Town of Warwick Transfer Tax Form Fillable

What is the Town Of Warwick Transfer Tax Form Fillable

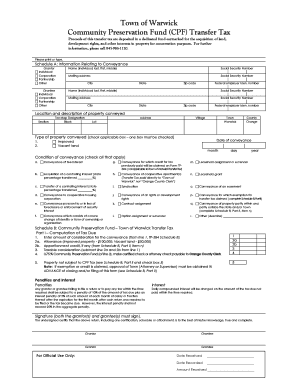

The Town of Warwick Transfer Tax Form Fillable is a document used to report the transfer of property within the town. This form is essential for ensuring that the appropriate transfer taxes are calculated and paid. It captures vital information about the property, the buyer, and the seller, making it a critical part of the property transaction process. The fillable format allows users to complete the form digitally, streamlining the process and reducing the chance of errors that can occur with handwritten forms.

How to use the Town Of Warwick Transfer Tax Form Fillable

Using the Town of Warwick Transfer Tax Form Fillable involves several straightforward steps. First, access the form through a reliable digital platform. Once opened, enter the required information, including details about the property, the parties involved, and the transaction date. Ensure all fields are accurately filled out to avoid delays in processing. After completing the form, review it for any errors before submitting it. The digital format allows for easy corrections, making the process more efficient.

Steps to complete the Town Of Warwick Transfer Tax Form Fillable

Completing the Town of Warwick Transfer Tax Form Fillable involves a series of clear steps:

- Open the fillable form on your device.

- Enter the property details, including the address and type of property.

- Provide information about the buyer and seller, including names and contact information.

- Fill in the transaction date and the agreed sale price.

- Review all entered information for accuracy.

- Save the completed form to your device.

- Submit the form according to the town's submission guidelines.

Legal use of the Town Of Warwick Transfer Tax Form Fillable

The legal use of the Town of Warwick Transfer Tax Form Fillable is crucial for compliance with local tax laws. This form must be accurately completed and submitted to ensure that the transfer tax is properly assessed and collected. Failure to use the form correctly can lead to penalties or delays in property transactions. It is advisable to keep a copy of the submitted form for your records, as it serves as proof of compliance with the town's regulations.

Key elements of the Town Of Warwick Transfer Tax Form Fillable

Several key elements are essential in the Town of Warwick Transfer Tax Form Fillable:

- Property Information: This includes the address, type, and description of the property being transferred.

- Parties Involved: Names and contact details of both the buyer and seller must be accurately listed.

- Transaction Details: The date of the transaction and the sale price are critical for tax calculation.

- Signature Lines: Both parties may need to sign the form to validate the transaction.

Form Submission Methods

The Town of Warwick Transfer Tax Form Fillable can be submitted through various methods to accommodate different preferences. Users may choose to submit the form online via the town's official website, which often allows for immediate processing. Alternatively, the form can be printed and mailed to the appropriate town office. In some cases, in-person submission may also be available, allowing for direct interaction with town officials if questions arise during the process.

Quick guide on how to complete town of warwick transfer tax form fillable

Effortlessly Prepare Town Of Warwick Transfer Tax Form Fillable on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Town Of Warwick Transfer Tax Form Fillable on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Easily Modify and Electronically Sign Town Of Warwick Transfer Tax Form Fillable

- Locate Town Of Warwick Transfer Tax Form Fillable and select Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or black out sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign feature, which requires just seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, tiring searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and electronically sign Town Of Warwick Transfer Tax Form Fillable ensuring exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the town of warwick transfer tax form fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the town of Warwick transfer tax form fillable?

The town of Warwick transfer tax form fillable is a digital document designed for residents and businesses in Warwick to easily complete and submit their transfer tax forms. This fillable form simplifies the tax submission process, ensuring accuracy and efficiency.

-

How can I access the town of Warwick transfer tax form fillable?

You can access the town of Warwick transfer tax form fillable by visiting the airSlate SignNow website. Our platform offers a user-friendly interface where you can find, fill, and electronically sign the form with ease.

-

Is there a cost associated with using the town of Warwick transfer tax form fillable?

Using the town of Warwick transfer tax form fillable on airSlate SignNow is cost-effective, with various pricing plans available to match your needs. You can choose from several options, including pay-per-use or subscription models, providing flexibility for both individuals and businesses.

-

What features does the town of Warwick transfer tax form fillable offer?

The town of Warwick transfer tax form fillable includes features like digital signatures, automatic saving of your progress, and easy sharing options. These features enhance the overall experience, ensuring that you can complete your transfer tax form quickly and securely.

-

Can I integrate the town of Warwick transfer tax form fillable with other tools?

Yes, the town of Warwick transfer tax form fillable can be integrated with various tools and applications, such as customer relationship management (CRM) systems and document storage solutions. This allows for a seamless workflow and enhances productivity.

-

Is the town of Warwick transfer tax form fillable user-friendly?

Absolutely! The town of Warwick transfer tax form fillable is designed to be intuitive and easy to navigate. Users of all skill levels can complete their forms without difficulty thanks to our straightforward interface and helpful resources.

-

What are the benefits of using the town of Warwick transfer tax form fillable?

Using the town of Warwick transfer tax form fillable streamlines the tax filing process, reducing paperwork and minimizing errors. Additionally, it saves time by allowing users to complete and submit their forms online, leading to quicker processing by local authorities.

Get more for Town Of Warwick Transfer Tax Form Fillable

- Gcoesva form

- Generic mrmra prior authorization form healthplus

- Giftrust options form 1 american century

- Po box 785040 form

- Illinois legal last will and testament form for single person with no children

- Buyers retail sales tax exemption certificate form

- Po box 9034 form fill out and sign printable

- Transition service agreement template form

Find out other Town Of Warwick Transfer Tax Form Fillable

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure