5060 Form

What is the 5060 Form

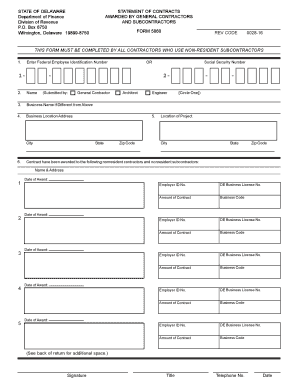

The 5060 form, also known as the Delaware Division of Revenue Form 5060, is a document used primarily for reporting specific financial information related to business activities in the state of Delaware. This form is essential for compliance with state tax regulations and is typically required for businesses operating within Delaware. It serves as a declaration of contracts and revenue, ensuring that businesses accurately report their financial dealings to the state authorities.

How to Use the 5060 Form

Using the 5060 form involves several key steps. First, ensure that you have the correct version of the form, which can be obtained from the Delaware Division of Revenue's website or through authorized sources. Next, gather all necessary financial information, including details of contracts and revenue generated. Fill out the form carefully, ensuring that all information is accurate and complete. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the guidelines provided by the state.

Steps to Complete the 5060 Form

Completing the 5060 form requires careful attention to detail. Follow these steps:

- Obtain the blank 5060 form from the official source.

- Review the instructions provided with the form to understand the requirements.

- Fill out your business information, including name, address, and tax identification number.

- Detail the contracts and revenue figures as required by the form.

- Double-check all entries for accuracy before submission.

- Submit the completed form according to the guidelines, ensuring that you meet any deadlines.

Legal Use of the 5060 Form

The 5060 form is legally binding when completed and submitted in accordance with Delaware state laws. It is important to adhere to the regulations set forth by the Delaware Division of Revenue, as failure to do so can result in penalties. The form must be signed by an authorized representative of the business, affirming that the information provided is truthful and accurate. Compliance with legal requirements ensures that businesses maintain good standing with state authorities.

Key Elements of the 5060 Form

Several key elements are essential when filling out the 5060 form. These include:

- Business Identification: Accurate details about the business, including name and address.

- Contract Information: A clear description of contracts and revenue sources.

- Financial Figures: Accurate reporting of income and expenses related to the contracts.

- Signature: An authorized signature confirming the validity of the information provided.

Form Submission Methods

The 5060 form can be submitted through multiple methods, providing flexibility for businesses. Options include:

- Online Submission: Many businesses choose to submit the form electronically through the Delaware Division of Revenue's online portal.

- Mail: The completed form can also be printed and mailed to the appropriate state office.

- In-Person: Businesses may opt to deliver the form in person at designated state offices for immediate processing.

Quick guide on how to complete 5060 form

Easily Prepare 5060 Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and safely store them online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and efficiently. Handle 5060 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Alter and eSign 5060 Form Effortlessly

- Locate 5060 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize necessary sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your adjustments.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, and errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Alter and eSign 5060 Form and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 5060 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 5060 form and how is it used with airSlate SignNow?

The 5060 form is a document commonly used in various business transactions. With airSlate SignNow, you can easily upload, send, and eSign the 5060 form, streamlining the signing process and ensuring legal compliance.

-

How much does it cost to use airSlate SignNow for managing the 5060 form?

airSlate SignNow offers flexible pricing plans that cater to different business needs. The cost to manage the 5060 form through our platform starts at an affordable monthly rate, making it a cost-effective solution for organizations of all sizes.

-

What features does airSlate SignNow provide for the 5060 form?

airSlate SignNow includes a variety of features such as customizable templates, real-time tracking, and secure cloud storage to enhance the management of the 5060 form. These features help improve efficiency and productivity when handling critical documents.

-

Can I integrate airSlate SignNow with other tools for the 5060 form?

Yes, airSlate SignNow supports integrations with a wide range of applications such as CRM systems, cloud storage, and productivity tools. This allows you to seamlessly incorporate the 5060 form into your existing workflows for enhanced efficiency.

-

Is it safe to eSign the 5060 form using airSlate SignNow?

Absolutely! airSlate SignNow employs state-of-the-art security measures, including encryption and secure storage, to protect your data. Your eSignature on the 5060 form is legally binding, ensuring both safety and compliance.

-

How can airSlate SignNow enhance my workflow for the 5060 form?

By utilizing airSlate SignNow for the 5060 form, you can automate your document processes, reducing manual work and saving time. Our user-friendly interface allows for quick edits and easy sharing, thus streamlining your overall workflow.

-

Does airSlate SignNow offer customer support for issues with the 5060 form?

Yes, airSlate SignNow provides dedicated customer support to assist you with any inquiries regarding the 5060 form. Our team is available through various channels to ensure you receive timely assistance whenever needed.

Get more for 5060 Form

Find out other 5060 Form

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself

- eSign West Virginia Rental lease agreement template Safe

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free