New York State Resale Certificate Form

What is the New York State Resale Certificate

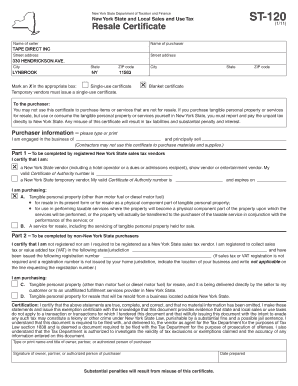

The New York State resale certificate is a legal document that allows businesses to purchase goods without paying sales tax. This certificate is primarily used by retailers and wholesalers who intend to resell the purchased items. By presenting a resale certificate, businesses can avoid the upfront sales tax costs, which can be significant, especially for bulk purchases. It is essential to understand that this certificate is not a blanket exemption from sales tax; it is only applicable for items that will be resold in the regular course of business.

How to obtain the New York State Resale Certificate

To obtain a New York State resale certificate, a business must first register for a sales tax permit with the New York State Department of Taxation and Finance. This process typically involves submitting an application form, which can be completed online or via mail. Once registered, businesses can download the resale certificate form, known as ST-120, from the Department of Taxation and Finance website. It is crucial to ensure that all information provided is accurate, as any discrepancies may lead to complications during audits or transactions.

Steps to complete the New York State Resale Certificate

Completing the New York State resale certificate involves several key steps:

- Download the ST-120 form from the New York State Department of Taxation and Finance website.

- Fill in the required fields, including the buyer's name, address, and sales tax identification number.

- Provide a description of the property being purchased for resale.

- Sign and date the certificate to validate it.

Once completed, the certificate should be presented to the seller at the time of purchase. It is advisable to keep a copy for your records, as it may be needed for future reference or audits.

Legal use of the New York State Resale Certificate

The legal use of the New York State resale certificate requires adherence to specific guidelines. Businesses must ensure that the items purchased are intended for resale and not for personal use. Misuse of the certificate can result in penalties, including back taxes and fines. It is also important to maintain accurate records of all transactions where the resale certificate is utilized, as this documentation may be reviewed during tax audits.

Key elements of the New York State Resale Certificate

Several key elements must be included in the New York State resale certificate to ensure its validity:

- The buyer's name and address.

- The seller's name and address.

- The buyer's sales tax identification number.

- A description of the property being purchased.

- The signature of the buyer or an authorized representative.

Each of these elements plays a crucial role in establishing the legitimacy of the transaction and ensuring compliance with state tax laws.

Examples of using the New York State Resale Certificate

Businesses commonly use the New York State resale certificate in various scenarios, such as:

- A retail store purchasing inventory from a wholesaler.

- A contractor buying materials for a project that will be billed to a client.

- A food service business acquiring supplies for resale to customers.

In each case, the resale certificate allows the business to avoid paying sales tax on items that will be resold, thus improving cash flow and reducing upfront costs.

Quick guide on how to complete new york state resale certificate

Complete New York State Resale Certificate effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals alike. It offers a perfect eco-conscious alternative to conventional printed and signed documents, as you can easily find the necessary form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents rapidly without hurdles. Handle New York State Resale Certificate on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to adjust and eSign New York State Resale Certificate with ease

- Find New York State Resale Certificate and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to保存 your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign New York State Resale Certificate and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new york state resale certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a resale license ny?

A resale license ny is a legal document that allows businesses in New York to purchase goods for resale without paying sales tax. This license is essential for retailers and wholesalers who buy products with the intention of selling them to consumers.

-

How do I obtain a resale license ny?

To obtain a resale license ny, you need to apply through the New York State Department of Taxation and Finance. This process usually requires submitting an application form along with necessary documents related to your business, including your business type and sales tax information.

-

What are the fees associated with a resale license ny?

Obtaining a resale license ny typically does not incur a fee; however, you must ensure compliance with local regulations and any business licensing fees that may apply. It is important to check with your local authorities for any additional costs regarding your specific business type.

-

What are the benefits of having a resale license ny?

Having a resale license ny allows you to purchase inventory tax-free, increasing your profit margins. Additionally, it legitimizes your business operations, enhances your credibility with suppliers, and ensures you remain compliant with state tax laws.

-

Can I use airSlate SignNow to manage my resale license ny documentation?

Yes, airSlate SignNow is an effective tool for managing your resale license ny documentation. With its eSignature capabilities, you can securely sign and share your resale license with stakeholders and maintain a digital record of all your documents.

-

What features does airSlate SignNow offer for businesses needing a resale license ny?

airSlate SignNow provides features such as customizable templates, automated workflows, and multi-party signing, all of which can simplify the management of your resale license ny documentation. These features ensure a seamless process from initial document creation to final approval and filing.

-

How does airSlate SignNow integrate with other business tools for managing a resale license ny?

airSlate SignNow integrates easily with various business tools, including CRM systems and accounting software, which can help streamline the management of your resale license ny. This integration allows for better organization and tracking of your licensing and sales activities.

Get more for New York State Resale Certificate

- Asylum application checklist form

- Sight unseen addendum form

- Personal narrative rubric pdf form

- N c dma medicaid resolution inquiry form ncdhhs

- Nw natural residential new construction service agreement challenges grant of summary judgment form

- Pa 10 day notice to quit form

- Petty cash agreement template form

- Pharmaceutical supply agreement template form

Find out other New York State Resale Certificate

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation