Tink's Rebate Form

What is the Tink's Rebate?

The Tink's Rebate is a promotional offer designed to provide consumers with a financial incentive for purchasing specific Tink's products. This rebate program allows customers to submit proof of purchase and receive a portion of their spending back as a rebate. It is commonly used in the hunting and outdoor equipment industry, encouraging users to try or continue using Tink's products.

How to obtain the Tink's Rebate

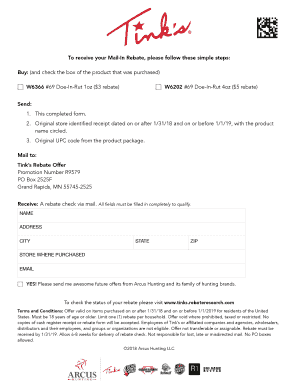

To obtain the Tink's Rebate, customers must first purchase eligible Tink's products from authorized retailers. After making a purchase, customers should keep their receipts as proof of purchase. The next step involves filling out the rebate form, which can typically be found on the Tink's website or included with the product packaging. Completing the form accurately is essential for successful processing.

Steps to complete the Tink's Rebate

Completing the Tink's Rebate involves several straightforward steps:

- Purchase eligible Tink's products from a participating retailer.

- Keep the original receipt as proof of purchase.

- Obtain the rebate form from the Tink's website or product packaging.

- Fill out the form with accurate information, including your contact details and purchase information.

- Attach the original receipt and any required documentation.

- Submit the completed form via the specified method, which may include online submission or mailing it to the designated address.

Key elements of the Tink's Rebate

Several key elements are crucial for successfully claiming the Tink's Rebate:

- Eligibility: Ensure that the purchased products are eligible for the rebate.

- Documentation: Provide the original receipt and any other required documents.

- Submission Method: Follow the specified submission method to ensure the rebate is processed correctly.

- Deadline: Be aware of the submission deadline to avoid missing out on the rebate.

Legal use of the Tink's Rebate

The Tink's Rebate must be used in accordance with the terms and conditions outlined by Tink's. This includes submitting the rebate form within the specified time frame and ensuring that all provided information is accurate. Misrepresentation or submission of fraudulent claims can lead to disqualification from the rebate program and potential legal consequences.

Form Submission Methods

Customers can typically submit the Tink's Rebate form through various methods, including:

- Online Submission: Many rebate programs offer an online portal where customers can upload their completed forms and receipts.

- Mail Submission: Alternatively, customers can print the completed form and mail it to the address provided on the form.

- In-Person Submission: Some retailers may allow customers to submit their rebate forms directly at the point of purchase, although this is less common.

Quick guide on how to complete tinks rebate

Effortlessly Prepare Tink's Rebate on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your documents without delays. Manage Tink's Rebate on any device with the airSlate SignNow Android or iOS applications and streamline any document-based procedure today.

The Easiest Way to Edit and eSign Tink's Rebate with Ease

- Obtain Tink's Rebate and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Tink's Rebate and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tinks rebate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are arcus hunting rebates?

Arcus hunting rebates are special offers and discounts provided by certain hunting equipment manufacturers and retailers. These rebates are designed to incentivize hunters to purchase specific products, making it more affordable to enjoy your sport. By taking advantage of arcus hunting rebates, you can save money on your hunting gear while still enjoying high-quality equipment.

-

How can I apply for arcus hunting rebates?

To apply for arcus hunting rebates, you typically need to purchase eligible products during the promotional period. After your purchase, you'll fill out a rebate form with your details and proof of purchase, which can usually be submitted online or via mail. Make sure to keep an eye on the terms and conditions associated with the specific arcus hunting rebates you are interested in.

-

What types of products are eligible for arcus hunting rebates?

Eligible products for arcus hunting rebates can include hunting gear such as rifles, scopes, clothing, and accessories from participating brands. The specific items may vary by retailer and promotional period, so always check the details outlined in the rebate offer. Keeping up with current offers will help you take full advantage of the available arcus hunting rebates.

-

Are arcus hunting rebates worth it?

Yes, arcus hunting rebates can be very worthwhile, as they provide signNow savings on your purchase of hunting equipment. Not only do they make your gear more affordable, but they also encourage you to try new products that could enhance your hunting experience. By using arcus hunting rebates smartly, you maximize your investment in quality hunting gear.

-

How long does it take to receive arcus hunting rebates?

The processing time for arcus hunting rebates can vary depending on the specific offer and the retailer's policies. Typically, you can expect to receive your rebate within 4 to 8 weeks after your application is submitted. Make sure to keep copies of your submitted forms to track your application for any arcus hunting rebates.

-

Can I track the status of my arcus hunting rebates?

Yes, most retailers and manufacturers that offer arcus hunting rebates provide a way to track the status of your application. You can usually do this through their website, where you can enter your rebate information to check the processing status. This feature ensures transparency and keeps you informed about your arcus hunting rebates.

-

Are there any limits on the number of arcus hunting rebates I can claim?

Yes, some arcus hunting rebates may have limits on the number of claims a customer can make within a certain timeframe. This could apply to specific products or per purchase. Always read the fine print associated with each rebate offer to ensure you comply with the limits to successfully claim your arcus hunting rebates.

Get more for Tink's Rebate

- Bescheinigung zur vorlage bei der ausl nderbeh rde z b in uni muenchen form

- Absentee application dutchess county board of elections form

- 500 east third street form

- City of albuquerque temporary food permit form

- Direct deposit form simmons college simmons

- Librarian application form template

- Fitness for duty certificate fcps form

- Virginia youth soccer association player team status form

Find out other Tink's Rebate

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free