W8 Form Us Tax

What is the W-8 Form Us Tax

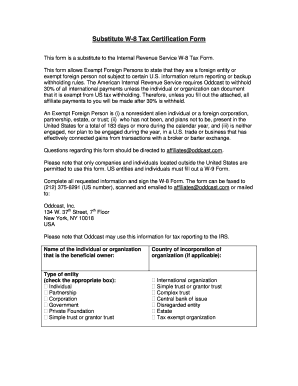

The W-8 form is a crucial document used by foreign individuals and entities to certify their foreign status for U.S. tax purposes. This form helps to establish that the individual or business is not subject to certain U.S. tax withholding requirements. There are several variants of the W-8 form, including the W-8BEN for individuals and the W-8BEN-E for entities, each serving specific purposes related to tax treaties and withholding exemptions.

How to use the W-8 Form Us Tax

To use the W-8 form effectively, individuals and entities must first determine which version of the form is applicable to their situation. After selecting the correct form, the next step is to complete it accurately, providing necessary information such as name, address, and tax identification number, if applicable. Once completed, the form should be submitted to the withholding agent or financial institution requesting it, not to the IRS. This ensures proper documentation of foreign status and eligibility for reduced withholding rates.

Steps to complete the W-8 Form Us Tax

Completing the W-8 form involves several key steps:

- Identify the correct version of the W-8 form needed for your situation.

- Fill in your personal or business information, including your name, address, and country of citizenship.

- Provide your foreign tax identification number, if applicable.

- Sign and date the form to certify that the information is accurate and complete.

- Submit the completed form to the requesting party, ensuring that it is kept on file for future reference.

Legal use of the W-8 Form Us Tax

The legal use of the W-8 form is essential for compliance with U.S. tax laws. By submitting this form, foreign individuals and entities can claim benefits under tax treaties, which may reduce or eliminate U.S. tax withholding on certain types of income. It is important to ensure that the form is filled out correctly and submitted to the appropriate parties to avoid issues with tax compliance and potential penalties.

Key elements of the W-8 Form Us Tax

Key elements of the W-8 form include:

- Name and Address: The full legal name and address of the individual or entity.

- Foreign Tax Identification Number: A unique identifier assigned by the foreign government.

- Claim of Tax Treaty Benefits: Information regarding any applicable tax treaties that may affect withholding rates.

- Signature and Date: The signer must certify that the information provided is true and accurate.

Filing Deadlines / Important Dates

Filing deadlines for the W-8 form can vary based on the type of income and the withholding agent's requirements. It is generally advisable to submit the form before receiving any U.S.-sourced income to ensure proper withholding rates are applied. Keeping track of any updates from the IRS regarding changes to deadlines or requirements is essential for compliance.

Quick guide on how to complete w8 form us tax

Complete W8 Form Us Tax effortlessly on any gadget

Managing documents online has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly and without delays. Manage W8 Form Us Tax on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign W8 Form Us Tax with ease

- Locate W8 Form Us Tax and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, frustrating form hunts, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign W8 Form Us Tax while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w8 form us tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W8 form example, and why is it important?

A W8 form example refers to the IRS documents used by non-US individuals to signNow their foreign status and claim tax exemptions. This form is crucial for businesses dealing with foreign clients, as it ensures compliance with US tax regulations while safeguarding against unnecessary tax withholding.

-

How can airSlate SignNow help with filling out a W8 form example?

airSlate SignNow provides an easy-to-use platform for businesses to fill out and eSign W8 forms. The intuitive interface allows users to complete their W8 form example efficiently, ensuring accurate information and saving valuable time.

-

Are there any costs associated with using airSlate SignNow for W8 form examples?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, allowing users to access all necessary features for sending and signing W8 form examples without breaking the bank.

-

What features does airSlate SignNow offer for managing W8 form example submissions?

airSlate SignNow offers features such as document templates, real-time tracking, and secure cloud storage for managing W8 form examples. These functionalities streamline the process of sending, signing, and storing forms, making compliance easier for businesses.

-

Can I integrate airSlate SignNow with other software for W8 form examples?

Absolutely! airSlate SignNow integrates seamlessly with popular software such as CRM systems, cloud storage services, and productivity tools. This helps streamline the workflow of sending and signing W8 form examples, enhancing overall efficiency for businesses.

-

Is eSigning a W8 form example legally binding?

Yes, eSigning a W8 form example through airSlate SignNow is legally binding in the United States. Our platform complies with various eSignature laws, ensuring that electronic signatures hold the same validity as traditional handwritten signatures.

-

How does airSlate SignNow ensure the security of W8 form examples?

airSlate SignNow employs industry-standard security measures, including encryption and secure access controls, to protect your W8 form examples. We prioritize user privacy and compliance, ensuring that your business information remains confidential.

Get more for W8 Form Us Tax

- Fns 191 form

- Students form study link

- Akc lure coursing entry form

- The perils of classifying social media platforms as public utilities mercatus

- Student portfolios and teacher logs form

- Form 3895 california health insurance marketplace statement

- Purchase option agreement template form

- Purchase offer to purchase real estate agreement template form

Find out other W8 Form Us Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors