Michigan Form 4281

What is the Michigan Form 4281

The Michigan Form 4281 is a state-specific document used for reporting certain financial information to the Michigan Department of Treasury. This form is primarily utilized by individuals and businesses to disclose various financial activities, ensuring compliance with state tax regulations. Understanding the purpose and requirements of this form is essential for accurate reporting and avoiding potential penalties.

How to use the Michigan Form 4281

Using the Michigan Form 4281 involves accurately filling out the required sections to report financial information. Start by gathering all necessary data, such as income statements, expense records, and any other relevant financial documents. Carefully follow the instructions provided on the form to ensure all information is correctly entered. Once completed, the form can be submitted either electronically or via traditional mail, depending on the specific requirements outlined by the Michigan Department of Treasury.

Steps to complete the Michigan Form 4281

Completing the Michigan Form 4281 requires several key steps:

- Gather all necessary financial documentation, including income and expense records.

- Carefully read the instructions accompanying the form to understand the requirements.

- Fill out the form, ensuring all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form through the preferred method, either electronically or by mail.

Legal use of the Michigan Form 4281

The legal use of the Michigan Form 4281 is governed by state tax laws and regulations. To ensure that the form is valid, it must be completed accurately and submitted within the specified deadlines. Failing to comply with these regulations may result in penalties or other legal consequences. It is important to maintain records of the submitted form and any supporting documentation for future reference.

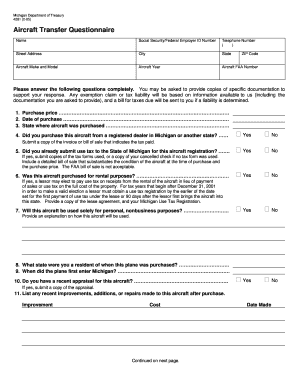

Key elements of the Michigan Form 4281

Key elements of the Michigan Form 4281 include:

- Identification information for the filer, including name and address.

- Detailed sections for reporting income and expenses.

- Signature line to certify the accuracy of the information provided.

- Instructions for submission and any additional documentation required.

Form Submission Methods

The Michigan Form 4281 can be submitted through various methods, including:

- Online submission via the Michigan Department of Treasury's official website.

- Mailing the completed form to the appropriate address as specified in the instructions.

- In-person submission at designated state offices, if applicable.

Quick guide on how to complete michigan form 4281

Effortlessly Prepare Michigan Form 4281 on Any Device

Managing documents online has become increasingly favored by both companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to access the right form and securely store it in the cloud. airSlate SignNow provides all the tools necessary to swiftly create, modify, and eSign your documents without any delays. Manage Michigan Form 4281 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to Modify and eSign Michigan Form 4281 with Ease

- Find Michigan Form 4281 and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you'd like to send your form—via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Michigan Form 4281 to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan form 4281

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Michigan form 4281?

Michigan form 4281 is a state-specific document used for certain tax-related procedures. It is important for Michigan residents and businesses to understand and utilize this form correctly. Using airSlate SignNow makes it easy to create, send, and eSign Michigan form 4281 efficiently.

-

How can airSlate SignNow help with Michigan form 4281?

airSlate SignNow streamlines the process of completing Michigan form 4281 by allowing users to easily fill out, share, and eSign documents online. This simplifies compliance with state requirements and ensures that your forms are accurately submitted. Plus, our platform provides an intuitive interface, making it user-friendly.

-

Is there a cost associated with using airSlate SignNow for Michigan form 4281?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, starting from affordable basic plans to comprehensive packages. The cost-effective solution ensures that you receive all the necessary tools to handle Michigan form 4281 and other documents efficiently. Prices depend on the features that best fit your requirements.

-

Can I integrate airSlate SignNow with other software for Michigan form 4281?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow when dealing with Michigan form 4281. This includes CRMs, cloud storage solutions, and productivity tools, allowing you to manage your documents more effectively.

-

What are the benefits of using airSlate SignNow for managing Michigan form 4281?

Using airSlate SignNow for Michigan form 4281 offers multiple benefits, including increased efficiency, reduced paper waste, and secure digital storage of your documents. eSigning not only accelerates the process but also ensures compliance with legal standards, making it a smart choice for businesses.

-

Is it safe to use airSlate SignNow for Michigan form 4281?

Yes, airSlate SignNow prioritizes your security by employing advanced encryption and security measures. This means your Michigan form 4281 and other documents are stored and transmitted securely, protecting sensitive information from unauthorized access.

-

How do I get started with airSlate SignNow for Michigan form 4281?

Getting started with airSlate SignNow for Michigan form 4281 is simple. You can sign up for an account on our website, explore our features, and begin creating and eSigning your documents. Our user-friendly interface and customer support make the transition smooth for all users.

Get more for Michigan Form 4281

- Boxing federal id application boxing federal id application form

- Transportation permission slip christ the king regional ctkny form

- Online check in ryanair form

- Credentialing alliance aza hp practitioner data fo form

- Attorney grievance procedures in connecticut form

- Sizeclassification self certification form

- 580 3286 8 application for good cause waiver form

- Illinois state library budget amendment request form

Find out other Michigan Form 4281

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF