Ct 240 Form

What is the Ct 240 Form

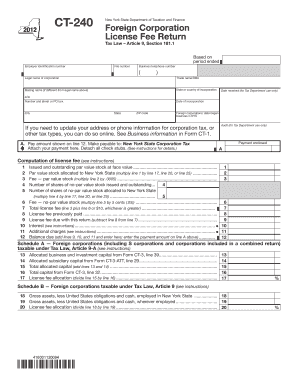

The Ct 240 Form is a specific document used primarily for tax-related purposes in the state of Connecticut. This form is typically utilized by businesses and individuals to report certain financial information to the Connecticut Department of Revenue Services. Understanding the purpose of the Ct 240 Form is essential for ensuring compliance with state tax regulations and avoiding potential penalties.

How to use the Ct 240 Form

Using the Ct 240 Form involves several key steps. First, gather all necessary financial information, including income statements, expense records, and other relevant documents. Next, accurately fill out the form, ensuring that all sections are completed according to the instructions provided. After completing the form, review it for accuracy before submission. It is important to keep a copy for your records, as this may be needed for future reference or audits.

Steps to complete the Ct 240 Form

Completing the Ct 240 Form requires careful attention to detail. Follow these steps to ensure proper completion:

- Gather all necessary documentation, including financial statements and previous tax returns.

- Begin filling out the form by entering your personal or business information at the top.

- Complete each section of the form, providing accurate financial data as required.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where indicated.

- Submit the form through the appropriate method, whether online, by mail, or in person.

Legal use of the Ct 240 Form

The Ct 240 Form serves a legal purpose in the context of tax reporting. It is essential for ensuring that individuals and businesses comply with state tax laws. Proper use of this form can help avoid legal issues, including audits and penalties. It is advisable to consult with a tax professional if there are any uncertainties regarding the legal implications of the information reported on the form.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 240 Form are crucial for compliance. Typically, the form must be submitted by the designated tax deadline, which may vary depending on the type of taxpayer. It is important to stay informed about these dates to avoid late fees and penalties. Mark your calendar with the relevant deadlines to ensure timely submission.

Who Issues the Form

The Ct 240 Form is issued by the Connecticut Department of Revenue Services. This state agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. It is important to obtain the form directly from this agency to ensure that you are using the most current version and following the latest guidelines.

Quick guide on how to complete ct 240 form

Complete Ct 240 Form with ease on any device

Digital document management has gained traction among companies and individuals. It serves as a superb eco-friendly substitute for conventional printed and signed papers, allowing you to locate the correct form and securely preserve it online. airSlate SignNow equips you with all the resources necessary to create, amend, and eSign your documents swiftly without delays. Manage Ct 240 Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign Ct 240 Form effortlessly

- Locate Ct 240 Form and click on Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your alterations.

- Select your preferred method of sending your document, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and eSign Ct 240 Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 240 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ct 240 Form?

The Ct 240 Form is a tax form used in Connecticut for businesses to report their income and calculate their tax liabilities. Understanding how to fill out the Ct 240 Form correctly can help businesses comply with state regulations and avoid penalties.

-

How does airSlate SignNow help with the Ct 240 Form?

airSlate SignNow streamlines the process of completing and eSigning the Ct 240 Form by providing a user-friendly platform for document management. You can easily upload your form, fill it out, and securely eSign it, making tax season less stressful and more efficient.

-

Is there a cost associated with using airSlate SignNow for the Ct 240 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost-effectiveness of the solution allows businesses to save on resources while ensuring a smooth filing process for forms like the Ct 240 Form.

-

What features does airSlate SignNow offer for managing the Ct 240 Form?

AirSlate SignNow provides several features that enhance the management of the Ct 240 Form, including document templates, collaboration tools, and real-time tracking. These features simplify the process of preparing and submitting the form for tax purposes.

-

Can I integrate airSlate SignNow with other software for the Ct 240 Form?

Yes, airSlate SignNow can be integrated with various applications and CRM systems, which can be beneficial for automating the process of filling out the Ct 240 Form. This integration helps streamline workflows and improve efficiency.

-

How secure is using airSlate SignNow for the Ct 240 Form?

AirSlate SignNow prioritizes security, ensuring that your Ct 240 Form and all sensitive data are protected with advanced encryption methods. Compliance with industry standards guarantees that your documents are safe while being electronically signed.

-

What are the benefits of using airSlate SignNow for the Ct 240 Form?

The main benefits of using airSlate SignNow for the Ct 240 Form include time savings, increased accuracy, and reduced paperwork. The intuitive interface makes it easy to manage your forms, helping you stay organized during tax season.

Get more for Ct 240 Form

- Mecosta county friend of the court form

- Nuaire dmev form

- Pha resident one year renewal term form

- Generic employment application form idaho fillable

- The baltic and international maritime council bimco uniform time charter party for container vessels code name ampquot

- Storybapp form

- Pa residency in geriatrics brochure michael e debakey va form

- Wedding photography agreement template form

Find out other Ct 240 Form

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding