Revenue Alabama Gov Form

What is the Revenue Alabama Gov

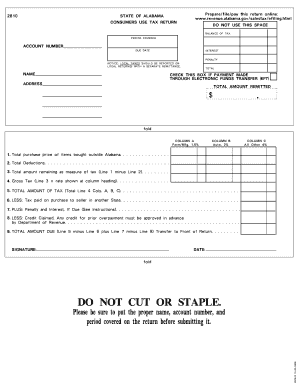

The Revenue Alabama Gov refers to the official state agency responsible for tax administration in Alabama. This agency oversees the collection of various taxes, including sales and use taxes, income taxes, and property taxes. It ensures compliance with state tax laws and provides resources for taxpayers to understand their obligations. The agency also manages the Alabama consumer use tax return form 2610, which is essential for individuals and businesses to report and pay use tax on purchases made outside of Alabama that are used within the state.

Steps to complete the Revenue Alabama Gov

Completing the Alabama consumer use tax return form 2610 involves several steps to ensure accurate reporting and compliance. First, gather all necessary documentation related to your purchases, including receipts and invoices. Next, calculate the total amount of use tax owed based on the items purchased. Fill out the form by entering your personal or business information, along with the details of your purchases. Review the form for accuracy before submission. Finally, submit the completed form either online, by mail, or in person, depending on your preference and the options available through the Revenue Alabama Gov.

Form Submission Methods (Online / Mail / In-Person)

The Alabama consumer use tax return form 2610 can be submitted through various methods to accommodate different preferences. Online submission is often the most efficient option, allowing for immediate processing. To submit online, access the Revenue Alabama Gov website and follow the instructions for electronic filing. Alternatively, you can print the completed form and mail it to the designated address provided on the form. In-person submission may also be available at local revenue offices, where you can receive assistance if needed. Each method has its own advantages, so choose the one that best suits your needs.

Legal use of the Revenue Alabama Gov

The legal use of the Alabama consumer use tax return form 2610 is governed by state tax laws. To ensure the form is legally valid, it must be completed accurately and submitted within the designated time frame. The use of electronic signatures is permissible under state law, provided that the eSignature complies with the requirements set forth by the ESIGN Act and UETA. This means that using a reputable digital signing platform can enhance the legitimacy of your submission. Understanding these legal frameworks is crucial for taxpayers to avoid penalties and ensure compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Alabama consumer use tax return form 2610 are crucial for compliance. Typically, the form is due on the 20th day of the month following the end of each reporting period. For example, if you made purchases in January, the form would be due by February 20. It is important to stay informed about any changes to these deadlines, as the state may adjust them due to specific circumstances or legislation. Marking these dates on your calendar can help ensure timely submission and avoid potential penalties.

Key elements of the Revenue Alabama Gov

Key elements of the Alabama consumer use tax return form 2610 include the identification of the taxpayer, a detailed listing of taxable purchases, and the calculation of the total use tax owed. The form requires you to provide your name, address, and taxpayer identification number. Additionally, you must itemize the purchases made outside of Alabama, including the date of purchase and the amount spent. Finally, the form includes a section for calculating the total use tax based on the applicable rate. Ensuring that all of these elements are accurately completed is essential for compliance.

Quick guide on how to complete revenue alabama gov

Complete Revenue Alabama Gov effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal sustainable substitute for conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without setbacks. Manage Revenue Alabama Gov on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

The easiest way to alter and electronically sign Revenue Alabama Gov with ease

- Locate Revenue Alabama Gov and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal standing as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you wish to send your form: via email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign Revenue Alabama Gov and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the revenue alabama gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alabama consumer use tax return form 2610?

The Alabama consumer use tax return form 2610 is a tax form used by residents in Alabama to report and pay consumer use taxes on purchases made when sales tax was not collected. It ensures compliance with state tax regulations and helps taxpayers properly account for their purchases. Utilizing this form can simplify your tax reporting process and maintain your good standing with the Alabama Department of Revenue.

-

How do I obtain the Alabama consumer use tax return form 2610?

You can obtain the Alabama consumer use tax return form 2610 from the official Alabama Department of Revenue website or directly through authorized tax preparation software. Many online resources also provide the form in a printable format. Additionally, airSlate SignNow can help streamline the eSigning process for this form, making it easier to submit.

-

What features does airSlate SignNow offer for handling the Alabama consumer use tax return form 2610?

airSlate SignNow offers a range of features for managing the Alabama consumer use tax return form 2610, including document templates, eSignature capabilities, and secure cloud storage. Users can easily edit and fill out the form, track changes, and ensure that all necessary signatures are collected effortlessly. This saves time and enhances the accuracy of your tax filing process.

-

Is there a cost associated with using airSlate SignNow for the Alabama consumer use tax return form 2610?

Yes, there is a cost associated with using airSlate SignNow, but it is a cost-effective solution compared to traditional methods. Our pricing plans offer various options based on your needs, allowing you to choose the best fit for your business. Investing in our service can lead to signNow time savings and improved efficiency when handling the Alabama consumer use tax return form 2610.

-

What are the benefits of eSigning the Alabama consumer use tax return form 2610 with airSlate SignNow?

ESigning the Alabama consumer use tax return form 2610 with airSlate SignNow offers several benefits, including enhanced security, faster turnaround times, and greater convenience. You can sign documents from anywhere, on any device, which means you won't have to print, scan, or mail your forms. This digital approach also minimizes the risk of errors, ensuring your tax documents are accurate and submitted on time.

-

Can I integrate airSlate SignNow with other tools for preparing the Alabama consumer use tax return form 2610?

Yes, airSlate SignNow can be integrated with various applications and software used for tax preparation. This seamless integration allows for automatic data transfer, making the process of completing the Alabama consumer use tax return form 2610 even more efficient. By linking your existing tools with airSlate SignNow, you can streamline your workflow and enhance productivity.

-

How secure is the submission of the Alabama consumer use tax return form 2610 through airSlate SignNow?

The submission of the Alabama consumer use tax return form 2610 through airSlate SignNow is highly secure. Our platform utilizes advanced encryption and security protocols to ensure sensitive information remains protected throughout the process. You can confidently eSign and submit tax forms knowing that your data security is our priority.

Get more for Revenue Alabama Gov

- I 864w form

- Savingscurrent account closure form axis bank

- Penn plax eorder form

- Guidelines for determining hospice eligibility st francis stfrancishawaii form

- Corp code request letter sample form

- Sovereign citizen training for law enforcement form

- An automated method for dispensing form

- Payment installment agreement template form

Find out other Revenue Alabama Gov

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors