign Instructions For Completing PV ST Sales And Use Tax Payment Voucher and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for completing pv st sales and use tax payment voucher

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key Instructions For Completing PV ST Sales And Use Tax Payment Voucher?

The key Instructions For Completing PV ST Sales And Use Tax Payment Voucher include detailed steps on filling out the voucher accurately, ensuring that all required information is provided. This includes your entity information, tax amounts, and the method of payment. By following these instructions, you can avoid errors and ensure timely processing of your tax payments.

-

How can airSlate SignNow assist with completing the PV ST Sales And Use Tax Payment Voucher?

airSlate SignNow simplifies the process of completing the PV ST Sales And Use Tax Payment Voucher by allowing users to eSign documents and send them securely without paperwork. Our platform provides templates and guidelines to follow the correct Instructions For Completing PV ST Sales And Use Tax Payment Voucher effortlessly, making your tax filing process quick and easy.

-

Are there costs associated with using airSlate SignNow for tax documents?

Yes, there are various pricing plans available for airSlate SignNow, which cater to different business needs. Our cost-effective solution offers flexibility depending on the volume of documents you need to process, including those related to Instructions For Completing PV ST Sales And Use Tax Payment Voucher. A detailed pricing chart is available on our website for transparency.

-

What features does airSlate SignNow offer for tax payment vouchers?

airSlate SignNow provides several features designed to support users in completing tax payment vouchers, including document templates, electronic signing, and tracking. With these features, businesses can easily comply with the Instructions For Completing PV ST Sales And Use Tax Payment Voucher while ensuring their documents are securely managed and always accessible.

-

Can I integrate airSlate SignNow with other software for tax purposes?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, helping streamline your workflow. This means you can manage tax documents directly from your preferred platforms while still following the Instructions For Completing PV ST Sales And Use Tax Payment Voucher. Our integration options enhance productivity and reduce manual data entry.

-

What benefits does airSlate SignNow provide over traditional paper methods for tax vouchers?

Using airSlate SignNow over traditional paper methods for tax vouchers offers numerous benefits, such as reduced processing time and increased accuracy. By following the Instructions For Completing PV ST Sales And Use Tax Payment Voucher digitally, users can minimize errors and expedite tax submissions, leading to better compliance and quicker payments.

-

Is it easy to access airSlate SignNow if I'm new to online tax management?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone new to online tax management to navigate. Our platform provides clear guidance on the Instructions For Completing PV ST Sales And Use Tax Payment Voucher and offers customer support for any questions that may arise as you familiarize yourself with the system.

Get more for Instructions For Completing PV ST Sales And Use Tax Payment Voucher

- Nj application for open burning permit njac 7 27 2 1 et seq form

- Rental application form design wordpress com

- Schadeverhaalformulier afrekenen met winkeldieven procesverbaaltransactienummer op te vragen bij de politie delictdatumtijdstip

- Ecats blank forms

- Field trip lunch form

- Printable pdf sounds of music djs form

- Fire preventionparsons fire department form

- Hamilton fairfield little league form

Find out other Instructions For Completing PV ST Sales And Use Tax Payment Voucher

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now