51a159 Form

What is the 51a159

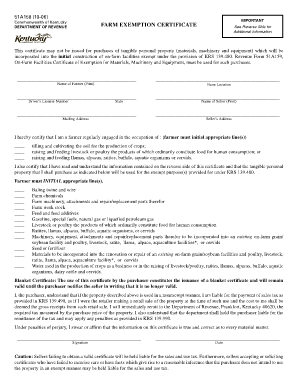

The 51a159 form, also known as the Kentucky Revenue Form 51a159, is a crucial document used for various tax-related purposes in the state of Kentucky. This form is primarily associated with reporting specific financial information to the Kentucky Department of Revenue. It is essential for individuals and businesses to accurately complete this form to ensure compliance with state tax regulations.

How to use the 51a159

Using the 51a159 form involves several key steps. First, gather all necessary financial documents that pertain to your income and deductions. Next, fill out the form by providing accurate information as required. It is important to review the completed form for any errors before submission. Once finalized, the form can be submitted either electronically or via mail, depending on your preference and the guidelines set by the Kentucky Department of Revenue.

Steps to complete the 51a159

Completing the 51a159 form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, including income statements and receipts.

- Access the form online or obtain a physical copy from the Kentucky Department of Revenue.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check your entries for any mistakes or omissions.

- Submit the form according to the specified submission methods.

Legal use of the 51a159

The legal use of the 51a159 form is governed by Kentucky tax laws. To be considered valid, the form must be filled out completely and truthfully. Any discrepancies or fraudulent information can lead to penalties or legal repercussions. It is essential to understand the legal implications of submitting this form and to ensure compliance with all relevant regulations.

Key elements of the 51a159

Key elements of the 51a159 form include personal identification information, income details, and deductions. Each section must be filled out with precision to reflect the taxpayer's financial situation accurately. Additionally, the form may require signatures to validate the information provided, which is essential for its acceptance by the Kentucky Department of Revenue.

Form Submission Methods

The 51a159 form can be submitted using various methods, offering flexibility to taxpayers. Options include:

- Online submission through the Kentucky Department of Revenue's electronic filing system.

- Mailing a printed copy of the form to the appropriate address.

- In-person submission at designated tax offices.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the 51a159 form can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for taxpayers to understand these consequences and to ensure timely and accurate submission of the form to avoid any issues with the Kentucky Department of Revenue.

Quick guide on how to complete 51a159

Complete 51a159 effortlessly on any device

Online document management has gained immense traction among companies and individuals. It offers a flawless eco-friendly alternative to traditional printed and signed paperwork, enabling you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents quickly without delays. Manage 51a159 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign 51a159 with ease

- Locate 51a159 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors necessitating new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Edit and eSign 51a159 and guarantee effective communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 51a159

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 51a159, and how can it be used with airSlate SignNow?

Form 51a159 is a specific document that can be easily filled, signed, and managed with airSlate SignNow. Our platform provides intuitive features that allow users to streamline the signing process for this form, ensuring compliance and efficiency.

-

What features does airSlate SignNow offer for managing form 51a159?

airSlate SignNow offers a range of features to enhance the management of form 51a159, including templates for quick access, real-time tracking of document statuses, and reminders for signers. This helps ensure that your important documents are handled promptly.

-

Is there a pricing plan for using airSlate SignNow with form 51a159?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs, starting from a basic plan up to advanced features. Each plan includes the capacity to manage documents like form 51a159 effectively.

-

How does airSlate SignNow improve the signing experience of form 51a159?

airSlate SignNow enhances the signing experience for form 51a159 by providing an easy-to-use interface and mobile accessibility. This allows signers to review and sign documents anytime, anywhere, increasing efficiency and reducing turnaround times.

-

Can form 51a159 be integrated with other applications using airSlate SignNow?

Absolutely! airSlate SignNow supports integrations with numerous applications, making it easy to combine workflows across platforms. This allows for seamless processing of form 51a159, linking it with your existing business tools.

-

What are the security measures in place when using airSlate SignNow for form 51a159?

When using airSlate SignNow for form 51a159, all documents are secured with advanced encryption and authentication measures. This ensures that your sensitive information remains confidential and protected during the signing process.

-

How can I access support if I have questions about form 51a159?

airSlate SignNow provides comprehensive customer support for any queries regarding form 51a159. You can access FAQs, live chat, or contact our support team via email for prompt assistance.

Get more for 51a159

- How to draw up a personal detail form

- Form 2a lay representation form simple procedure

- Enclosed is the revert to owner agreement rto form dominion

- Writ of mandamus louisiana form

- Trial preparationpacket 14 these forms must not b

- Tenancy sublet agreement template form

- Tenancy subletting agreement template form

- Tenancy termination agreement template form

Find out other 51a159

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter